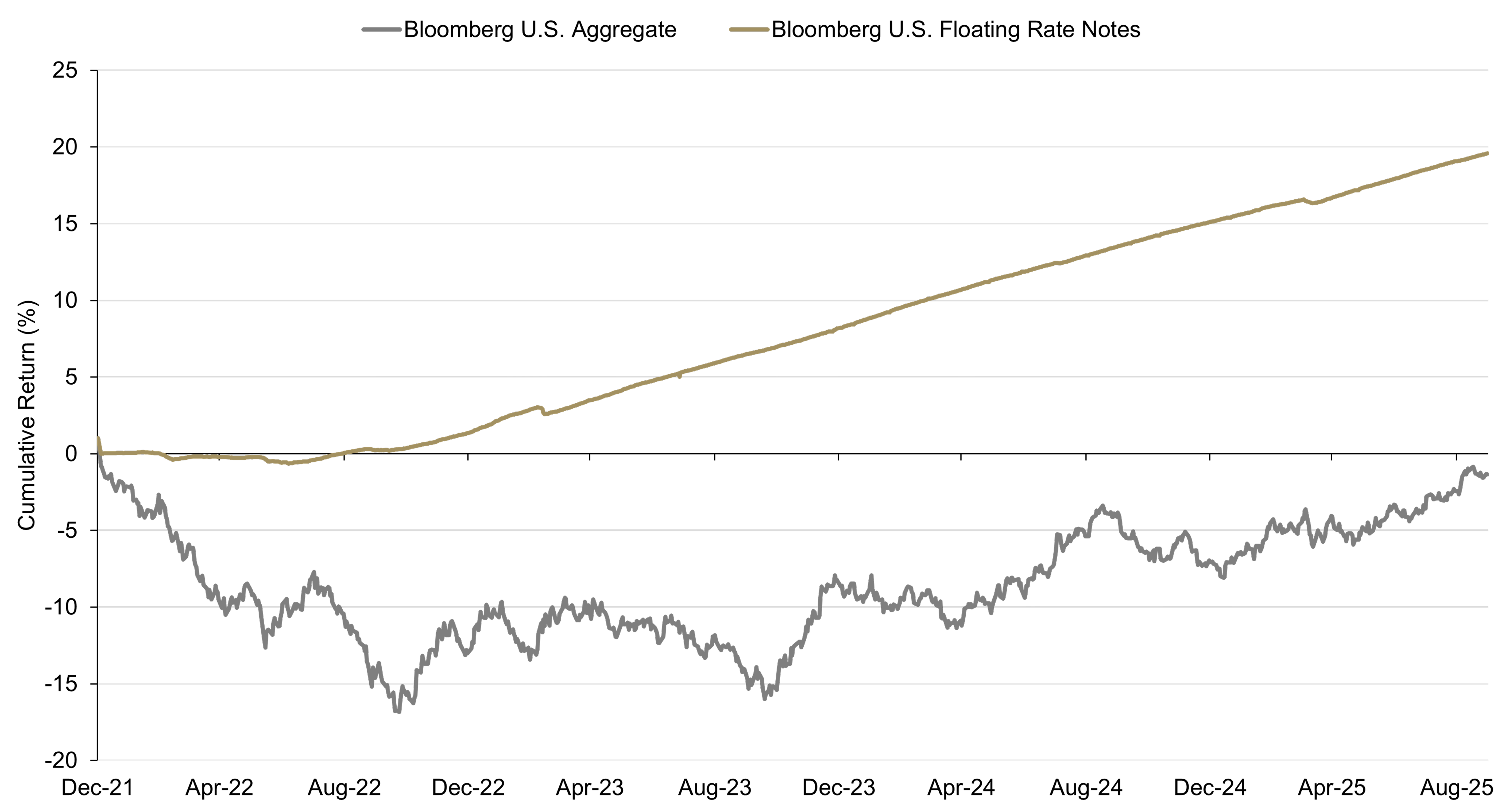

After an extended period of low interest rates, fixed-income yields remain historically attractive and offer investors an opportunity to reassess their portfolio allocations. We believe the opportunity for the asset class, as a significant part of long-term asset allocations, is compelling. What might be the best way to balance those fixed-income allocations in today’s volatile and uncertain rate environment? Here, we will focus on a particularly attractive opportunity in investment-grade, floating-rate strategies.

