Key Points

- Markets have mostly recovered since intense volatility was triggered by the tariff announcement on April 2. However, certain indicators show elevated uncertainty persists.

- Mixed signals on the health of the U.S. economy have come from the sharp decline in sentiment and confidence measures (soft data) and relatively healthy job growth and consumer spending (hard data).

- Despite the significant policy changes and heightened uncertainty, a strong economic foundation, characterized by full employment and decreasing inflation, should provide stability and continuity going forward.

The overarching theme that has been the focus of financial markets is elevated uncertainty. The economic recovery following COVID-19 demonstrated remarkable strength and resilience. As we now face another round of heightened uncertainty due to significant changes in trade, immigration, fiscal, and regulatory policy all occurring simultaneously, an important question is whether the economy is experiencing a sharp break from the initial years of the current recovery, or if there are elements of continuity going forward. In 2024, U.S. Federal Reserve (Fed) policy was able to reduce inflation, though not all the way down to their 2% target, while maintaining a full employment economy with substantial job creation. This robust economic foundation may help to provide a degree of stability and continuity as we navigate the unknowns ahead, offering a constructive outlook amidst the challenges.

Conflicting Market Signals Add to Uncertainty

On a positive note, financial markets have been exhibiting optimism. Following the spike in volatility that was triggered by the tariff announcements on April 2, equity markets have moved higher, and high yield spreads have meaningfully tightened. As the implementation of most new tariffs was delayed for 90 days and an initial round of negotiations led to agreements that lowered rates, investors have become less pessimistic about the outlook. Despite the remaining uncertainty, investors have become more confident that a policy “put” exists that ensures policymakers will back away from changes that are deemed too negative for growth and earnings. That has, in turn, led to renewed confidence that technological advancements, such as artificial intelligence (AI), will likely unleash a surge in productivity.

