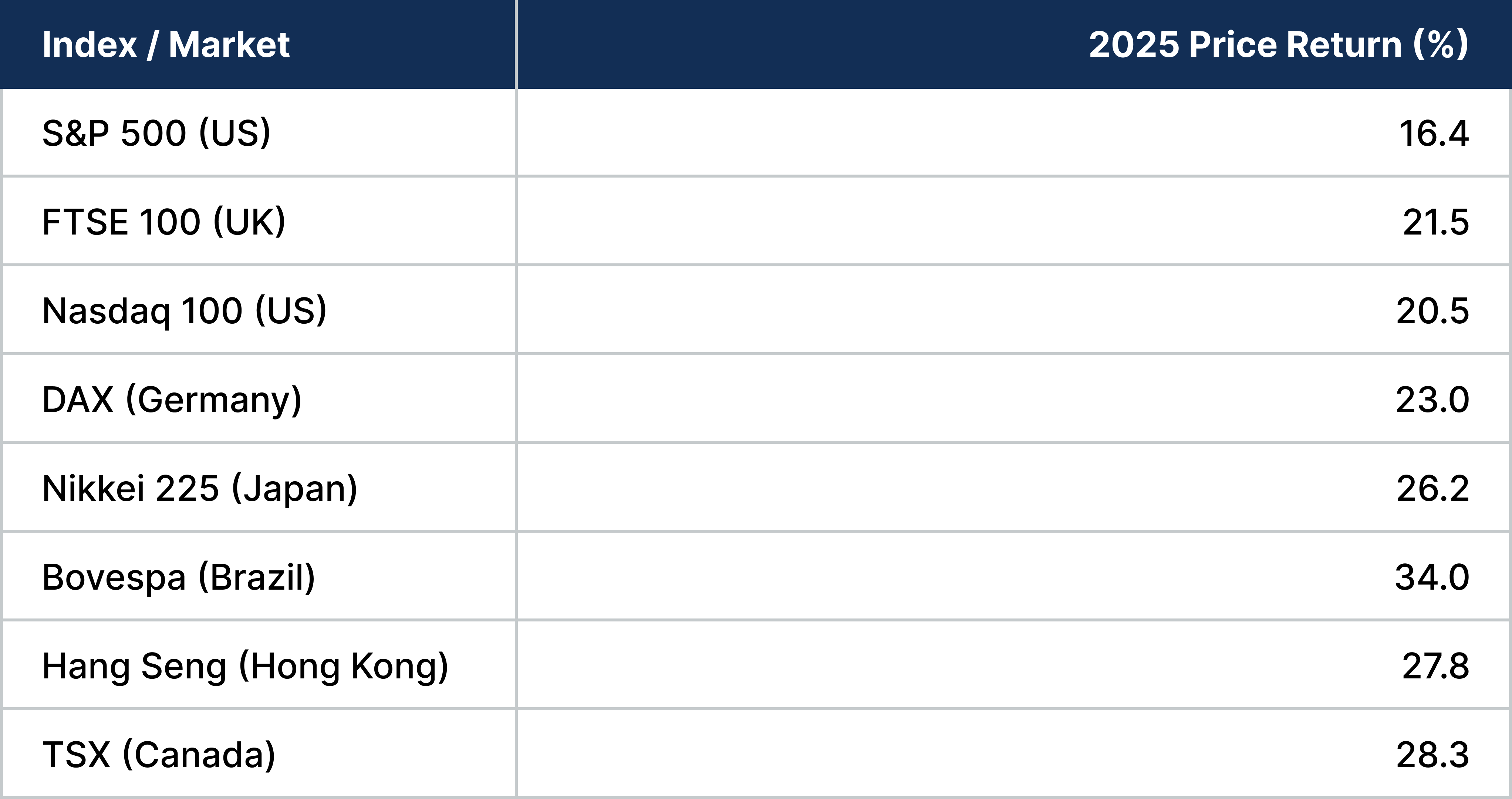

In 2025, equity markets throughout the world delivered excellent returns, a welcome reminder that long-term investors are rewarded for staying the course. (See Figure 1.)

