One encouraging sign for investors has been that central banks have not been overly rigid about hitting their inflation targets in the very short run. For example, while the U.S. Federal Reserve’s (Fed) inflation target is 2%, inflation has held above that level. Nevertheless, the Fed has decided that inflation is heading lower in the medium term and close enough to its target to allow it to implement rate cuts aimed at supporting real economic activity and maximum employment, even as inflation remains slightly above target. Financial markets have taken a positive view of this policy flexibility, and medium-term inflation expectations have remained well-anchored, consistent with the 2% target.

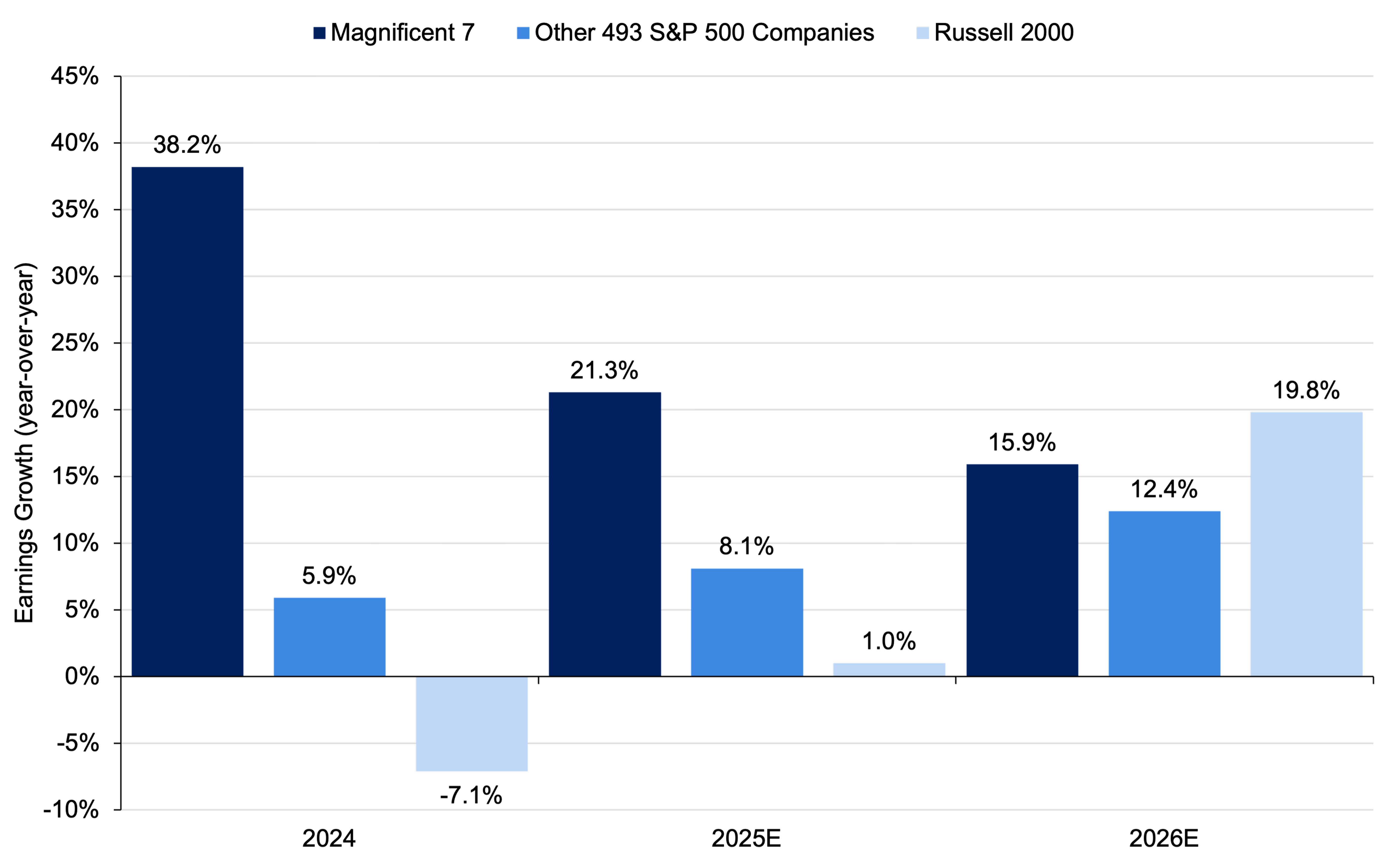

Broad Earnings Growth and AI Hopes Fuel Multiple Expansion

Strong earnings growth, led by the technology sector (but not just concentrated in tech), has also supported financial markets. The broadening of earnings growth beyond tech has also been met with expanding multiples, driven mostly by the outlook for AI. Although it remains uncertain how far AI developments will transform businesses, there is still plenty of room for optimism. AI shows promise not just in making scientific research and drug discovery processes more effective, but also as a developing general-purpose technology that can be applied across businesses and industries to boost efficiency. The expansion of equity valuation multiples has been, in part, an expression of that optimism.

