Equity markets faced challenges in the early part of the year, as global trade and tariff uncertainty created headwinds that were stronger than the expected tailwinds from more supportive U.S. fiscal and monetary policy. But investors have shaken off concerns over tariffs and the economy to bid stocks higher. Here, we focus on three key factors supporting equities in the current market.

1. Earnings Remain Strong

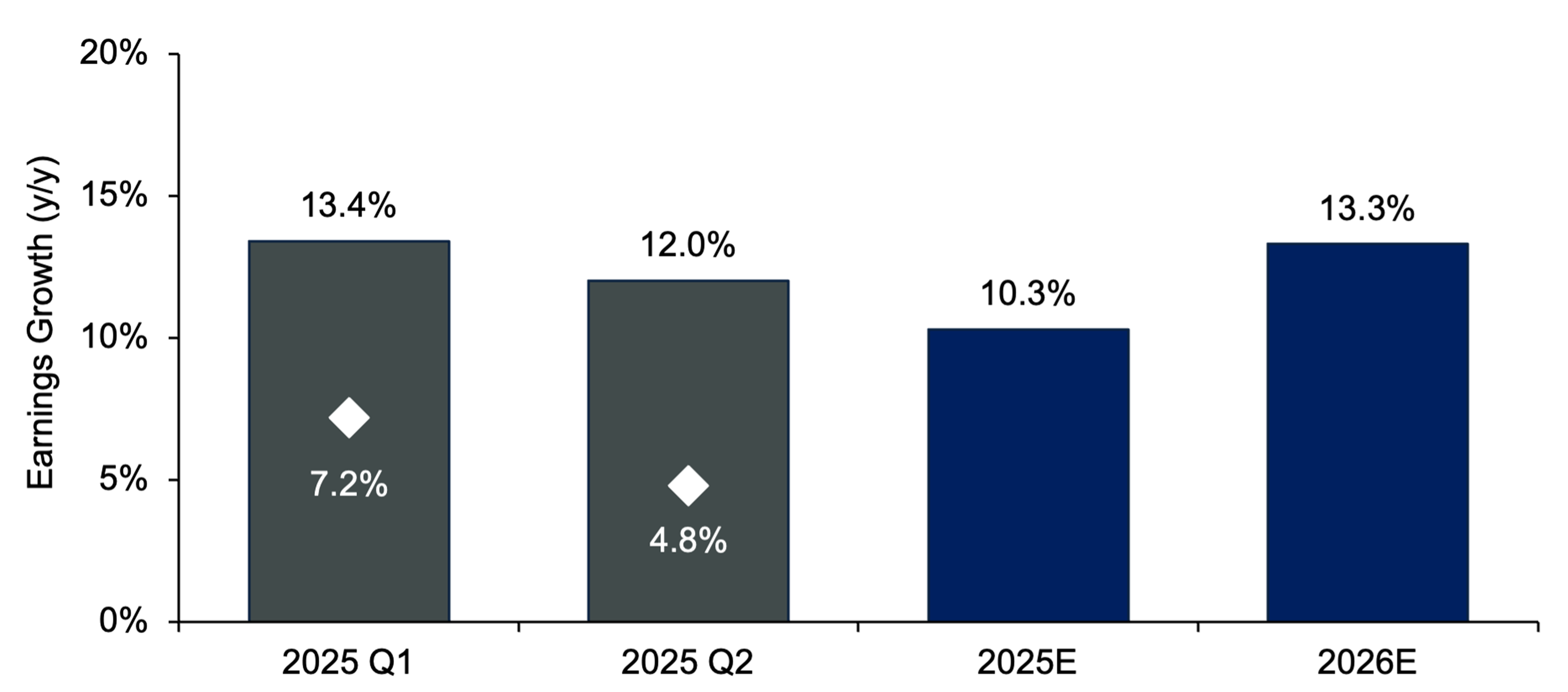

The equity markets have shown some resilience as first- and second-quarter earnings for the S&P 500® Index beat expectations by a wide margin. (See Figure 1.) Earnings growth for the rest of the year, and for 2026, is expected to be in double digits.