Figure 1. Equity Market Strength Extended Across the Globe in 2025

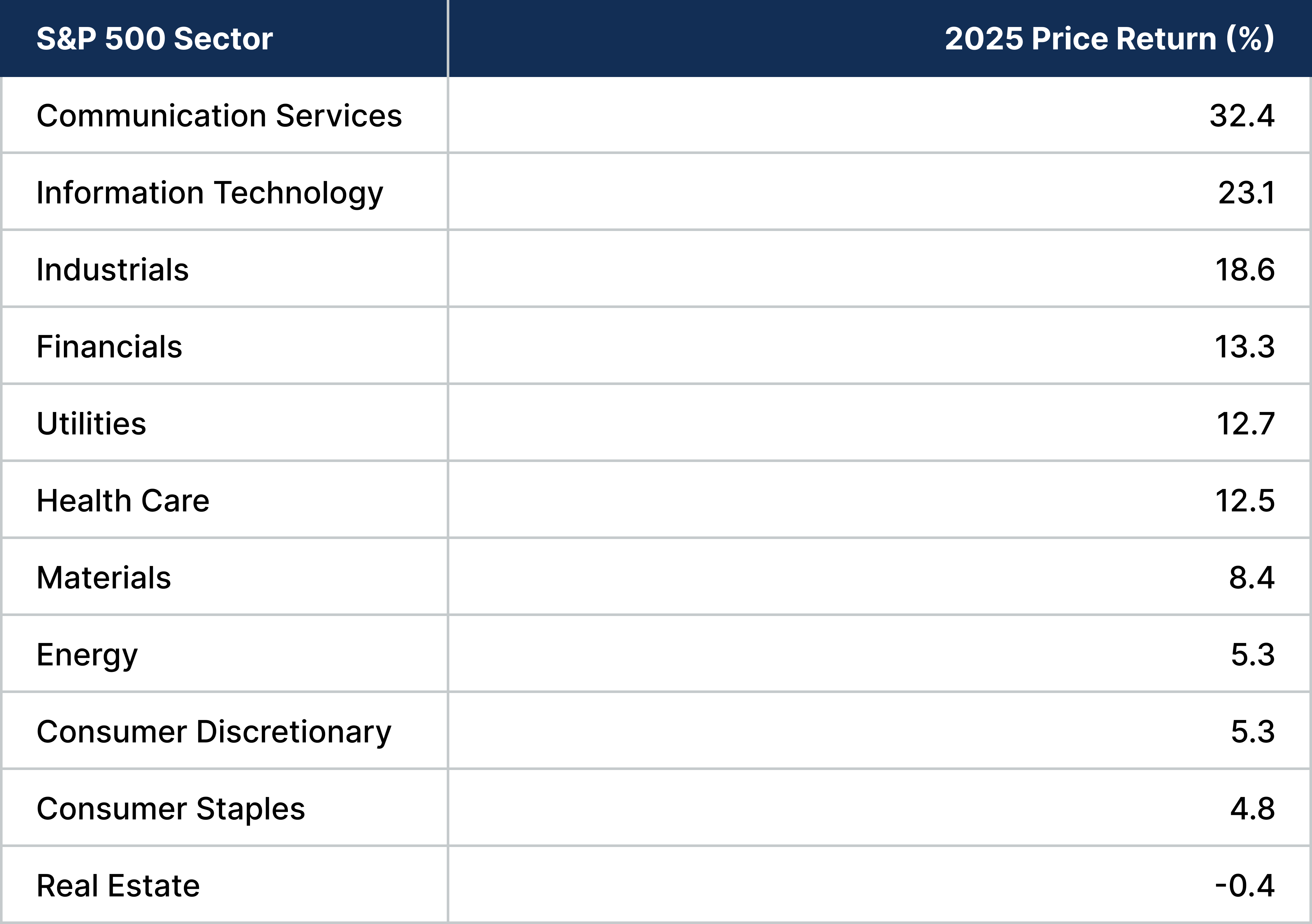

In the United States, performance was broad-based, with nearly all of the sectors in the S&P 500® Index finishing the year in the black. The S&P 500 itself posted a strong double-digit gain, led by strength in Communication Services, Information Technology, and Industrials, but with participation extending well beyond just a few big names. (As we previously mentioned in our 2026 Investment Outlook, the current bull market, even with a strong absolute performance in 2023–25, has been average compared to history.)