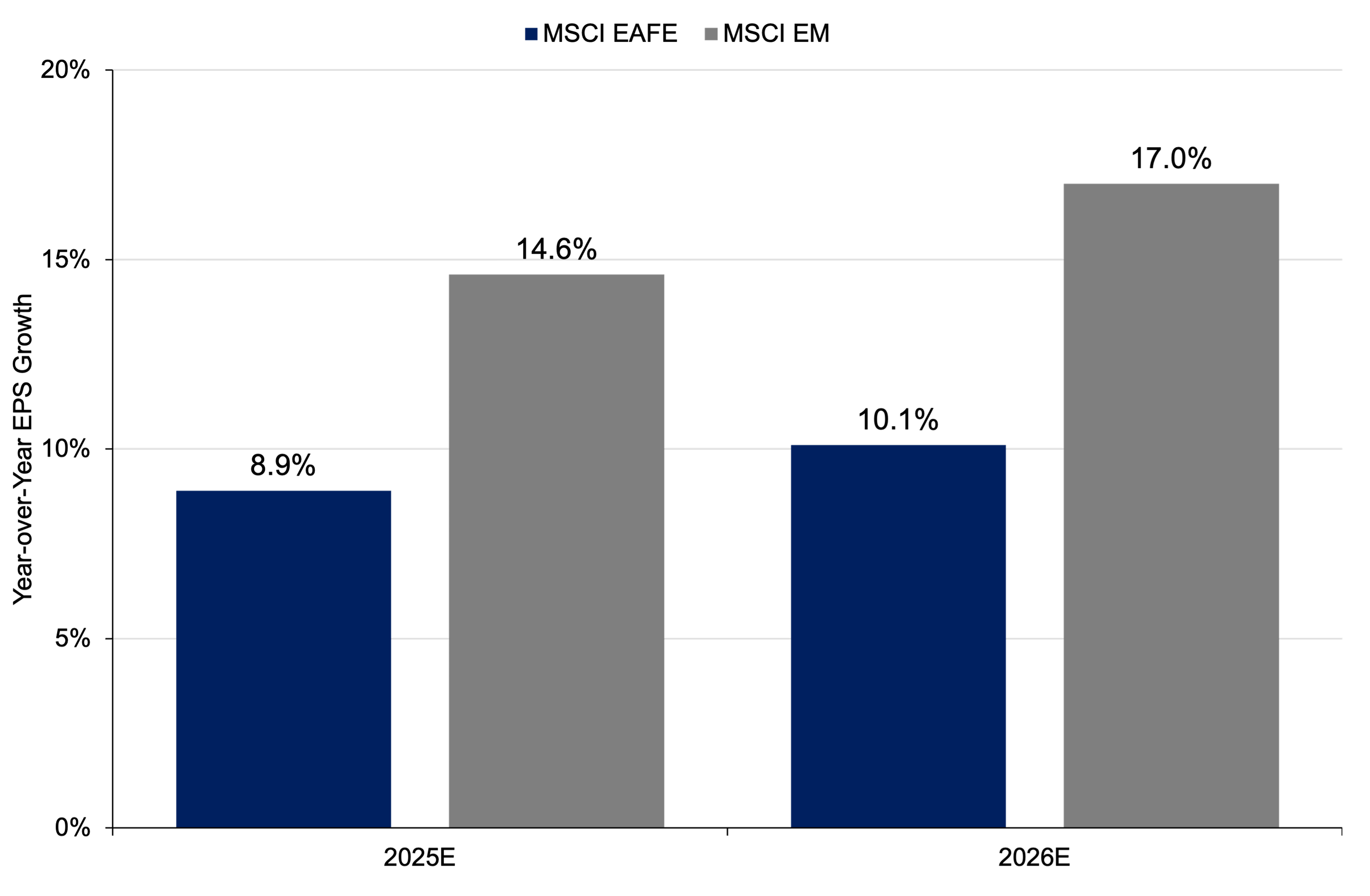

Key Themes Extend to Overseas Markets

Multiple expansion, driven by lower interest rates, the promise of AI, and relatively low inflation, has also been a strong tailwind for financial markets globally. This strength is evident not only in the United States, where stocks have risen about 17% this year through October 31—based on the performance of the S&P 500® Index—but also internationally. The MSCI All Country World Index (ACWI) ex-U.S. has risen about 28% in the same period, reflecting both a weaker U.S. dollar and robust performance by overseas companies. This marks a notable shift from prior years, when non-U.S. equities, despite appearing attractively valued, consistently underperformed U.S. stocks. In contrast, many international markets, including Japan, the Eurozone, the United Kingdom, and several emerging economies, have posted higher returns in 2025.

Global Growth Prospects Driven by Major Economies

Another major theme has been resilience in China. China’s transition from a housing-led economy to an export-driven model has faced challenges. The risks to its export sector came in the form of tariff policy in the United States, as well as growing unease in industries globally where China has expanded rapidly, particularly in motor vehicles, especially electric vehicles (EVs). Despite these headwinds, industrial activity in China has been resilient, boosting high value-added production at home and leveraging its trade relationships with countries such as Vietnam and Thailand to maintain overseas market access. What happens domestically in the United States and China has a significant impact on the global economy due to their size. China’s continued strong performance and its avoidance of political and financial crises have underscored its resilience, which has been a major factor shaping the global economy.

Europe has seen stronger growth amid challenges posed by the ongoing war in Ukraine, high energy costs, and uncertainty about future supply, and rising military spending. Indeed, spending on redevelopment and expansion of member nations’ defense and security infrastructure, and a relaxation of budgetary rules in major economies in the region, have acted as fiscal stimulus, lifting Eurozone growth above the sluggish 1% previously seen. Meanwhile, Japan has maintained pro-growth policies that the new government appears to be committed to.

