Real estate-linked investment vehicles such as commercial mortgage-backed securities (CMBS) and residential mortgage-backed securities (RMBS) are often significant holdings within core, core plus, and multi-sector fixed-income portfolios. As such, we are often asked how these asset classes will fare under various economic scenarios.

In our last update, which focused on the commercial real estate and CMBS markets, we noted that most property types and markets were balanced, suggesting a supply-and-demand equilibrium amid continued strong economic and labor market growth. Since then, the announcement of plans to implement higher tariffs on U.S. trading partners by the new administration on April 2 has spurred concerns about the impact of elevated trade friction on U.S. economic growth. (See our special report “Navigating Volatile Markets” for more on the economic and investment implications of the announced tariffs.)

We have received questions from investors regarding the potential impact of tariffs on commercial and residential real estate investments. Here, we offer a sector-by-sector view of the current landscape, along with some thoughts on investment positioning.

A Constructive Outlook on Select Property Types

The industrial property segment of commercial real estate (CRE) generally refers to spaces used for manufacturing, production, storage, and distribution of goods.

Our outlook for this sector is mixed given the potential effect of sustained tariffs. A decline in import volumes could be offset over time by the re-domestications of manufacturing activity. However, tenant demand is also tied to consumer spending, and we note that there could be headwinds for consumers due to higher prices.

Here are some observations on areas we favor within the industrial property space:

Logistics/Warehouses: We have remained focused on logistics/warehouse facilities used for storage and delivery of goods, and are favorable toward facilities that are smaller, more flexible in terms of tenant configuration and use, and are located in dense infill locations (i.e., “last mile” sites).

Location is a key factor, in our view, as trade uncertainty continues. We believe West Coast ports and markets are more vulnerable as tenants may hesitate to sign new leases due to this uncertainty. Historically, a large segment of total demand in this region has been driven by companies in Asia, and that concentration poses a potentially unique set of risks for markets such as Long Beach and Los Angeles, California. Within this sector, we favor other locations that are experiencing strong job growth, rising populations, and more favorable regulatory environments.

Data Centers: The demand for information technology should not be impacted by the tariffs. However, we would offer a caveat on that view as the buildout of data centers may face input cost pressures in a sector with one of the highest development pipelines. In addition, corporations could face pressure to reduce plans for large capital expenditures related to the construction or leasing of new data centers; however, recent management comments have affirmed or increased spending plans.

Here are some observations on other areas of real estate:

Housing Remains an Area of Relative Strength

The U.S. has a dearth of affordable single-family housing units, a situation which has been exacerbated by a historic increase in mortgage rates over the last few years and lackluster construction levels. While there are secular issues of higher operating expenses and rising insurance costs, as well as potential cyclical pressures of unemployment and lower household formation, the sector should be a relative haven given the factors such as the lack of supply. As we’ve seen lately, the majority of consumers should continue to prioritize their mortgage payments over other more costly forms of consumer debt.

Office and Retail: Emphasizing Strong Capitalization and Essential Consumer Products

The rebound of office leasing activity seen in the second half of 2024 should wane as companies face economic pressures and continued uncertainty from tariffs. Much like during the COVID-19 crisis, the long-term leases common in the sector will buffer landlords’ cash flows, provided the tenants remain solvent. We prefer well-capitalized sponsors that can afford the higher costs for tenant improvements and better-quality buildings in well-located areas.

Within the retail sector, our preference is for grocery-anchored shopping centers that benefit from necessity-based retailers. Marginal malls and power centers are most at risk from a strained consumer. We are keenly aware of possible tenant bankruptcies as retail margins and volumes are potentially squeezed due to tariffs.

Hotels and Hospitality: Cyclical and Geopolitical Concerns

The hospitality sector is cyclical in nature and highly correlated to the overall health of the economy. A strained U.S. consumer is likely to reduce travel plans, while foreign travelers may also cut back on U.S. travel due to the recent boycott announcement in Canada and a potential extension of this dynamic to other countries. We believe this may reduce discretionary spending by both consumers and businesses and new group bookings.

