The first half of 2025 brought several notable developments in the municipal bond market. Yields at the long end of the municipal curve (i.e., maturities 10 years and longer) have risen 40 to 70 basis points (bps) from the start of the year, contributing to a slightly negative performance for the Bloomberg Municipal Bond Index through June 20. This was partially driven by uncertainty around the new administration’s fiscal policies, which have also made Treasury bond rates rise somewhat, but municipals have risen more due to very heavy new-issue bond supply.

Recent developments have brought some clarity for municipals on the federal budget side, most notably, that municipal bond interest will remain tax exempt, with no changes coming out of the House and Senate budget bills under consideration near midyear.

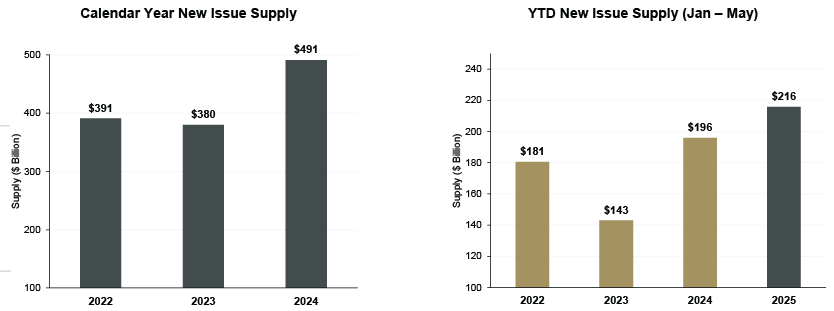

Elevated supply has presented the main challenge for the market. Last year, new-issue supply set a record at approximately $500 billion, and this year the amount is ahead of 2024’s pace. Issuers have been looking to raise money, after not issuing much debt in the aftermath of COVID-19, and want to tap the market now rather than wait for any policy changes coming out of Washington. Investor demand has been generally strong enough to absorb newly issued muni bonds throughout much of the year, but the increased supply has pressured rates to move higher than other fixed-income markets. Meanwhile, municipal credit fundamentals remain solid, bolstered by the domestic focus of issuers and continued fiscal discipline, so that is helping the market as well.

In the sections that follow, we’ll take a closer look at the current municipal bond landscape and highlight the key themes we believe will shape the market in the months ahead.

1. Municipal Bonds Show Attractive Relative Value

Reflecting fears over federal spending, tariff uncertainty, and above-average supply, municipal yields have reached attractive levels, particularly compared to what has been seen in taxable markets. Since the start of the year, the 10-year U.S. Treasury yield is lower by 19 bps, while yields on 10-year AAA-rated muni bonds have risen 14 bps. In the long end of the municipal curve, this trend is even more pronounced. While most fixed-income curves have steepened so far in 2025, long-term municipal yields have risen approximately 50 bps more than long Treasuries. Therefore, municipal bonds remain one of the few sectors of the fixed-income market that generously compensate investors to extend duration.

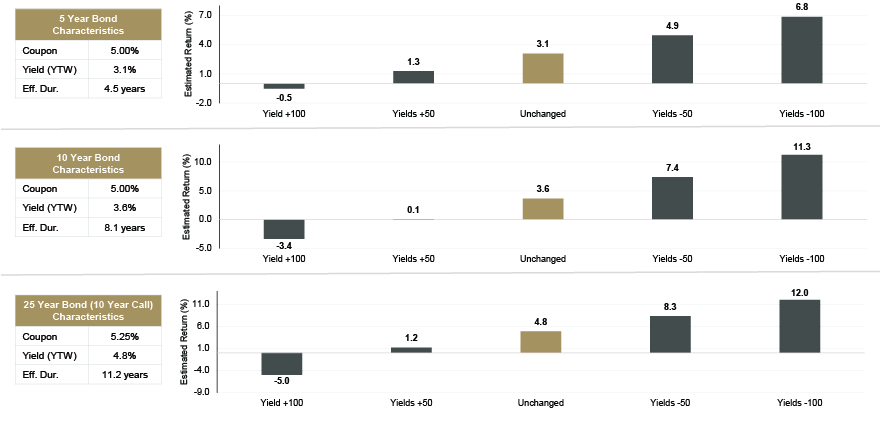

We think current yields—near their highest levels in over a decade—present appealing opportunities for investors. As starting yield is one of the best predictors of future performance, today’s yields present compelling total return opportunities regardless of whether the U.S. Federal Reserve lowers rates later in 2025. Additionally, these higher yields bring a more attractive risk/reward dynamic for investors. As shown in Figure 1, the enhanced carry in today’s environment can cushion returns should rates continue to rise.