The Rate Environment Has Changed

There was a tactical rush to bonds in late 2023, as markets responded to falling inflation readings and dovish commentary from U.S. Federal Reserve (Fed) officials by quickly pricing in over six 25-basis-point rate cuts before the end of 2024.

As 2025 progresses, inflation has continued to moderate and economic data has remained resilient. Signs of softening employment figures have prompted the Fed to begin easing, with market expectations for two more 25-basis-point rate cuts by year-end, reflecting investors’ reassessment of the Fed’s balancing act between supporting the labor market and managing inflationary pressures.

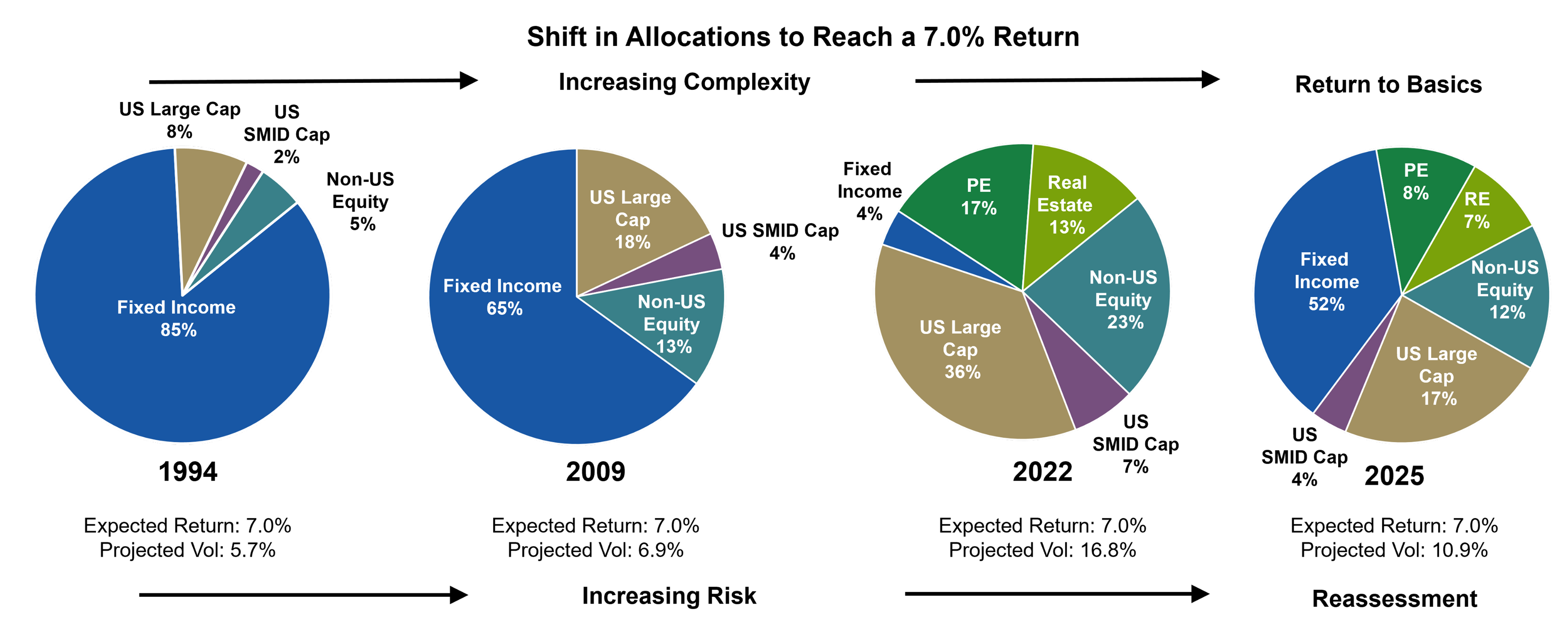

While uncertainty persists, the current environment of elevated yields remains supportive of higher bond allocations. Take a look at Figure 1, based on data from institutional consultant Callan. Investors with fixed return targets were forced out of low-yielding fixed income over the last 15 years, opting instead for higher-risk options in public and private equity and real estate. With today’s attractive yields, investors can potentially hit return targets with much less volatility by incorporating a higher proportion of fixed income.