For the ninth time since 1982, the U.S. government has entered a partial shutdown as of October 1, under which funding for all but the most essential operations is halted. As of this writing, U.S. lawmakers remained in a stalemate on a spending measure, with Senate Republicans (who hold 53 of the chamber’s 100 seats) needing seven votes from Democrats to reach the 60-vote threshold for passage.

We have some history of shutdowns to go by, although the length and potential impact of these events have increased in recent years. In general, the economic impact of shutdowns has ultimately been small. In most cases, stock prices rose after the shutdown ended (more on that below), while bond yields fell.

What happens during a U.S. government shutdown?

All nonessential services funded by congressional appropriations are halted, and those employees are furloughed. Essential services such as law enforcement, air traffic control, and parts of the military will continue to be provided. Some functions such as passport issuance or other permitting agencies may see delays, while tourist services (such as national parks) may shut down completely. Note that the furloughs could potentially come after a number of U.S. government agencies have already been downsized significantly since the creation earlier this year of the Department of Government Efficiency; President Trump has indicated that additional government workers may be laid off in the event of a shutdown.

What is the potential economic impact of a U.S. government shutdown?

This current shutdown is expected to result in furloughs for 750,000 "non-essential" employees (out of a total of 2.9 million civilian workers). Essential workers must report to their jobs but will not be paid during the shutdown. In the past, federal workers have been fully compensated for pay lost after a budget is passed and the shutdown ends. That has prevented shutdowns from having large negative multiplier effects on spending, provided they end relatively quickly.

The longer a shutdown lasts, or if furloughs turn into permanent layoffs, the larger the negative impact on the economy will be. Since 1980, the length of shutdowns has ranged from less than a day (1981, 1984, 1986) to 35 days (2018-2019). According to a report from S&P Global, each week of a U.S. shutdown would shave an estimated 0.15% from U.S. GDP, though most of that activity would likely be recovered quickly when the shutdown ends.

Note, however, that there has already been a significant reduction in government-related economic activity this year. Federal purchases of goods and services have dropped at a 5.4% annual rate in real (inflation-adjusted) terms in the first half of 2025, including an even larger 8.5% drop in nondefense spending. The effect of the spending reductions knocked 0.35% off real GDP growth in the first half, on average. With much of that likely frontloaded, a shutdown of nonessential services in October likely wouldn’t have a much greater impact on growth.

Apart from the direct impact on GDP, there are other ways in which a shutdown may contribute to short-term uncertainty. First, because we cannot know for certain what the true economic impact may be, markets may struggle to interpret economic data during, or soon after, a shutdown. Also, the calculation of some economic data may fall under “nonessential” government functions, and so the release of some key economic indicators, such as the U.S. consumer price index (CPI) and the monthly jobs report, may be delayed.

How have U.S. government shutdowns affected the stock market?

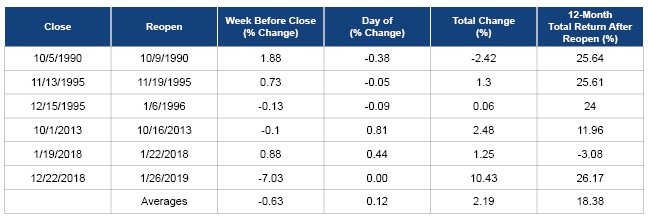

Figure 1 shows that the equity market generally looks through shutdown episodes, with a slight sell-off prior to the event, and no discernable trend during the shutdown. Markets are generally higher after the uncertainty of the shutdown eases, as shown by 12-month forward returns.