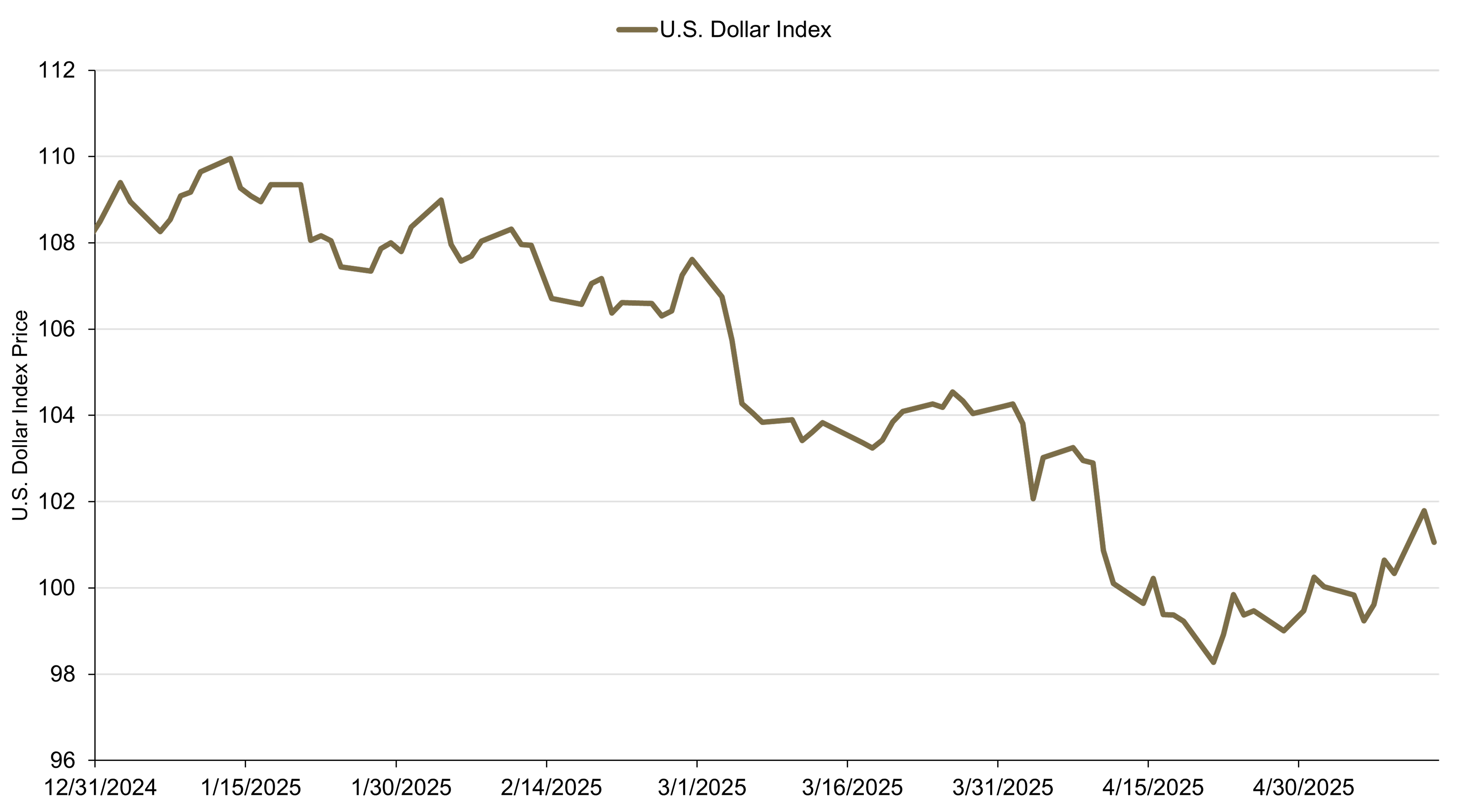

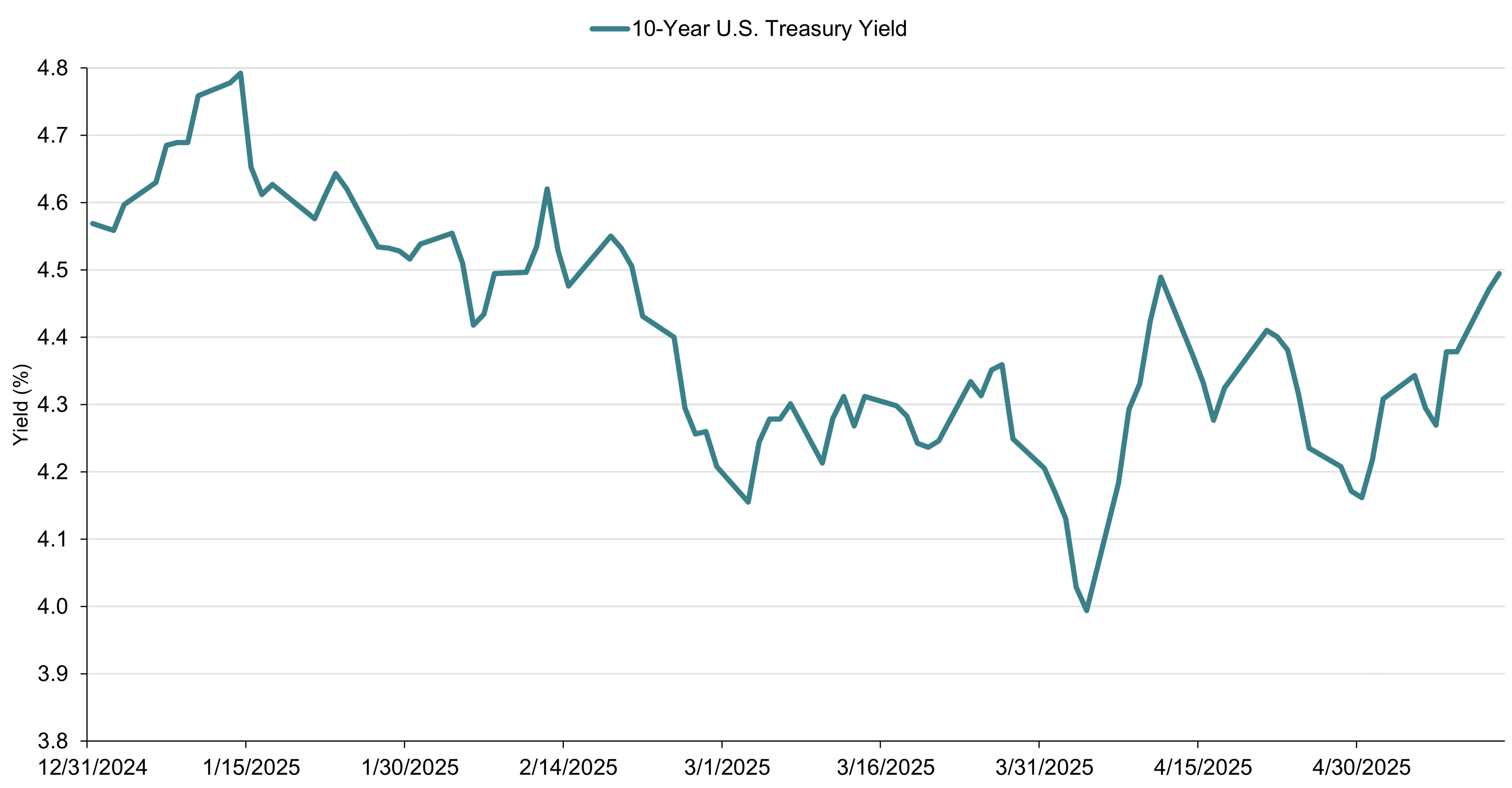

However, there are also concerning signs. During the market sell-off from mid-February to early April 2025, safe haven assets did not play their usual role. Normally, in a global market sell-off, the U.S. dollar would strengthen, and U.S. Treasury bonds would appreciate as these have typically been considered global safe assets. Instead, we saw the Treasury market sell off and the dollar weaken (see Figure 1).

Figure 1. Safe Harbor Assets Behaved Differently During This Period of Uncertainty

U.S. Dollar Index spot price, December 31, 2024-May 13, 2025 (top panel) and 10-year U.S. Treasury bond yield, December 31, 2024-May 13, 2025 (bottom panel)

This shift in the behavior of safe haven assets may suggest that investors are beginning to view the world differently. The U.S. had gained a special status due to its strong economic recovery post-COVID and its leadership in AI innovations. However, the fact that U.S. assets did not behave as expected during the market sell-off has called “U.S. exceptionalism” into question.

Differentiating Soft and Hard Economic Data

Concerns about how fiscal and trade policy changes may affect future economic activity have likely influenced the recent decline in consumer sentiment and business confidence surveys. Sentiment indicators are considered soft data and can change rapidly. They also have often preceded shifts in hard data, such as job growth and consumer spending. Currently, soft data suggest a troubling economic outlook, while hard data indicates more stability or a slight slowdown, but nothing severe.

A similar dichotomy emerged in 2022 when the Fed began tightening monetary policy. Many feared that significant rate hikes would lead to a deep recession. However, despite an increase of 525 basis points (bps) in the fed funds rate, the economy remained resilient, growing faster than its long-term trend. Consumer and business confidence measures initially declined but then recovered. The question now is whether the economy will show similar resilience in the face of current challenges or if activity will slow sharply, potentially leading to a recession.

