Note: This is an updated version of an article previously published in November 2024.

Key Takeaways:

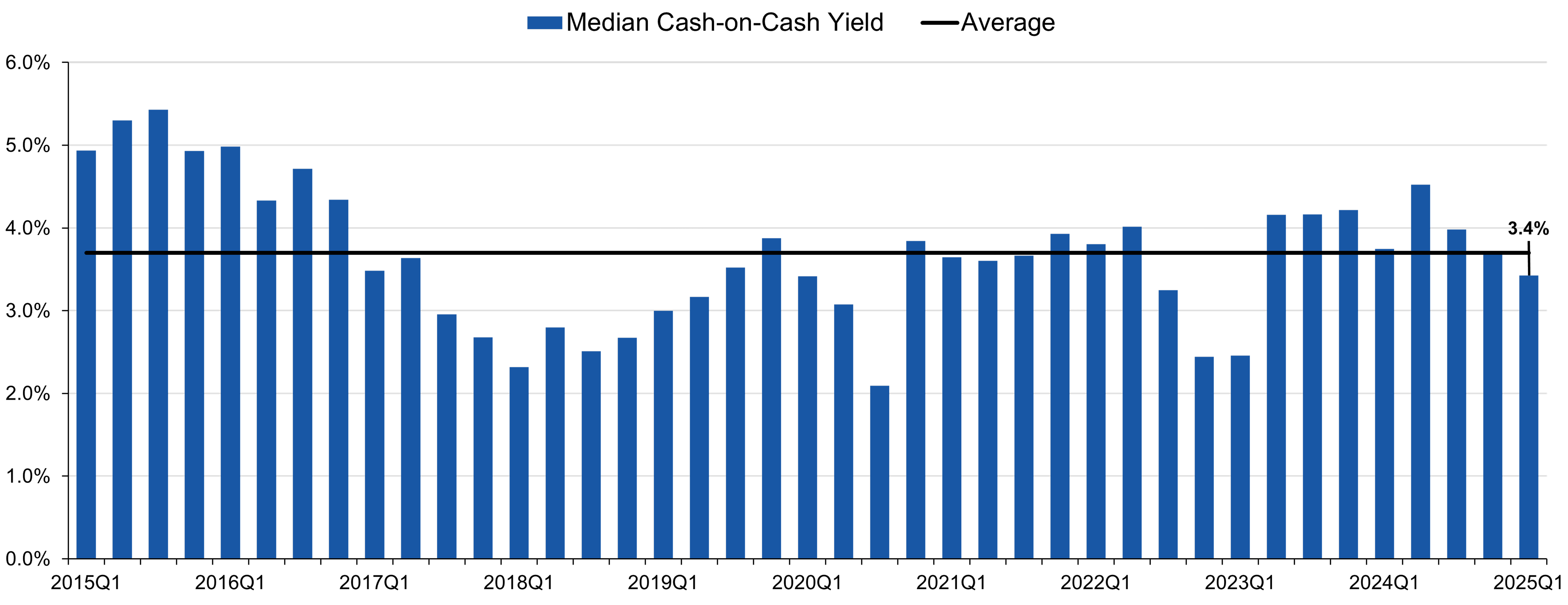

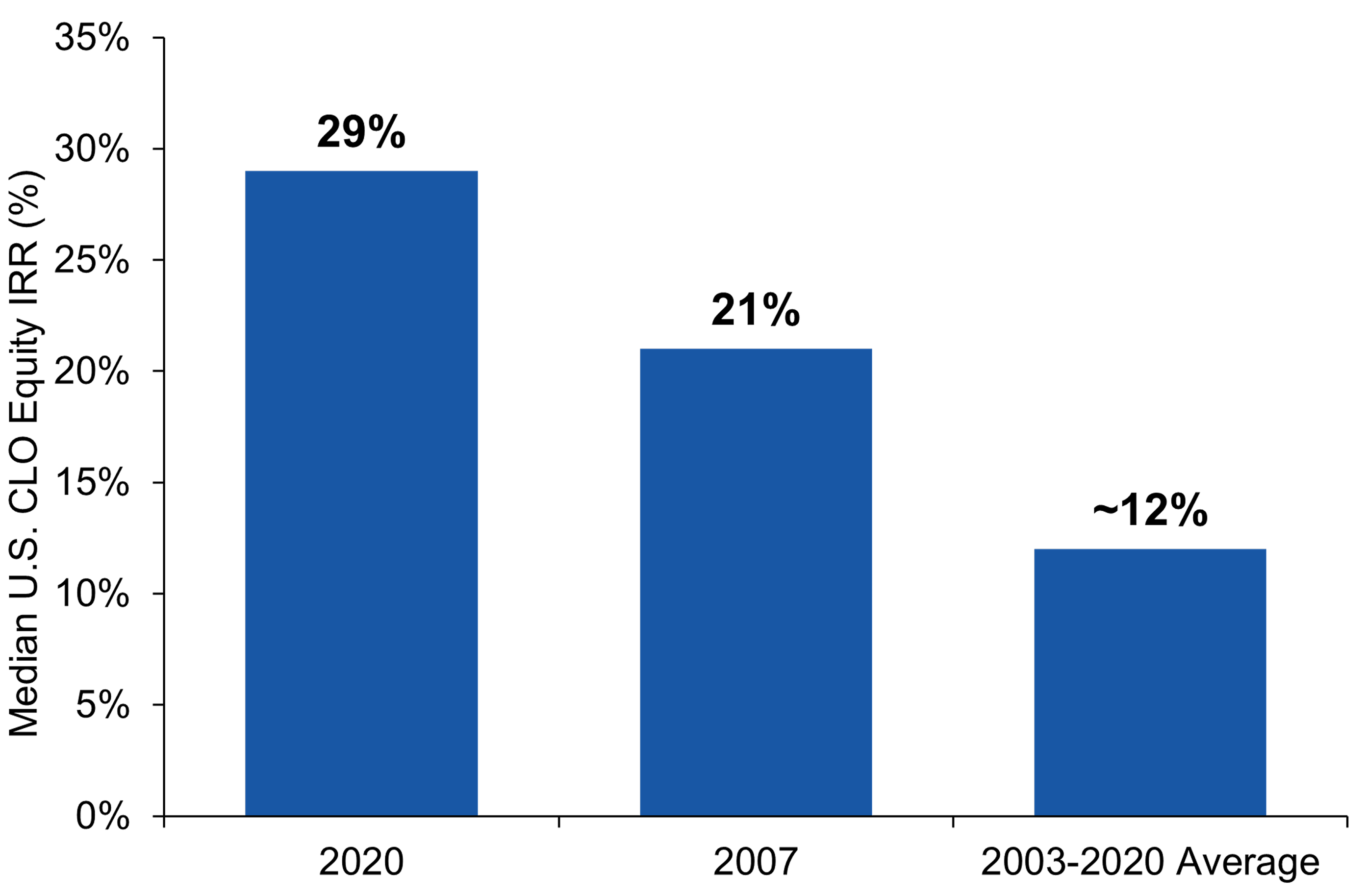

- The CLO structure provides several key features that have helped to maintain or improve CLO equity’s historically consistent, front-loaded cash flow experience.

- CLO equity offers higher potential risk-adjusted returns, along with a differentiated and attractive cash flow profile.

- A CLO’s underlying debt collateral is actively managed, which allows a skilled manager the flexibility to buy and sell loans to potentially mitigate credit risk and enhance return in multiple investment environments.

Over the last 18 months, the formation of CLOs has skyrocketed, and for good reason. The structure and characteristics of CLOs may offer something for investors of all risk tolerances, from the most loss-averse to the most return-seeking. From a regulatory standpoint, CLOs have supported the growth of the bank loan market, as banks have reduced lending in response to balance sheet regulations following the global financial crisis (GFC). As a result of this demand from a wide range of investors, new issuance is at an all-time high. In fact, the CLO market is now approximately 70% of the size of the roughly $1.5 trillion bank loan market, up from around 40% a decade ago, according to J.P. Morgan research in July 2024.

While CLO debt enjoys a vast and varied constituency of investor types, from insurers and banks to pension funds and asset managers, CLO equity tends to have a narrower pool of investors. Part of this has to do with the relative opportunity size of CLO equity versus CLO debt. However, we believe a lack of appreciation by investors of what CLO equity offers is a bigger driver. In our view, CLO equity offers a set of return and cash flow characteristics that can appeal to a wide range of return-seeking investors.

