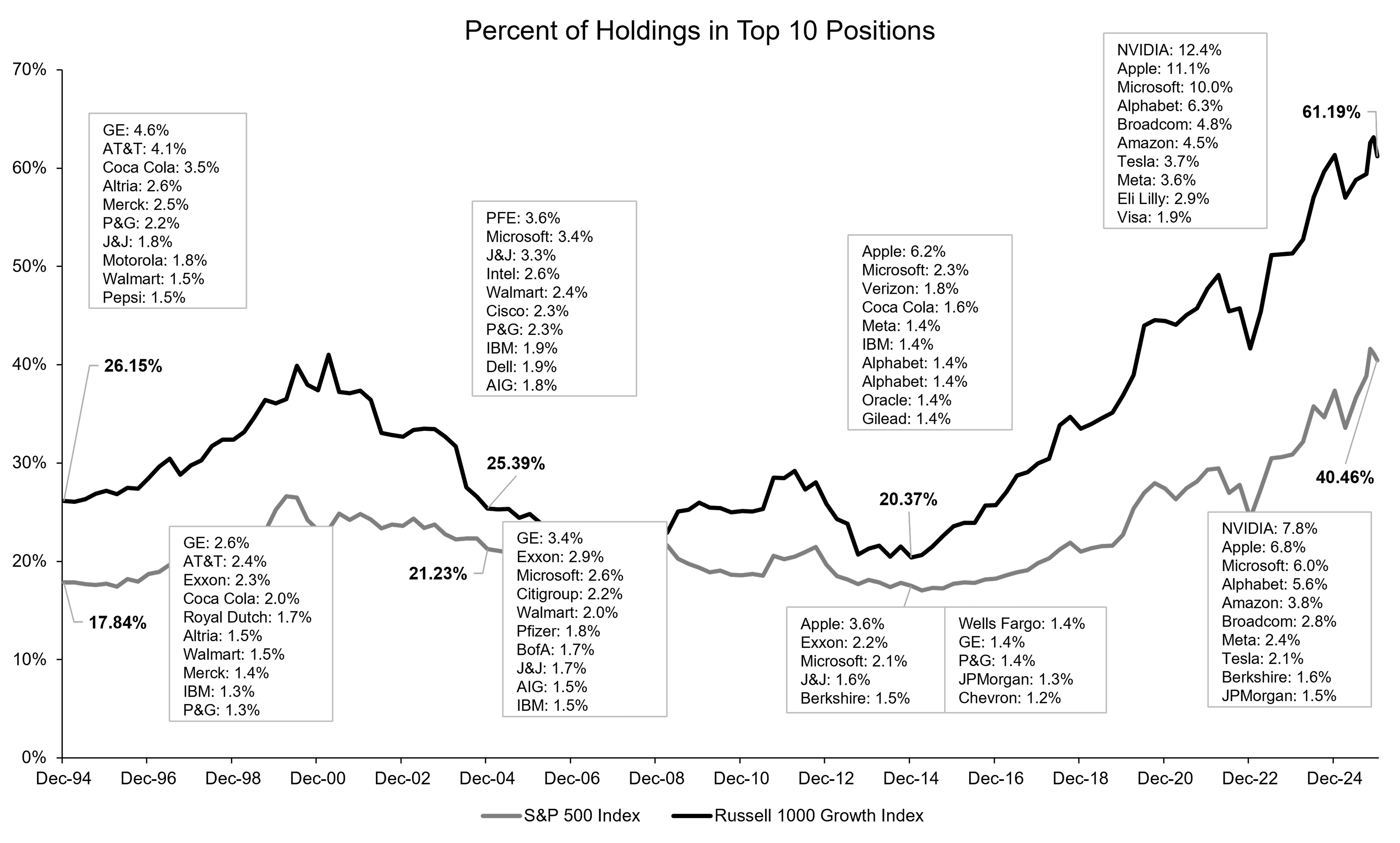

Over the past few years, the composition of major stock market benchmarks like the S&P 500® Index and the Russell 1000® Growth Index has become increasingly dominated by a small number of very large companies. These indexes are designed to represent a broad slice of the U.S. stock market, but today, their top 10 holdings account for a much larger share of the total index value than they did in the past. At the time of this writing (December 31, 2025), the top 10 holdings of the S&P 500 represent 40% of the index’s total weight. The Russell 1000® Growth Index shows an even greater degree of concentration, with its top 10 holdings now representing over 60% of the index’s total weight. (See Figure 1.)

Why is this important? The growing concentration of mega-cap names in these indexes means that a small group of companies, mostly large technology and internet firms, now exert an outsized influence on overall market performance.