Figure 2. Broad-Based Strength for U.S. Stocks in 2025

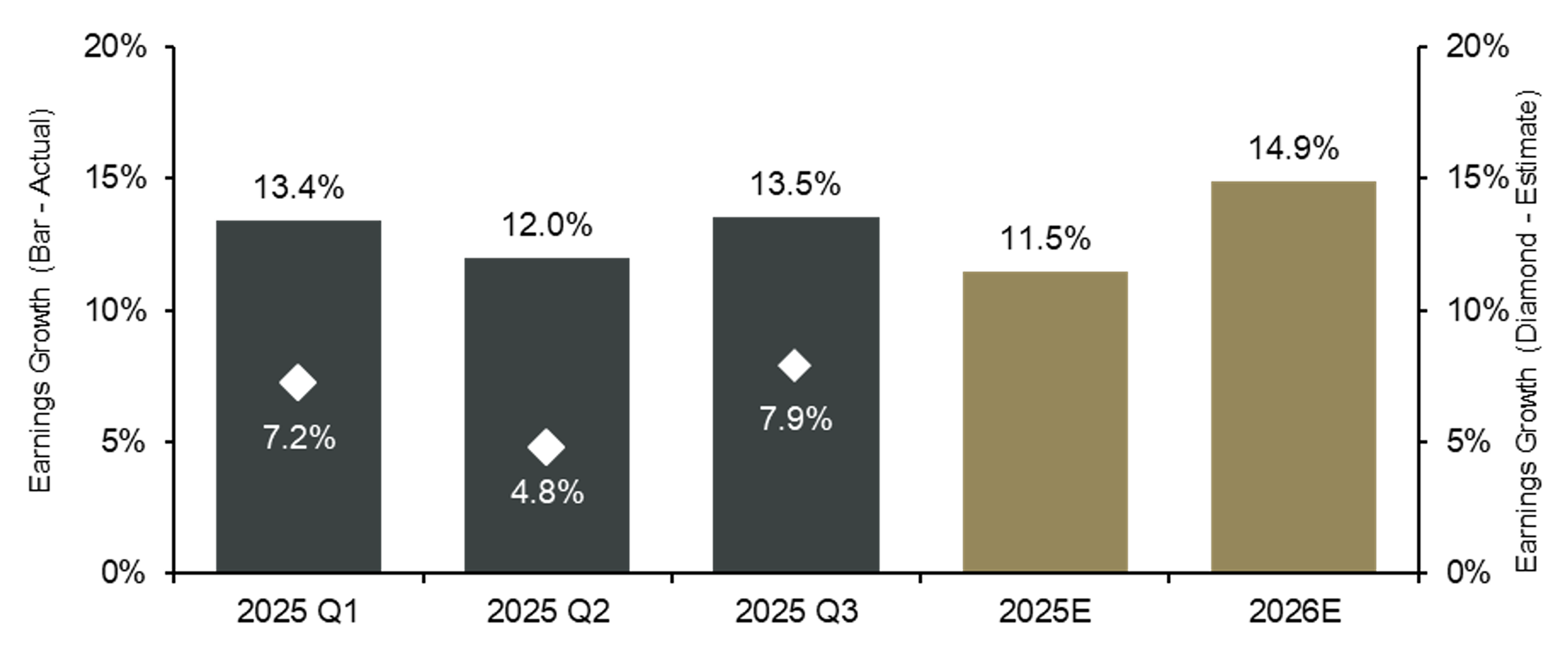

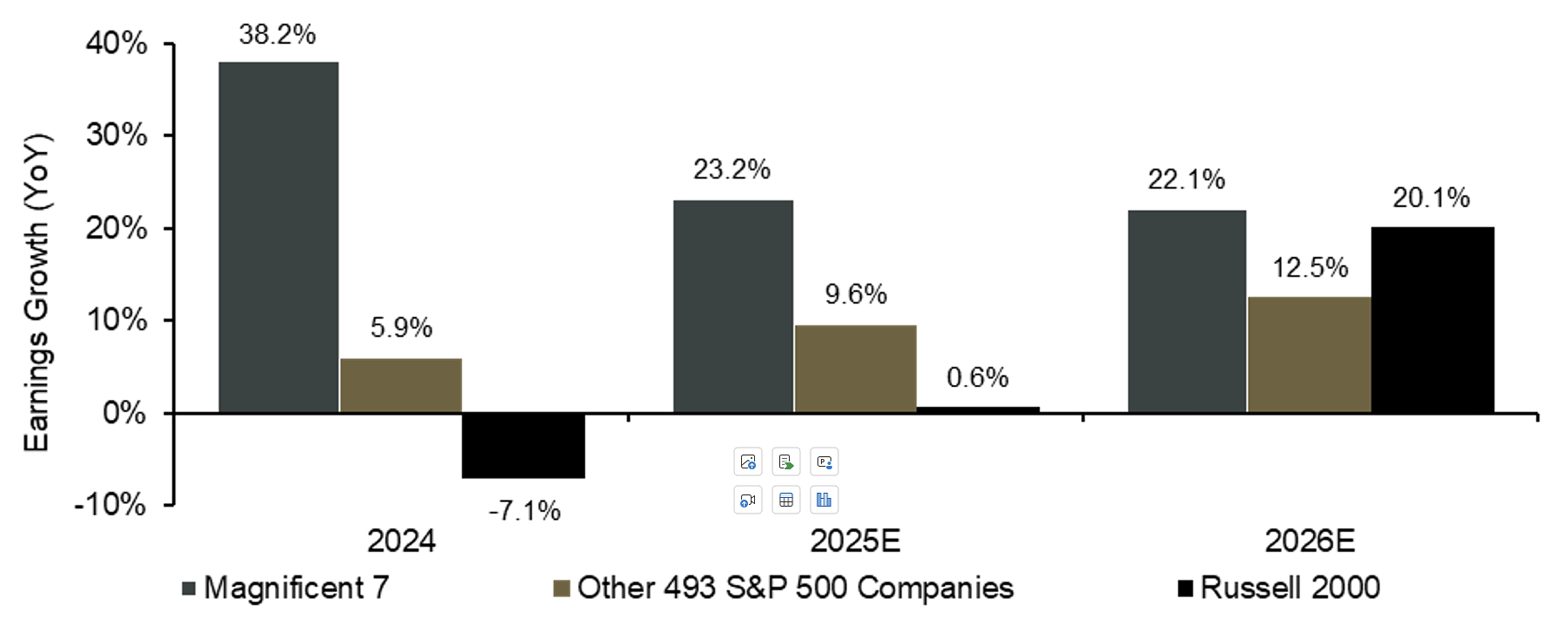

This market strength has been underpinned by robust earnings growth, which is the result of healthy economic growth, moderating inflation, and a supportive fiscal and monetary policy backdrop. Analysts expect the growth to continue in 2026 and 2027. Importantly, the strength is forecast to extend beyond the mega-cap stocks that dominated measures of market performance over the past couple of years.

Figure 3. Earnings Growth Has Outpaced Expectations and Is Expected to Maintain a Double-Digit Pace …

S&P 500 EPS growth (estimated and reported)

... While Continuing to Broaden Beyond the Magnificent 7

Year-over-year EPS growth for indicated indexes (estimated and reported)

A major force carrying this momentum forward into 2026 continues to be generative artificial intelligence (AI). What began as a story dominated by data center builders, chip manufacturers, and hyperscalers (large cloud data service providers) is now expanding into the real economy. We are seeing AI tools quietly but meaningfully improve productivity across industries, from manufacturing floors and logistics networks to financial firms, marketing departments, and small businesses.

This shift matters. As AI adoption broadens, its impact becomes more durable and more widespread. It supports earnings growth across a wider swath of the market, reinforcing the idea that this cycle is not just about a handful of winners, but about a more powerful and productive global economy. Price movements often lead data, and the breadth of 2025 returns suggests that the market is anticipating the broad-based impacts of AI before it shows up in reported economic statistics.