There are valid reasons to expect the economy to slow from the 2%-2.5% growth rate recorded since mid-2021, according to the U.S. Bureau of Economic Analysis. Heightened uncertainty may cause hesitation among businesses and consumers, but a recession is not inevitable. If souring sentiment measures are followed by sharp cuts to spending by households and businesses rather than just feelings of concern, a recession could develop. The current situation is complicated by the anticipation of tariffs, thus leading to a temporary surge in demand as people buy ahead of price increases. This behavior may create a misleading appearance of strong demand, which will likely fade once the tariffs take effect, reducing purchasing power and leading to a slowdown in consumer spending. But the healthy economic foundation should offer at least a measure of stability and consistency as we face future uncertainties.

In the other segments of our 2025 midyear investment outlook, we discuss how these conditions, as well as contra indicators and earnings growth outlooks for stocks, supportive elements for fixed income, historically attractive yields in municipal bonds, and a focus on selectivity and underwriting practices in private credit, inform our positive outlook on risk assets in an environment where active investment management may be crucial to capitalize on changing market conditions.

Key Points

- Market uncertainty is expected to continue, with ongoing tariff negotiations likely to reduce anxiety.

- Although U.S. economic growth is slowing, a recession is not in our base case. Inflationary impulses remain a potential challenge but are expected to be short-lived as trade policy becomes clear.

- Within investment grade, we favor an up-in-quality approach with strategic shifts toward less cyclical sectors and agency mortgage-backed securities (MBS) and commercial mortgage-backed securities (CMBS).

- Credit remains attractive, in our view, and we expect to continue to take measured risks in high yield bonds and selective positioning in non-U.S. and European credit.

As we begin our outlook on bond markets for the rest of 2025, the first question we ask is: what kind of environment are we in? The most pressing and common theme, or even word, that comes up these days is uncertainty. We believe this characterization accurately reflects how we currently view the markets. However, this doesn't mean we are paralyzed or inactive in our portfolio management. We are indeed playing offense, but it's crucial to recognize that we are navigating a highly uncertain world, and this past April was a clear indication of this uncertainty.

Evaluating Tariff and Policy Impacts

Evolving news about tariff policy continues to drive client discussions and create uncertainty around two key questions: 1) Will this lead to a recession?; and 2) Will this lead to inflation? The question of what will happen with tariffs is constantly on everyone's mind. Every day or week, we hear something new—sometimes positive, sometimes negative. It's crucial to separate the signal from the noise in these discussions to understand the true impact and implications. While headlines about tariff policy have the potential to continue to cause market volatility, we believe we are likely past peak anxiety about the tariffs as progress has been made in negotiations with a number of countries.

Another commonly asked question in recent weeks is whether we are in a stagflationary environment or if stagflation is on the horizon. The answer to this is also uncertain. However, there are inflationary impulses stemming from both immigration policy and trade tariff policy.

Stagflation consists of two parts: the first being whether we are heading into a recession. Although we believe the probability of recession has increased, it is not our base-case scenario for the next 12 months.

The second part concerns inflation: whether we are facing sustained inflation or merely a one-time increase in prices due to tariffs, which act as a tax and may be passed on by companies to consumers. We believe there is an upward pressure on prices, particularly in certain goods, leading to short-term inflationary impulses. However, this inflation is likely to be temporary and will eventually subside. Additionally, there may be some pressure on corporate margins during this period.

Investment Grade Strategies: Measured Responses to Uncertainty

While there are various policy changes occurring, we don't believe they are substantial turning points requiring a significant reaction. Rather, we have been readjusting our strategy, shifting from cyclical sectors to a more defensive stance in recent weeks.

For example, we have reduced our energy exposure across portfolios and rotated to more defensive sectors like consumer staples and utilities—sectors that benefit from secular tailwinds or have more stable revenue and earnings profiles. Additionally, we are focusing a bit more on domestic investments rather than international ones in general. We have reduced emerging market exposure and rotated to U.S.-based real estate investments, including MBS and CMBS. While the magnitude of these adjustments is relatively small, these measured responses to the current environment have been key to staying balanced, playing some offense and some defense, while effectively separating the signal from the noise.

Leveraged Credit Strategies: Balancing Risk and Return and Staying Agile

Over the past year, we have emphasized that a high nominal growth environment, which includes both real economic growth and inflation, is generally a positive investment landscape for risk assets. However, in a slowing economy, the need for flexibility, credit research, and selectivity becomes vital, in our view. Before the term "tariff" became prominent, U.S. growth was already slowing, and we believe this trend will continue.

