Note: This is an update of an article originally published in November 2024.

Buy low and sell high! This strategy has been preached since the beginning of investing. The thinking behind this maxim: When the equity market is expensive, investors should sell their winners and capture some of their hard-earned gains. When stocks are seen as cheap, often after a market downdraft, investors should increase their equity exposure and position themselves for future appreciation.

This approach is simple conceptually, yet it is much more complicated to execute in practice. Peaks and troughs are not necessarily foreseeable, and it is difficult to determine the duration of upward or downward moves in the equity market. This is why history has shown that those who stay invested, or those who invest at regular intervals, have had much better outcomes than those who tried to time the market.

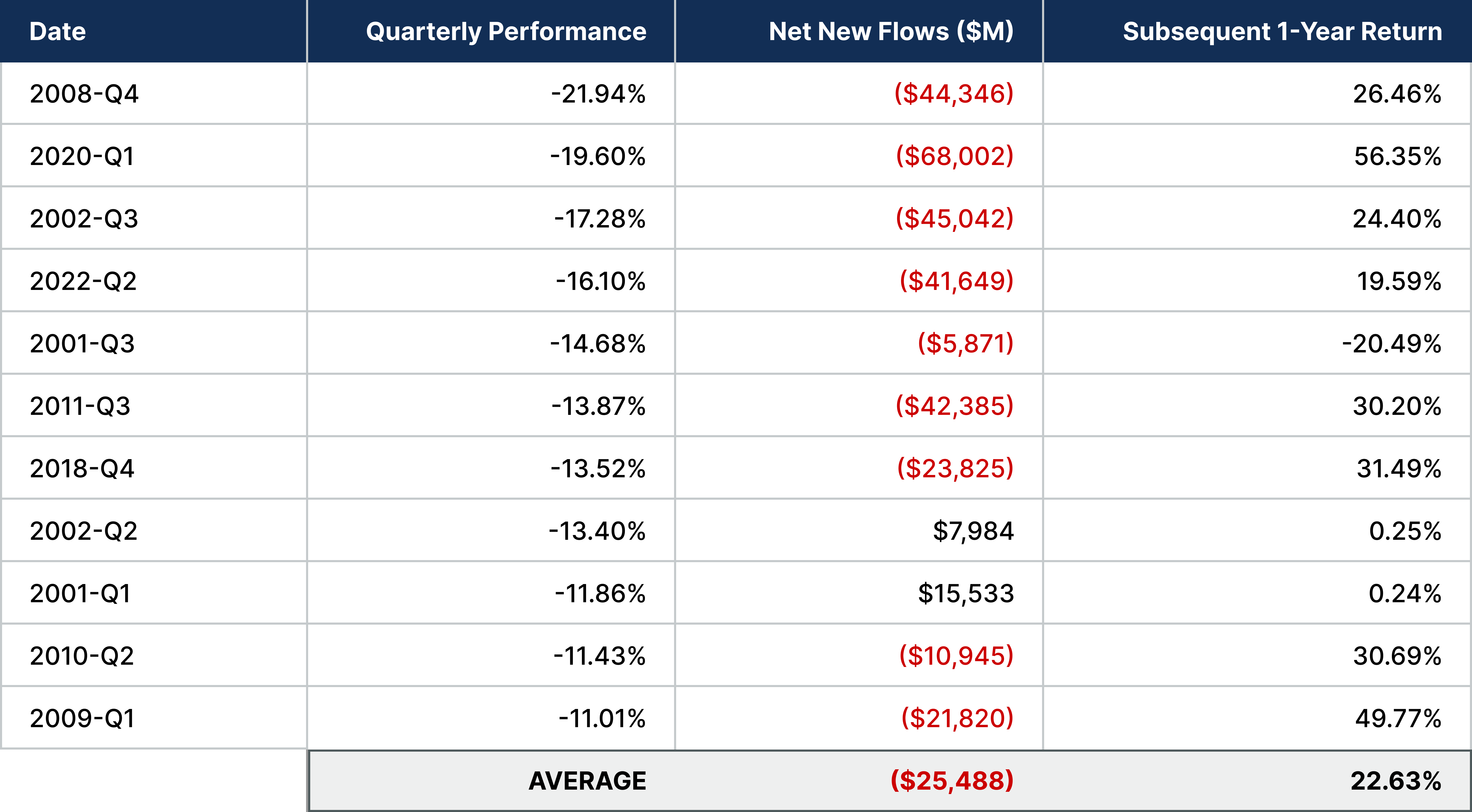

Despite this evidence, investor behavior still shows a reluctance to stay invested in equity markets after periods of weak returns. Over the last 25 years, whenever major U.S. stock indexes had a double-digit drawdown over a quarter, it was common to see net outflows in the equity markets. In almost every instance, the market rebounded strongly over the following 12 months, meaning that some investors inverted the old cliché and “sold low,” missing out on that recovery (Figure 1).