In our view, there are a few other factors also supporting a bullish case for 2026, including:

- International stocks may be in the first inning of a long-awaited revival, reflecting strong earnings estimates, historically attractive valuations, and favorable macro factors.

- Beyond tech and AI, fundamentals appear strong for areas such as infrastructure, biotechnology, and defense.

- Outside the mega caps, valuations do not appear stretched.

We will monitor markets and intend to explore some of these topics in the months to come.

A Final Word

While signs point to a continuation of equity-market strength in 2026, we would note that in our experience, bull markets are never smooth, and investors should not expect them to be. Risks are ever present. These include the timing and diffusion of AI investment returns, geopolitical tensions, policy and election-year uncertainty, as well as employment or inflation surprises.

It is also worth remembering a simple but overlooked fact: In most years, U.S. equity markets experience a drawdown of about 10% at some point during the year, even during bull markets. Pullbacks are a part of the process and can help dispel the speculative excesses that can sometimes build up during a bull run. Provided that underlying conditions remain intact—healthy economic growth, steady employment, moderating inflation, and the powerful tailwind of ongoing AI innovation—we view market sell-offs not as reasons to retreat but as opportunities to lean in. Across every market capitalization, both in the U.S. and abroad, Lord Abbett active managers are ready to capitalize on potential alpha opportunities.

Want to know more? Listen to a podcast featuring Matt DeCicco’s views on the big picture for equity markets in 2026.