Last October, we wrote about the potential benefits of a multi-sector approach in core bonds. We focused on the risk-and-return merits of investment-grade securitized credit when compared to investment-grade corporate bonds and agency mortgage-backed securities (MBS), the two primary sources of spread risk in the Bloomberg U.S. Aggregate Bond Index (Aggregate Index).

In this commentary, we take a similar approach to highlight persistent risk-adjusted return advantages available in the high yield bond sector and expand upon the potential benefits of a disciplined multi-sector approach to drive results in the core plus bond category.

Short Duration Anomaly in High Yield Bonds

The high yield sector and its historically larger spread compensation is a natural area of focus for core plus investors. This spread compensation can be divided into a few components: a default risk premium, a liquidity risk premium (compensation for the illiquidity of the bond or issuer, as well as the mark-to-market risk from relatively higher spread volatility), and finally a term premium to compensate for increasing duration risk.

With below-investment-grade ratings, the uncertainty around the appropriate compensation for those premiums is much greater, and the high yield sector represents a true opportunity to gain competitive advantage through the strength of fundamental research, in our view. Skillful credit research analysts can identify contrarian views and idiosyncratic risks among issuers in this space and correctly value the mispricing of premiums to drive relative outperformance through security selection.

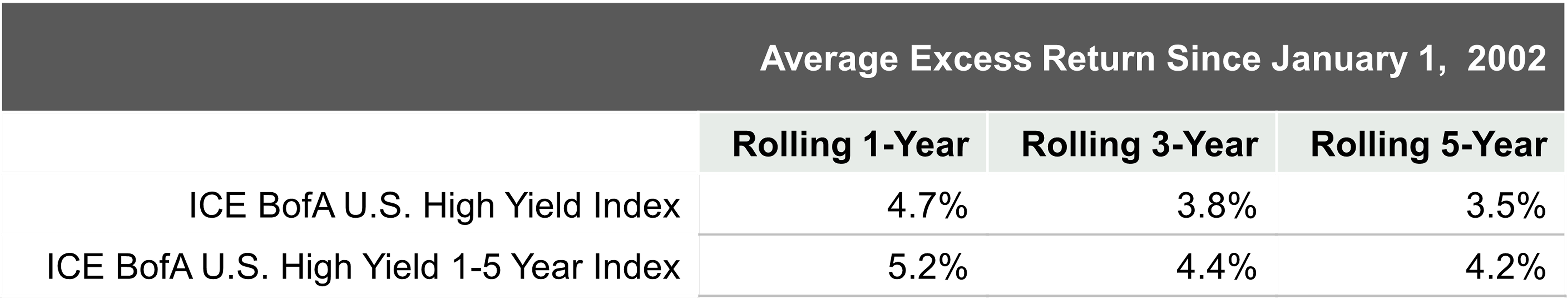

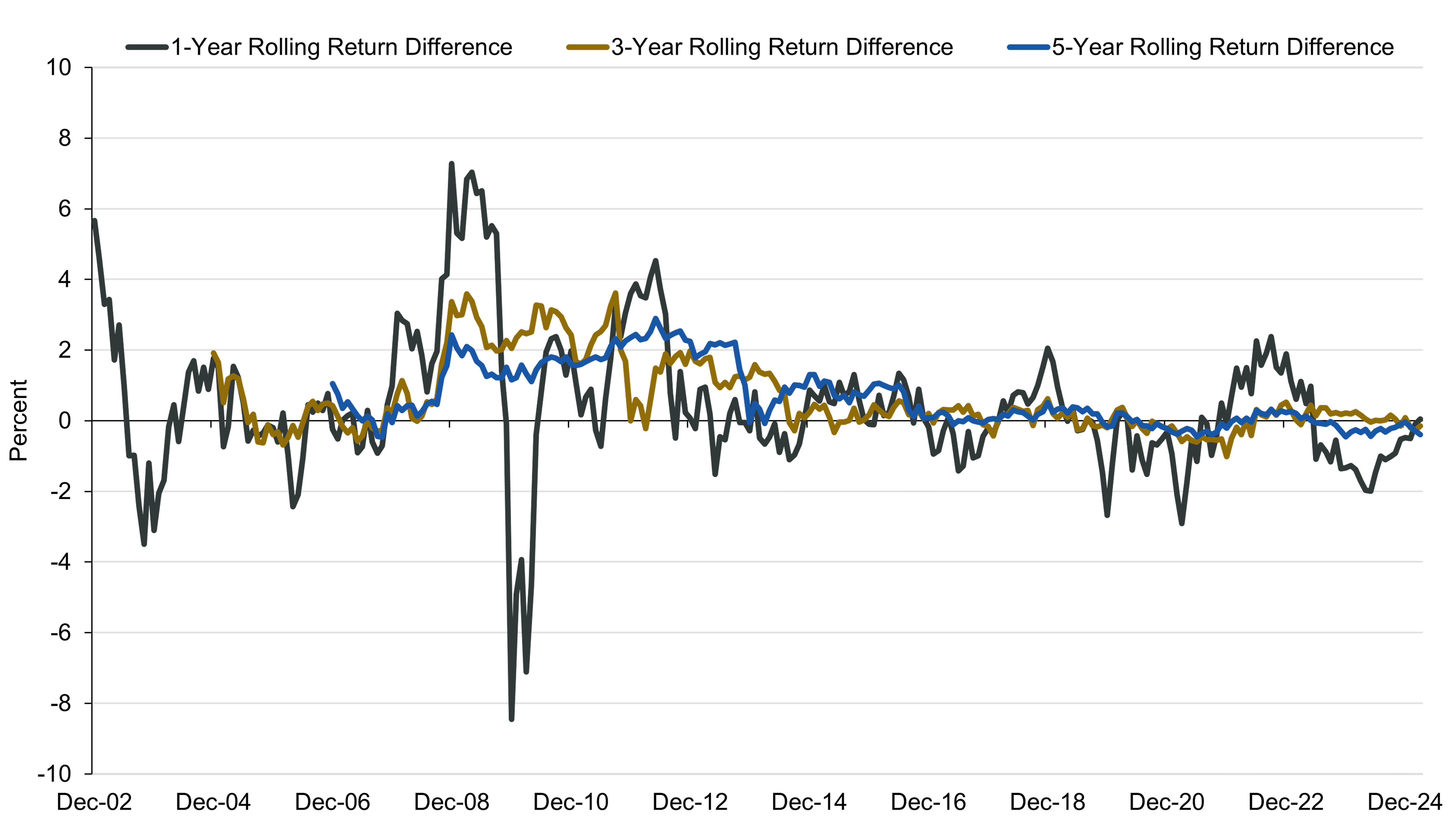

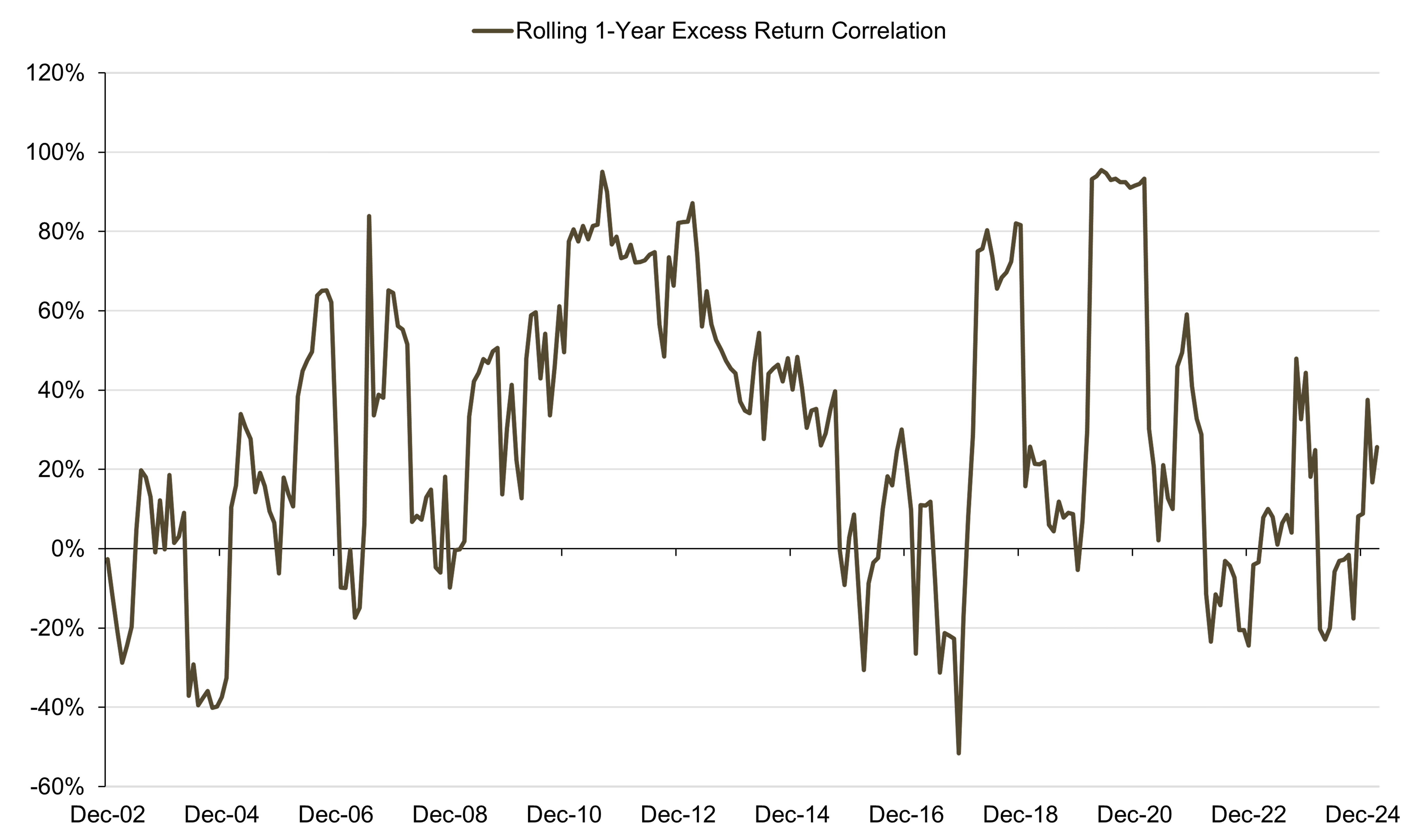

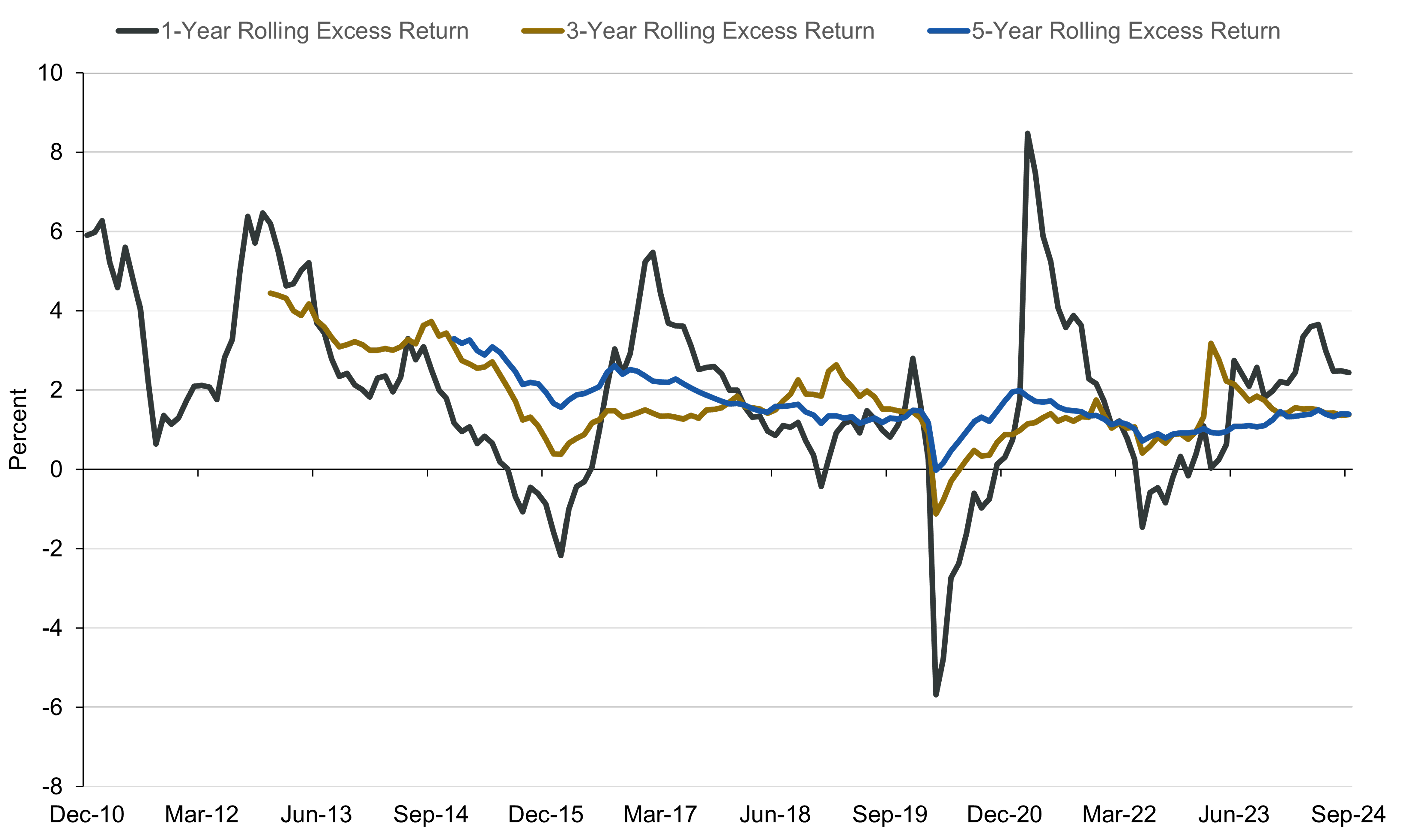

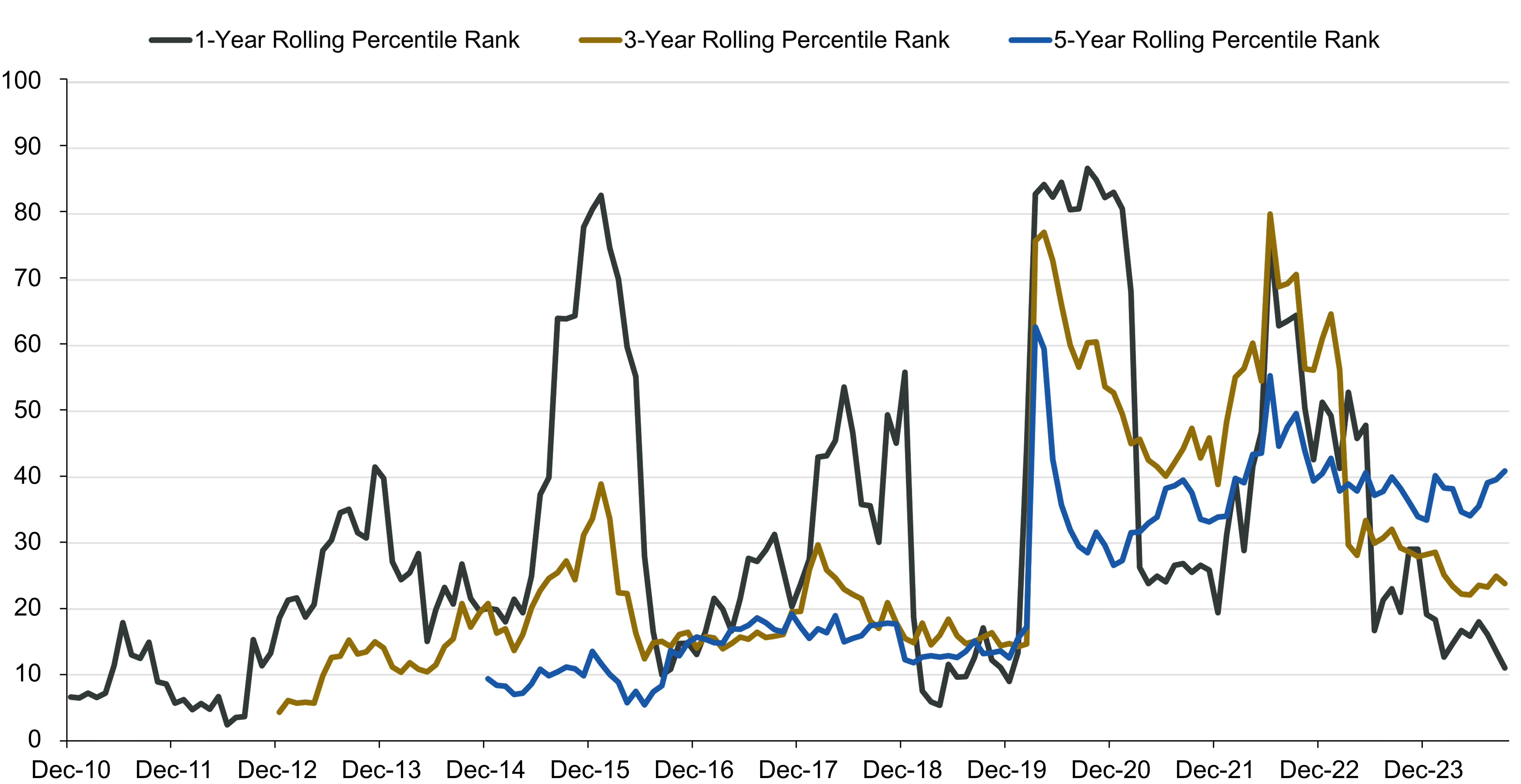

With credit research as a foundation, quantitative insights are also valuable as we seek optimal multi-sector portfolio construction. Specifically, within the high yield sector, an analysis of the short-duration subsector reveals a persistent and attractive risk-adjusted return opportunity. Figure 1 displays the average excess returns over one-, three-, and five-year rolling periods (since January 2002) for the ICE BofA High Yield Index and the subsector of the index comprised of one- to five-year maturities (1-5 Year Index). Figure 2 displays the time series of the return difference of each of these three rolling periods.