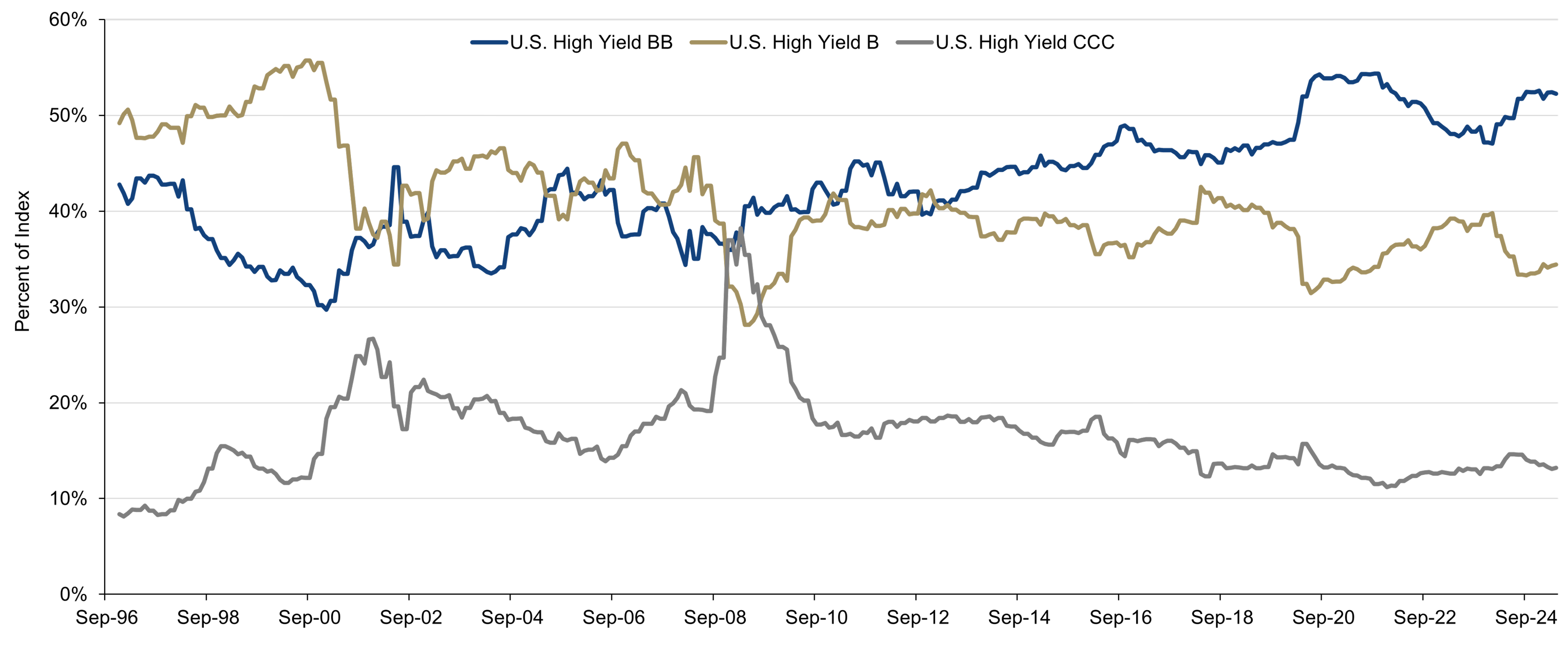

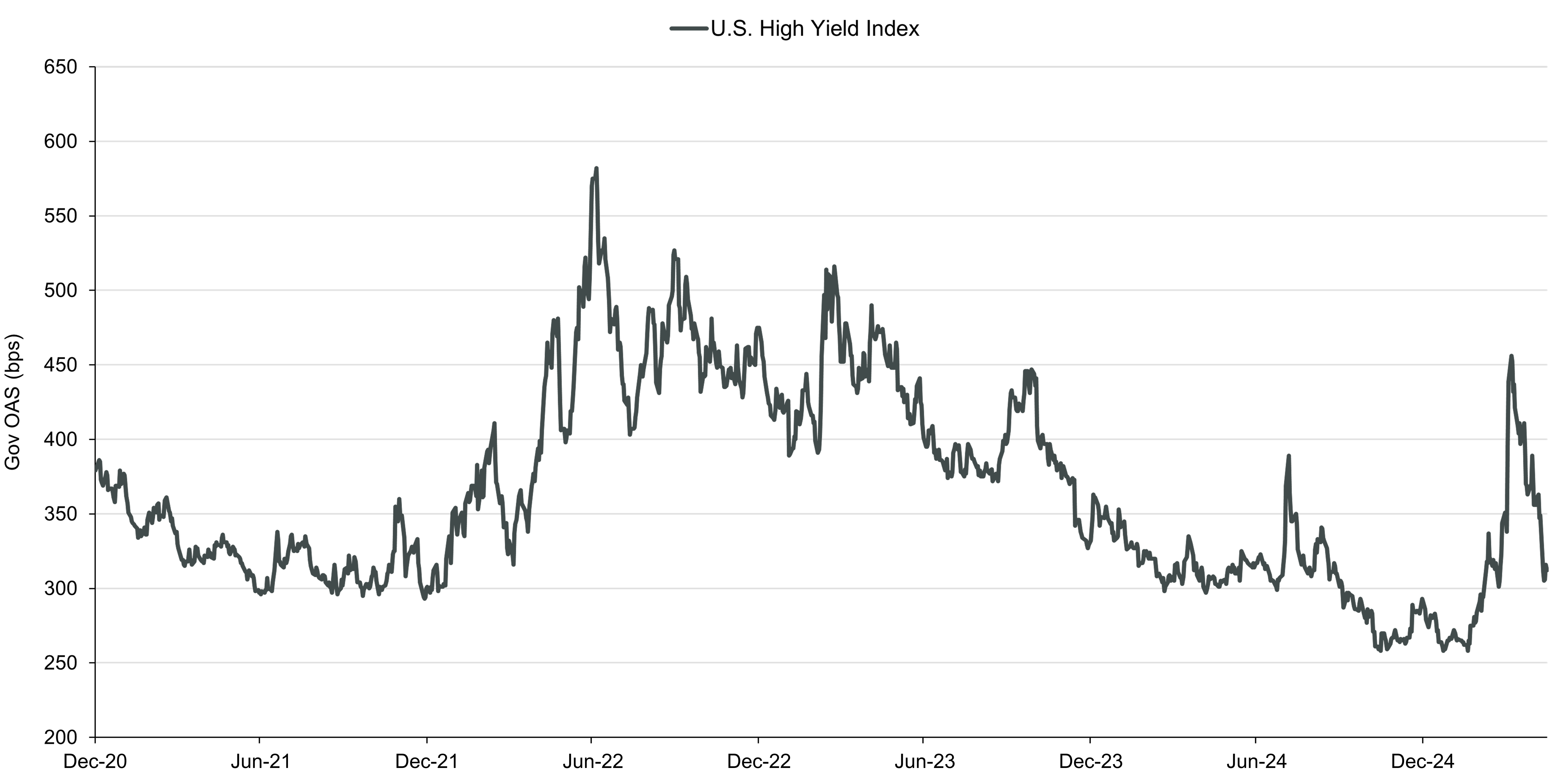

As tariff policy uncertainty led to the increasing possibility of recession, high yield credit spreads widened sharply to approximately 460 basis points (bps) in early April, from a low of 260 bps earlier this year. Importantly, as high yield spreads widened, buyers quickly came back into the market. That demonstrated the resilience of the asset class we have spoken about with clients for some time, which can be attributed to several factors, including the higher credit quality profile of the market (see Figure 2), the lower duration versus history, and increased prevalence of secured bonds in the index. This suggests that spreads in the index as it is currently constituted should be lower on average than where they have traded historically, all else being equal.