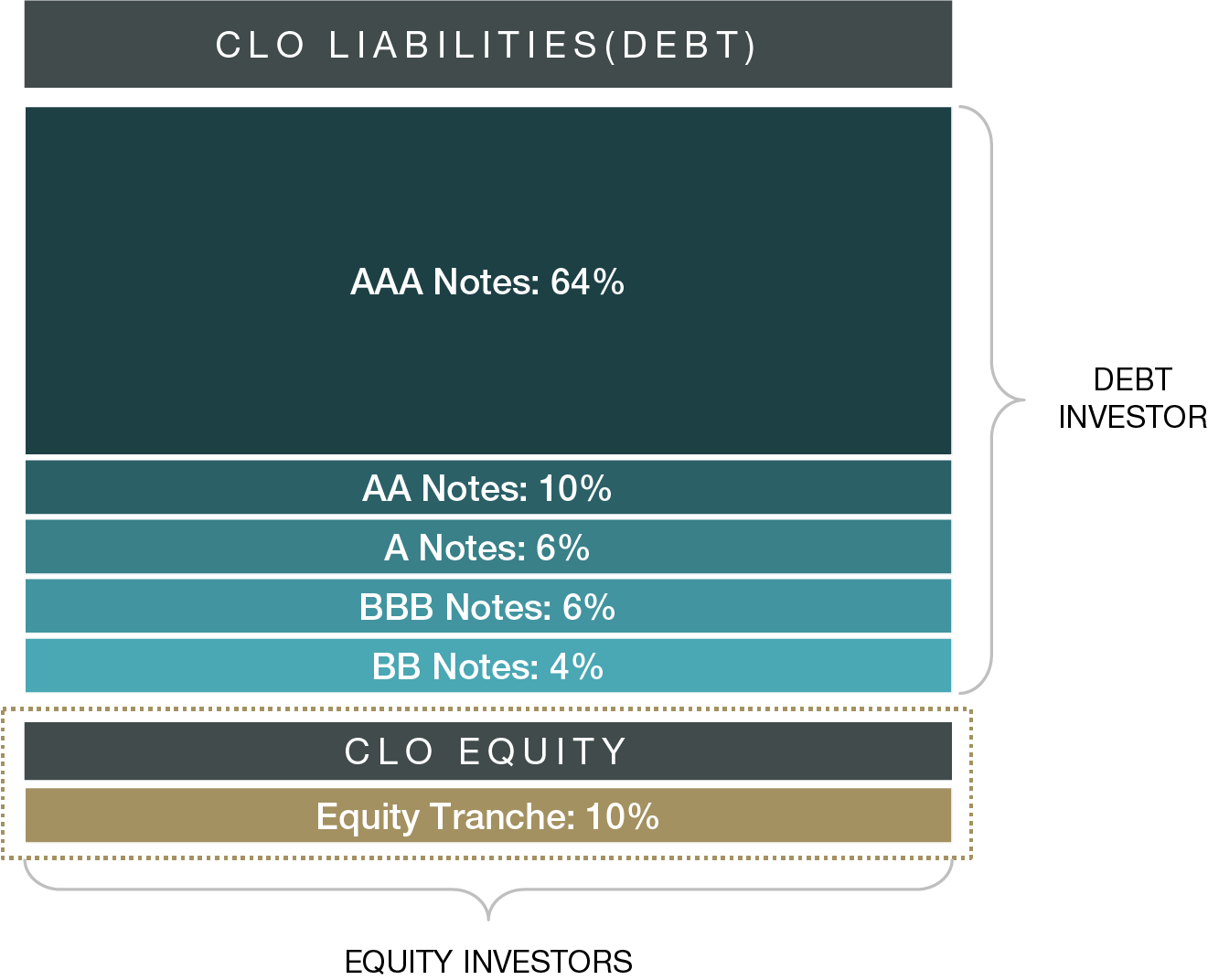

Explaining the CLO Capital Structure

CLOs are special purpose vehicles (SPVs) that invest in a diversified pool of leveraged bank loans. These loans are packaged together, and the funding for these structures is raised through investors in different tranches (primarily debt, with some residual equity), each representing varying levels of risk and return. The cash flows from the underlying loans are distributed to investors based on the seniority of the tranche they hold (see Figure 1). The highest-rated (AAA) tranches receive payments first and have lower risk of loss, while the equity tranche represents the “first-loss” capital but offers higher potential upside. The CLO vehicle is actively managed by asset managers with resources and experience in leveraged credit. There are various phases of the CLO lifespan, namely warehousing, the ramp, the reinvestment period, and finally the amortization period. During all of these phases, some combination of equity investor capital and debt capital is required. To learn more about potential opportunities in CLO debt, visit Investment Brief: Addressing Key Questions on CLOs.