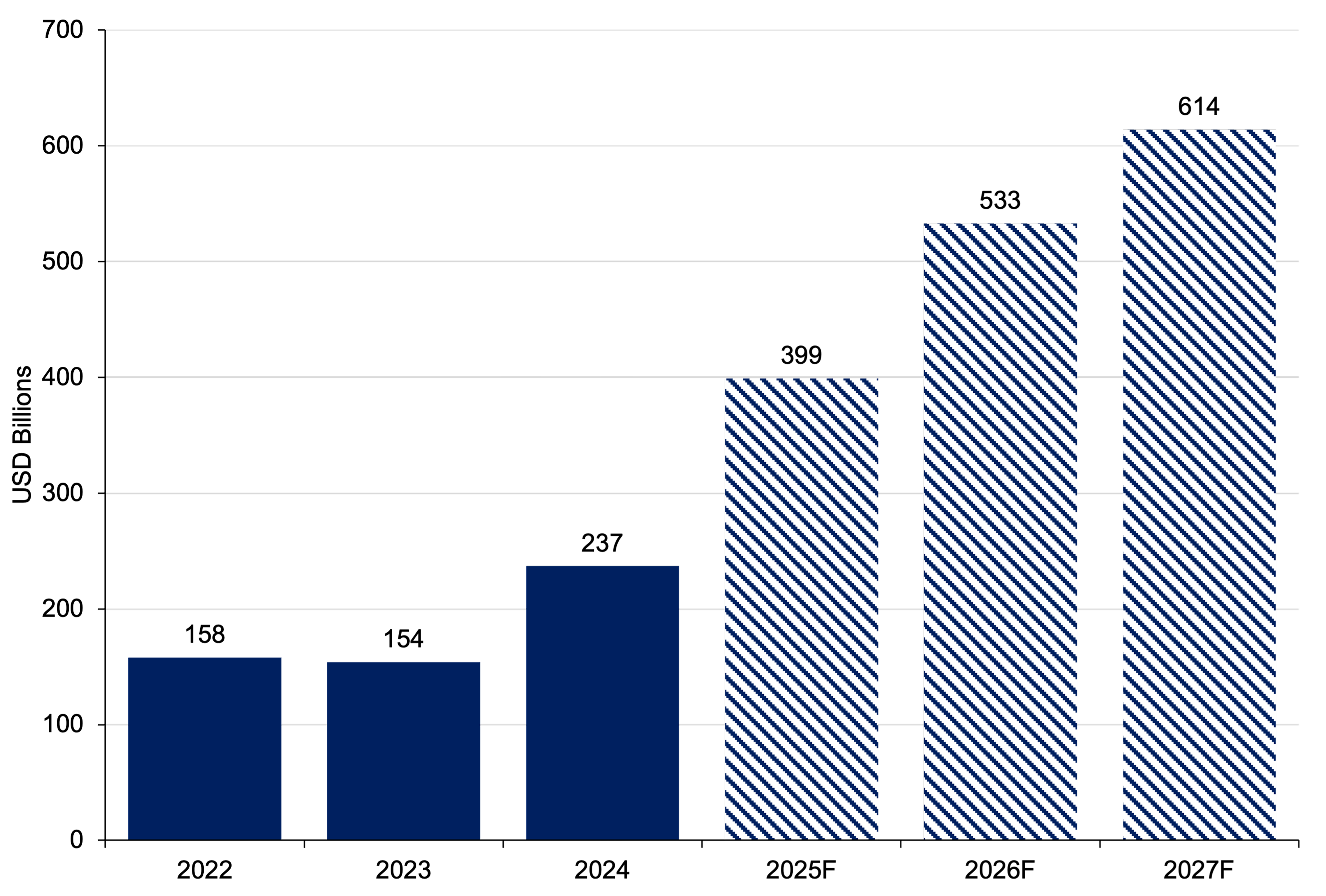

A Supportive Era for Cryptocurrency, Stablecoins, and Tokenization

The United States has taken a strong stance in supporting the development of cryptocurrency, stablecoins, and tokenization, an approach that contrasts with the caution of the previous administration and global central banks. This backing has fueled momentum in the industry, driving rallies in digital currencies and shares of related businesses and accelerating the adoption of new payment systems. While these innovations carry both risks and benefits, they now appear poised to potentially become a permanent part of the financial landscape. Given that global payment systems underpin the entire financial system, any shift, whether disruptive or enhancing, could have far-reaching implications.

Risks to Watch in 2026

Growing Deficits

An unresolved challenge for global markets is the rapid growth of public-sector debt in relation to economic output, particularly in the United States. U.S. debt appears to be on a path to rise indefinitely as a share of GDP, soon crossing the 100% threshold. While the exact number matters less than the prospect of its continued rise, investors may eventually demand more compensation for bearing this risk.

Inflation and Tariffs

An unresolved issue remains around the inflationary impact of U.S. tariffs. If tariffs raise the baseline level of inflation, it could complicate the Fed’s ability to cut rates before reaching its target, highlighting ongoing tension between fiscal and monetary policy. Markets are currently priced for the Fed to lower rates another 100 basis points in 2026, and stubborn inflation could force a re-assessment.

The Ukraine War

Another significant risk stems from the ongoing conflict in Ukraine, which has continued to escalate rather than diminish. The longer the conflict drags on, the more pressing the threat to global food supplies and the more pressing the necessity of substituting low-priced Russian oil and natural gas with more expensive alternatives.