Figure 2. High Yield Bond Index Remains Near Highest Quality in History

ICE BofA U.S. High Yield Bond Index by credit quality, March 31, 1997-April 30, 2025

Currently, spreads are at approximately 315 bps, recovering from the widening seen in April. Given the current valuations and prevailing uncertainty, we have been strategically moving our portfolio up in quality, rotating away from cyclical exposure toward defensive sectors. This shift is in preparation for slower economic growth, which remains our base-case scenario, though we do not anticipate an outright recession. Consequently, we feel our portfolios are positioned to withstand further market volatility, while allowing for the ability to participate in continued market recovery, balancing caution with the need for potential returns.

Figure 3. U.S. High Yield Bond Spreads Have Substantially Tightened

ICE BofA U.S. High Yield Index OAS, December 31, 2020-May 16, 2025

Looking outside of the U.S., the global economic landscape presents a mix of opportunities and challenges. Growth is accelerating in certain regions, particularly in Europe. The European Central Bank (ECB) is cutting rates, and Germany is implementing substantial fiscal stimulus measures. Additionally, the weaker dollar is beneficial for exposure to these markets. In our multi-sector strategies, we are embracing non-U.S. risk and European credit, which we expect to continue in the coming months.

We think credit offers the opportunity for attractive yield. In this market environment, staying liquid is crucial, as conditions can change rapidly. We are cautiously optimistic about the back half of the year, hoping for more improvements on the tariff front, while continuing to take measured risks, seeking to earn attractive returns for our clients.

Key Points

- Strength in first quarter earnings underscored the healthy condition of companies and the broader economy as markets encountered tariff and policy uncertainty.

- Technical and sentiment indicators continued to show elevated uncertainty and bearish sentiment, which historically have been followed by attractive recoveries over time.

- We are strategically positioned to prioritize earnings resiliency and key secular trends, seeking to capitalize on current market conditions and navigate uncertainty.

The stock market has experienced a significant rally following intense volatility in early April 2025. Understanding the reasons behind this surge can provide valuable insights into future trends. One of the key factors contributing to the rally has been the easing of tensions in the tariff discussions, which have alleviated some of the market's previous anxieties. Additionally, company earnings reports for the first quarter have largely exceeded expectations, further boosting investor confidence.

Prioritizing Earnings Over Macro Uncertainty

As we near the end of the earnings season, approximately 97% of the S&P 500® companies have reported their results, along with about 90% of the Russell 3000®. Notably, 78% of these companies have reported earnings that surpassed expectations, which is above the historical average of approximately 65%. Companies normally beat earnings estimates by about 4%. This past quarter, the average beat was approximately 8% above consensus estimates. This positive earnings trend has played a crucial role in driving the recent market rally.

Looking back on the first quarter, earnings growth surpassed expectations, achieving a 10% year-on-year increase. Despite some downward revisions to the 2025 full-year earnings growth forecast—from the low double digits to around 8%—the downgrade has been less severe than initially feared. This resilience in earnings highlights the underlying strength of both the companies and the broader economy as they entered this period of uncertainty and underscores the solid foundation upon which these companies are operating, providing a positive outlook despite the challenges ahead.

Forward earnings guidance has also been more optimistic than expected. Contrary to concerns of a broad withdrawal of guidance, most companies have either guided conservatively or maintained their positive outlooks. The best forward-earnings revisions have been in the service sectors, including technology, communications, financials, and healthcare. This quarter, the spread between companies that outperform on revenues and earnings versus those that miss has been about 3.5% to 4%, which is normal. This indicates that the market is rewarding good performance and penalizing underperformance, showing that investors are focusing on company-specific results rather than macroeconomic factors. This normal spread is a positive sign, suggesting that good news is being recognized and rewarded in the market. All earnings data has been sourced from FactSet as of April 30, 2025.

