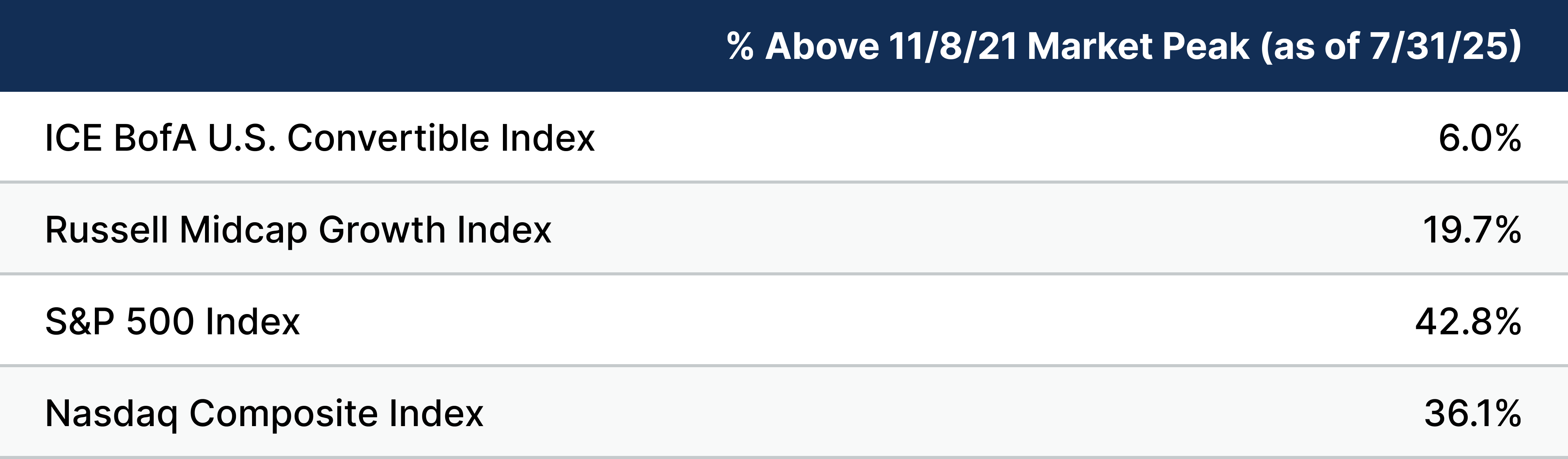

It’s been a strong year thus far for the convertible bond market, with the benchmark ICE BofA U.S. Convertible Index returning 9.6% year to date through July 31. And in a period marked by volatility amid concerns over the impact of U.S. trade policy, the convertible market has indeed offered attractive risk-adjusted returns based on the Sharpe ratio of the ICE BofA index relative to broader equity indexes. The market displayed its historical resilience, providing limited downside when markets sold off through early April, while offering significant upside participation during the subsequent market rally into June.

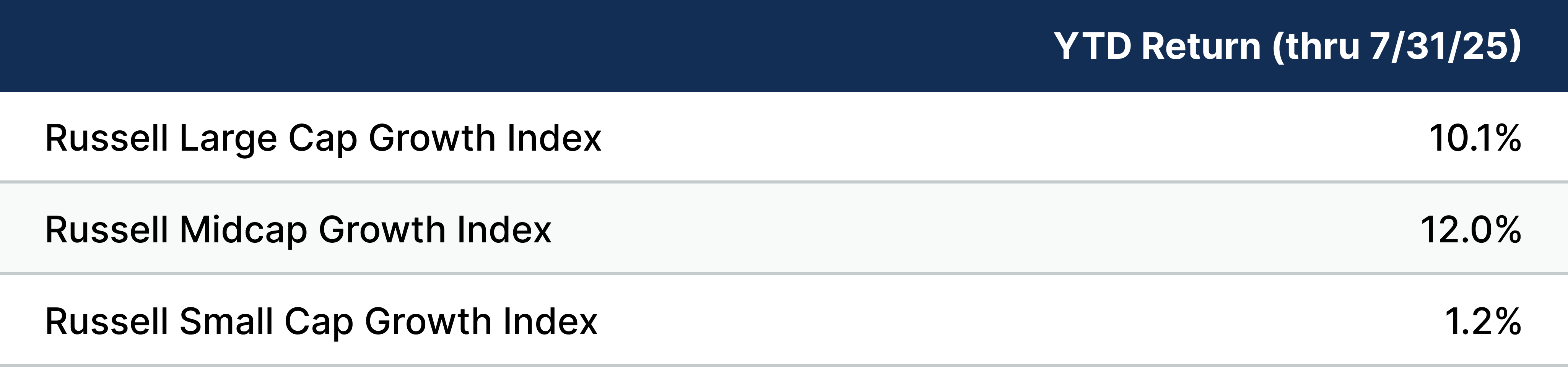

One major driver of convertible returns has been the strength in mid cap growth equities, where returns have been better than both their large- and small-cap growth equity counterparts (see Figure 1). Historically, convertible returns are most highly correlated to mid-cap growth equities.