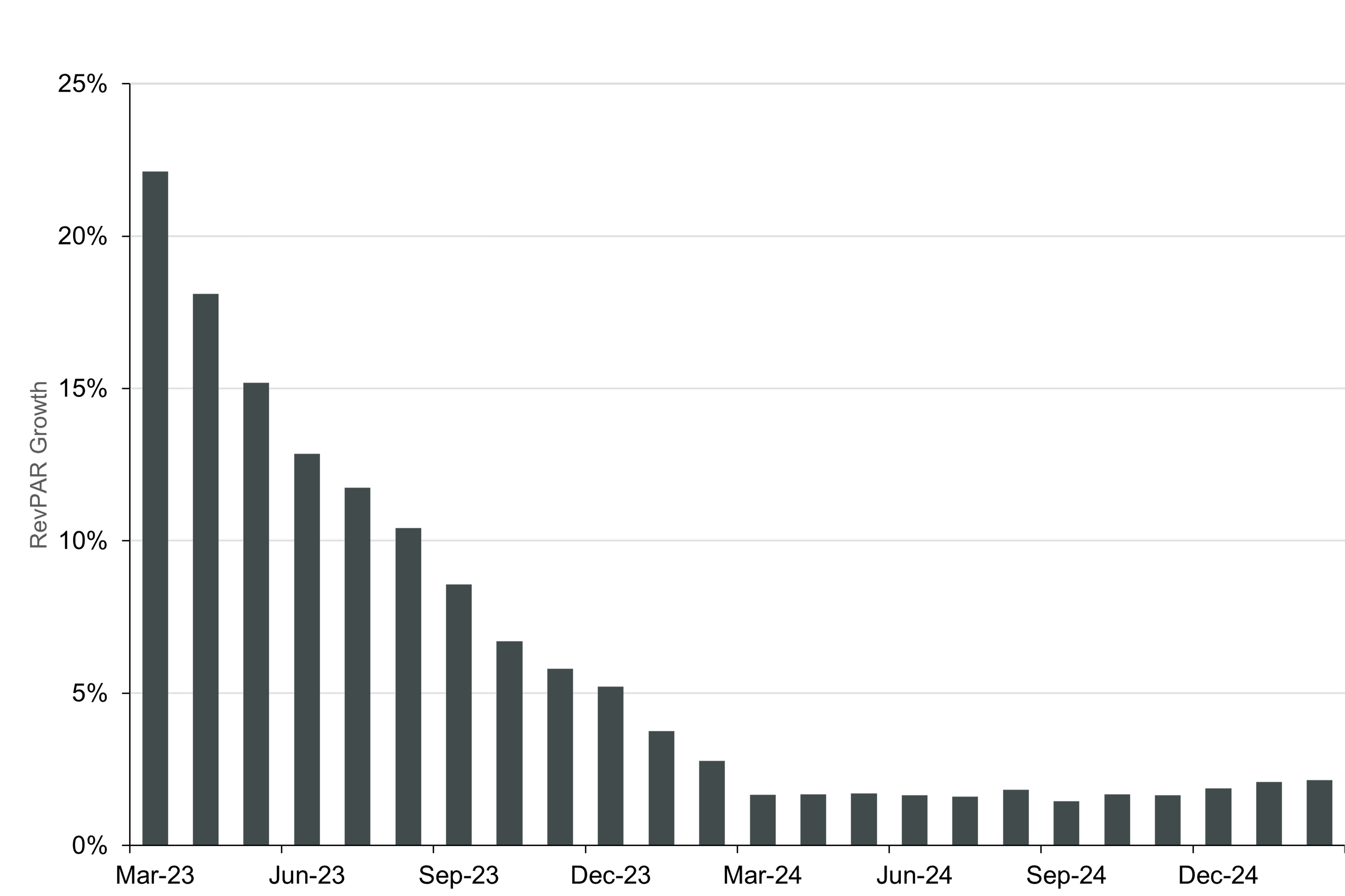

Hotel fundamentals have already been slowing over the last twelve months, and we have been generally less constructive on the sector over the past year, with the recent tariff announcement adding to our concern. Revenue per available room (RevPAR) is a key performance metric and has registered approximately 2% growth over the trailing 12-month period through February 2025, down from approximately 3% growth over the same period through February 2024 (see Figure 1). These national figures are also being pulled higher from an increase in demand from natural disasters attributable to hurricanes in the Southeast and wildfires in Los Angeles, according to CoStar.