Historically Strong Recoveries Following Equity Market Volatility

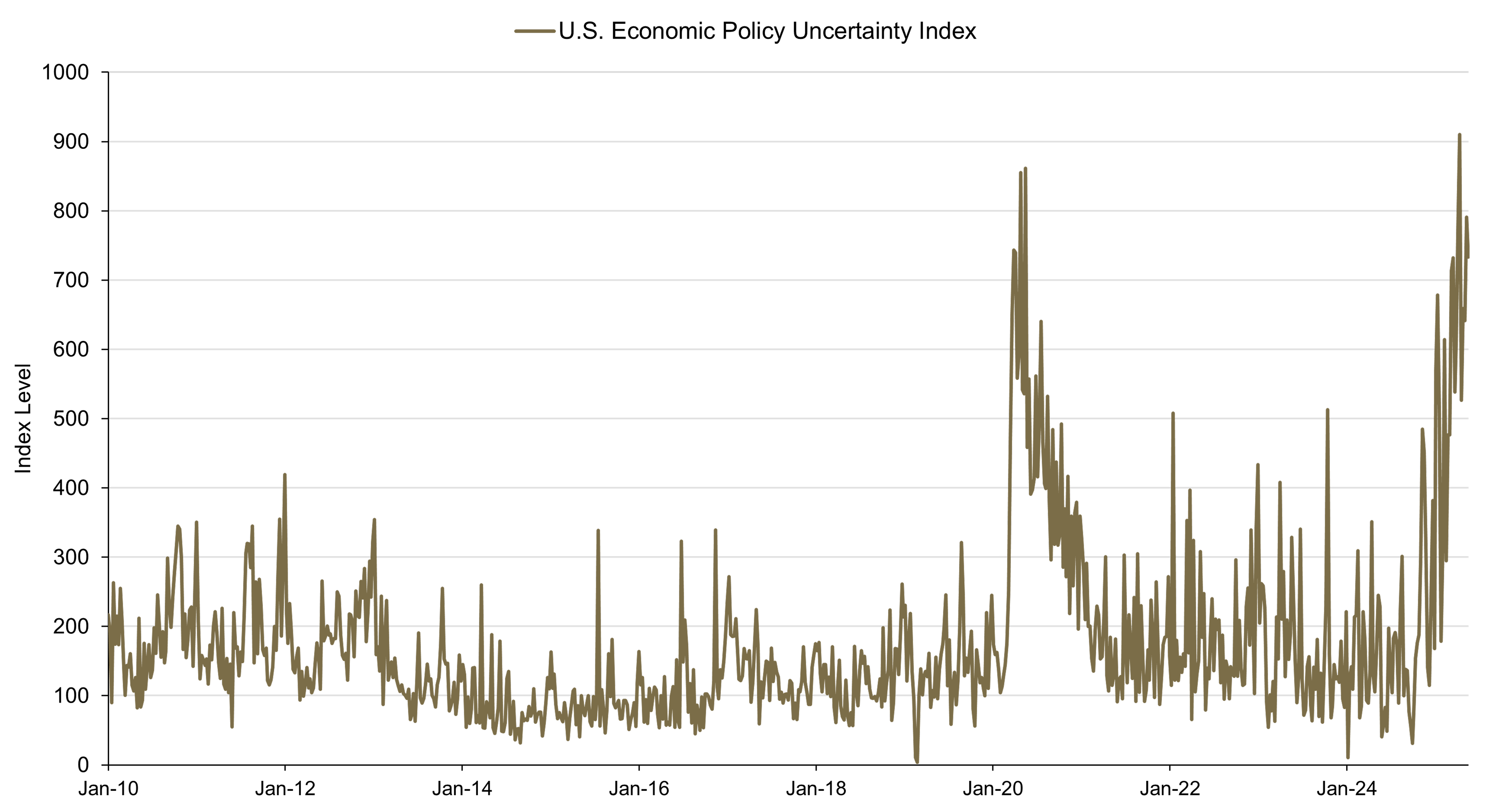

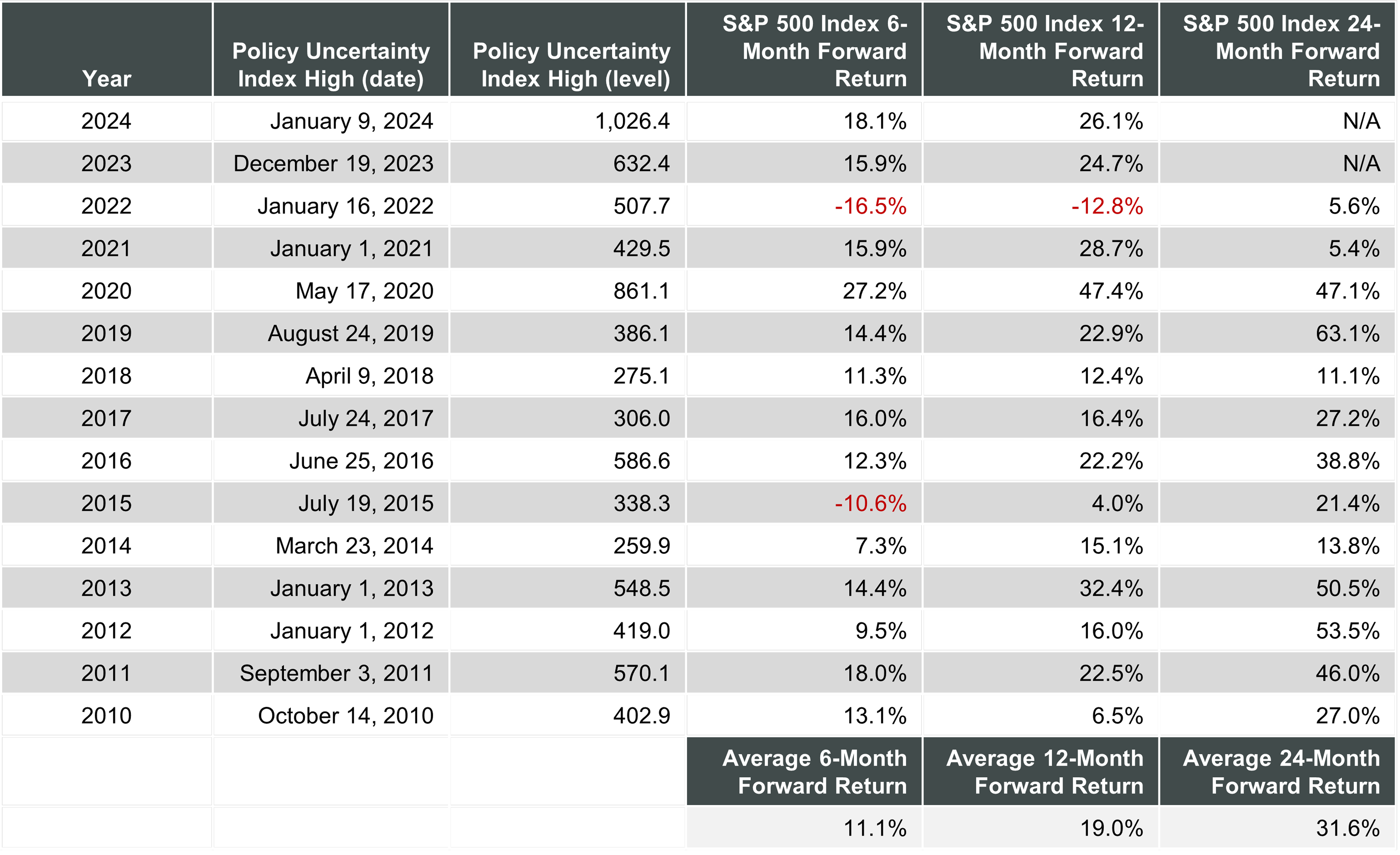

We’ve recently highlighted tactical indicators and sentiment measures that reached extreme levels following the tariff announcement on April 2. One such indicator is the Economic Policy Uncertainty index, which remains exceptionally high (see Figure 4). Historically, when this index is elevated, market returns over the next six to 12 months have been favorable, as the series tends to mean revert, or return to the long-term average. This suggests that as policy uncertainty eventually decreases, forward returns are likely to be positive.

Figure 4. S&P 500 Index Forward Returns Following Periods of Elevated Uncertainty

U.S. Economic Policy Uncertainty Index level, January 2, 2010–May 18, 2025, (top panel) and S&P 500 Index forward returns following the Economic Policy Uncertainty Index high in each calendar year shown (bottom panel)

Another important measure is the Investors Intelligence Bull/Bear ratio, which provides valuable insights into market sentiment. This survey, which dates back to 1964, reveals that it is quite unusual for bears to outnumber bulls. In the past 15 years, this phenomenon has occurred only eight times.1 The most recent instances were during the inflation bear market low of November 2022 and the COVID-19 market downturn in March 2020. Recently, we find ourselves in a similar situation, highlighting the rarity and significance of such market sentiment, which is a contra indicator and can be viewed as a positive sign looking forward.

Positioning for Earnings Resiliency and Significant Secular Trends

Our outlook is reflected in how we are strategically positioning portfolios to navigate current market conditions and the policy uncertainty that is likely to lie ahead. The equity team has prioritized earnings resiliency across all sectors, considering factors such as tariff exposure and economic uncertainty. Additionally, we are focused on secular trends that were in place before current policy shifts. These themes are still reflected in our portfolio. Firstly, we highlight generative AI and related applications, as well as exposure to the infrastructure build-out. Secondly, reshoring and near-shoring have been significant themes, with companies involved in capital expenditure for these initiatives likely benefiting from U.S. policy acceleration. Lastly, defense spending is on the upswing in Europe, benefiting companies in the aerospace and defense industries. This overview captures our thoughts on current positioning, future direction, and areas we favor as we head into the second half of 2025.

Key Points

- The most significant development for private credit in the first half was the April 2 U.S. tariff announcement, which caused deal activity to slow as market participants weighed the potential economic impact.

- However, deal activity rebounded in the following weeks, and we believe the direct lending market will return to a more normal environment by the end of 2025.

- Other factors to watch in the year’s second half include a potential increase in payment-in-kind deals, the legal environment for liability management exercises, and the ongoing convergence of public and private credit markets.

Much like other asset markets, the defining event for private credit in the first half of 2025 was the U.S. tariff announcement on April 2. Following the initial surprise of the larger-than-expected levies on U.S. trading partners, there was some volatility in the direct lending market as investors weighed the potential impact of the news on the U.S. economy.

But in less liquid markets like direct lending, volatility takes a different form after a market surprise on the order of the tariff announcement. In liquid markets, price changes are immediately evident; in private markets, the impact is felt in terms of deal activity—transactions that are trying to come to market at that time tend to be put on hold. In the case of the April 2 announcement, market participants likely thought, "We don't know the direct impact of this policy change. Let’s stay on the sidelines and see where things go."

The key questions for private credit investors following the tariff announcement were: What would be the potential impact of tariffs on a given potential borrower's financial ecosystem? And how would that, in turn, affect the potential lenders to that company? As the dust began to settle after the April 2 announcement, market participants took a closer look at the businesses affected by the news and realized the impact would not be the same for all companies. For example, service-oriented companies could have materially less exposure to the tariffs than internationally focused manufacturing companies. In select cases, this dynamic allowed for certain issuers to successfully come to market. In the weeks that have followed, deal flow has rebounded to levels seen earlier in the year but that amount of activity still represents muted deal flow in a historic context.

At the start of the year, the market was anticipating a material increase in deal volumes with the new administration taking office. That view was upended by the tariff news. We think that as the impact of the tariff news lessens, and as investors have more clarity about their ultimate shape, the chill in lending activity will thaw in the second half of the year, most likely in the fourth quarter. Once owners of enterprises decide that conditions are more favorable, they should be more likely to pursue strategic transactions, whether selling the company or buying a competitor. As the market calms, we believe borrowers and lenders will come back to the table. We are already starting to see that in our deal pipeline, but a full return to a more normal deal environment is not likely to happen until later in the year.

We believe that the volatility and uncertainty that resulted in delayed deal flow presents opportunities for investors in the direct lending space. Prior to April 2, credit markets had been benign for an extended period of time, a condition that tends to lead to less differentiation in pricing of risk. It can also lead to less discipline in terms of the type of deals that come to market, as an extended period of market calm may attract “tourist” buyers who do not normally participate in direct lending deals. We believe the post-April 2 volatility brought focus back to the market, resulting in more discipline for deal pricing. This led to deals being priced with different levels of spread, more reflective of their risk profile.

Factors to Watch in the Second Half

Apart from the lingering impact of the tariff news on deal flow, here are some other developments we will be watching in the remaining months of 2025:

Payment-in-kind (PIK). As a reminder, in PIK deals, the borrower capitalizes some or all of the interest due on a loan. When the PIK feature is used, the borrower doesn’t make all of their interest payment in a given quarter; the amount that they do not pay gets added to their principal, and so they're then paying interest on a higher principal amount over time. There has been some media coverage on how the amount of PIK debt outstanding in existing portfolios has moved higher. We consider PIK to be a credit negative, as it shows that a company is probably tight on liquidity.

Liability management exercises (LMEs). The market has been focused on recent court decisions, especially the so-called “Serta” ruling. On December 31, 2024, the U.S. Court of Appeals for the Fifth Circuit held that the “sacred” rights of lenders to pro rata payment under the Serta Simmons Bedding, LLC (“SSB”) credit agreement prevented a non-pro rata exchange of participating lenders’ existing debt for “new” super priority debt. We think rulings like these will result in more certainty around the language in loan covenants regarding protections for various classes of lenders.

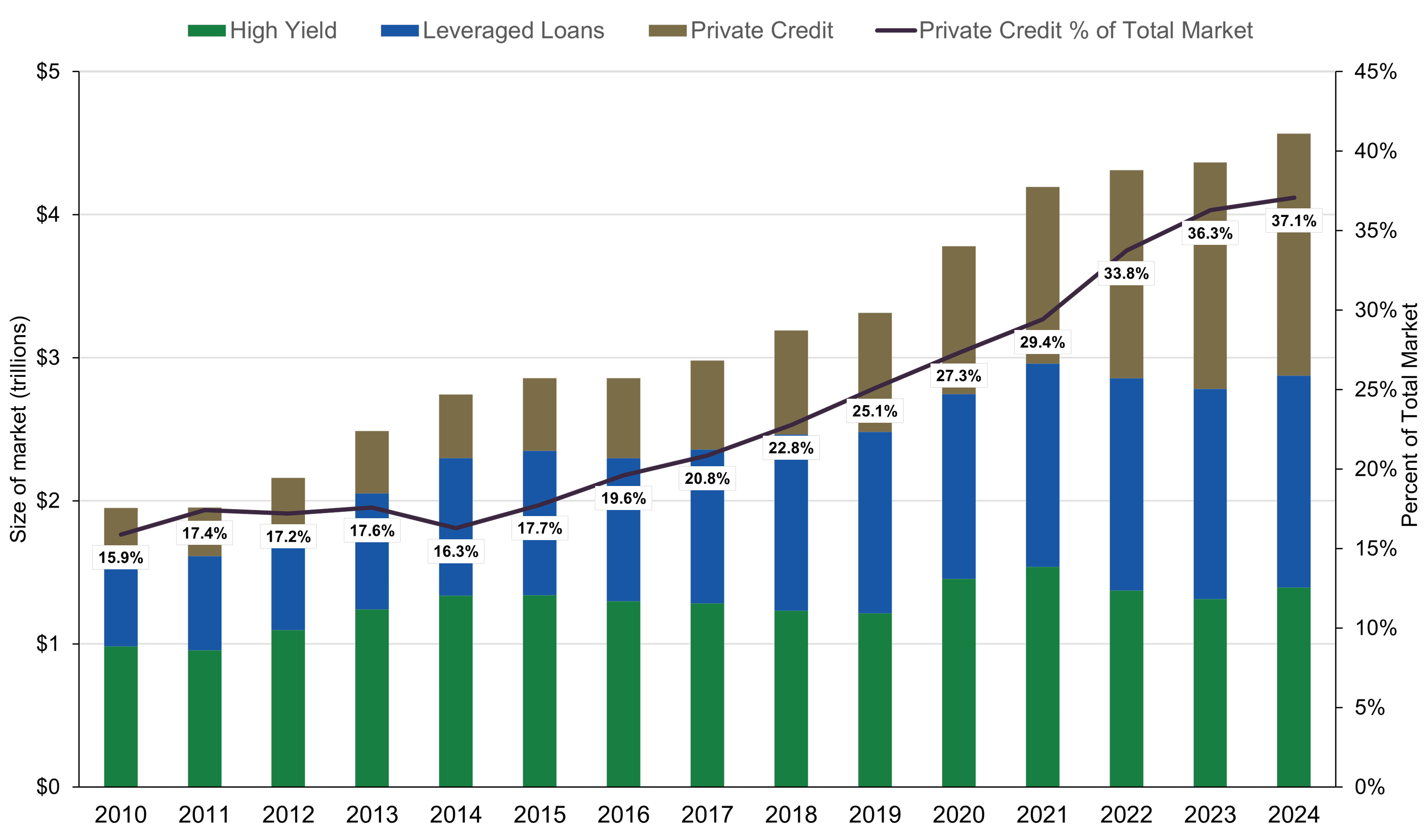

Convergence of public and private credit markets. Convergence is still happening at a rapid speed, not just in direct corporate lending but also in private asset-backed finance and other parts of the private markets. The broader private credit market has grown dramatically (see Figure 5), and this growth has implications for how companies choose to pursue financing.

Figure 5. The Private Credit Market Has Grown in Size and Prominence

Data for various components of the U.S. leveraged finance market for the calendar years 2010–2024

Private direct lending is a well-established source of financing for small and middle-market companies. Many larger issuers are evaluating their options more and want to have access to both public and private markets because of the flexibility and underwriting discipline that private credit can offer.

We believe capital formation around private strategies will continue to grow, and the market will continue to evolve. As that evolution occurs, asset managers will have increasing opportunities to differentiate themselves, as credit research and underwriting expertise will come to the fore.