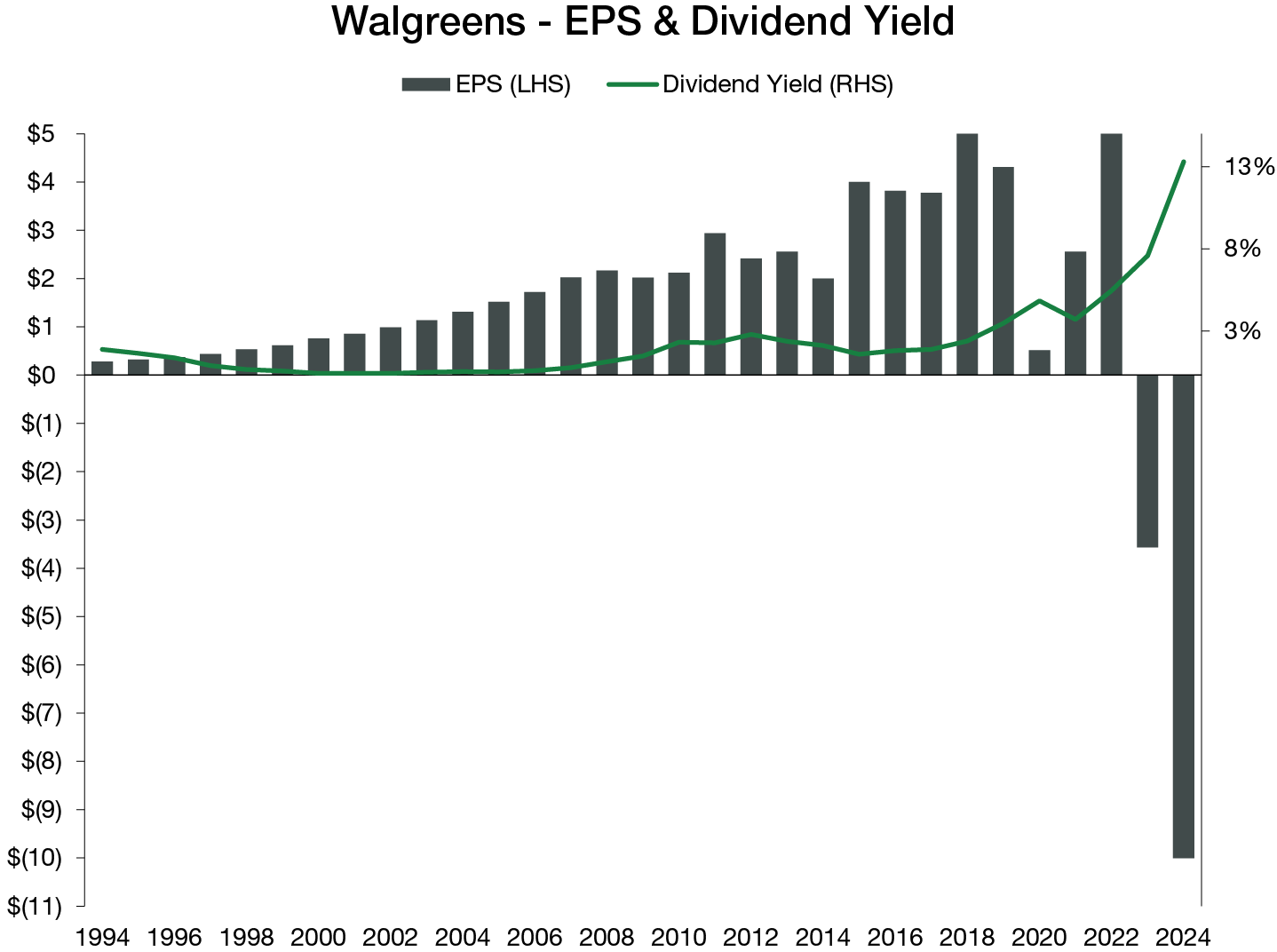

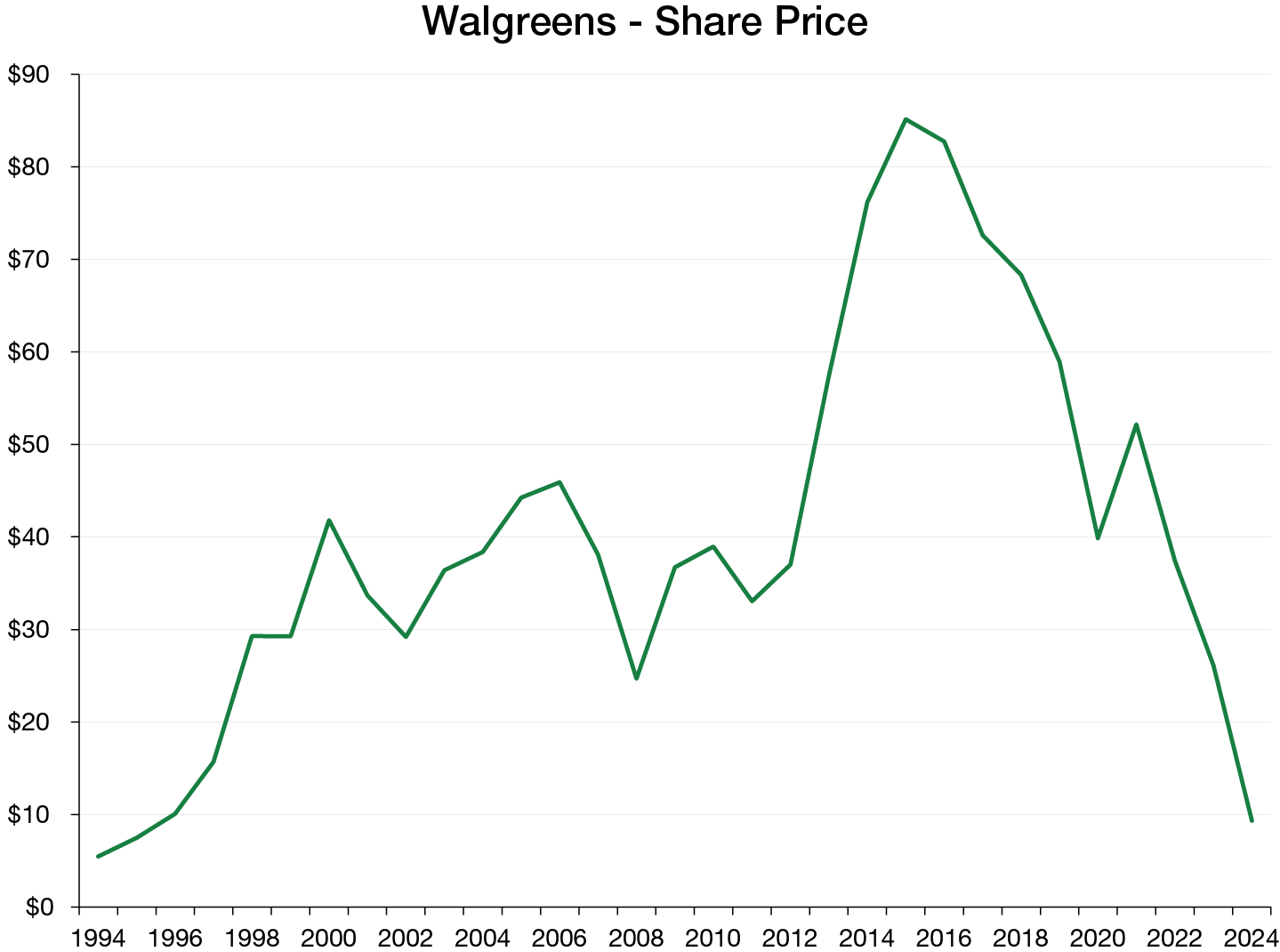

Walgreens and Coca-Cola are two household names that both had a long-standing history of increasing their dividends annually. Yet, in early 2024, Walgreens cut its dividend nearly in half before opting to fully suspend its quarterly payout at the beginning of 2025, while Coca-Cola has continued to grow its dividend.

In the wake of the Walgreens news, we thought it would be useful to take a fresh look at the factors that determine a company’s dividend trajectory, whether it is continued growth in the dividend, or an eventual reduction, or even cessation, of payouts. A brief look at the fundamental and dividend history of these famous franchises (through calendar 2024, the last year in which Walgreens paid a dividend) provides us with what we consider good examples of both outcomes, highlighting why we think it is important for dividend-focused investors to look under the hood at the strength and resiliency of the company itself (illustrated here by historical earnings data) rather than solely chasing stocks with high dividend yields.

Coca-Cola

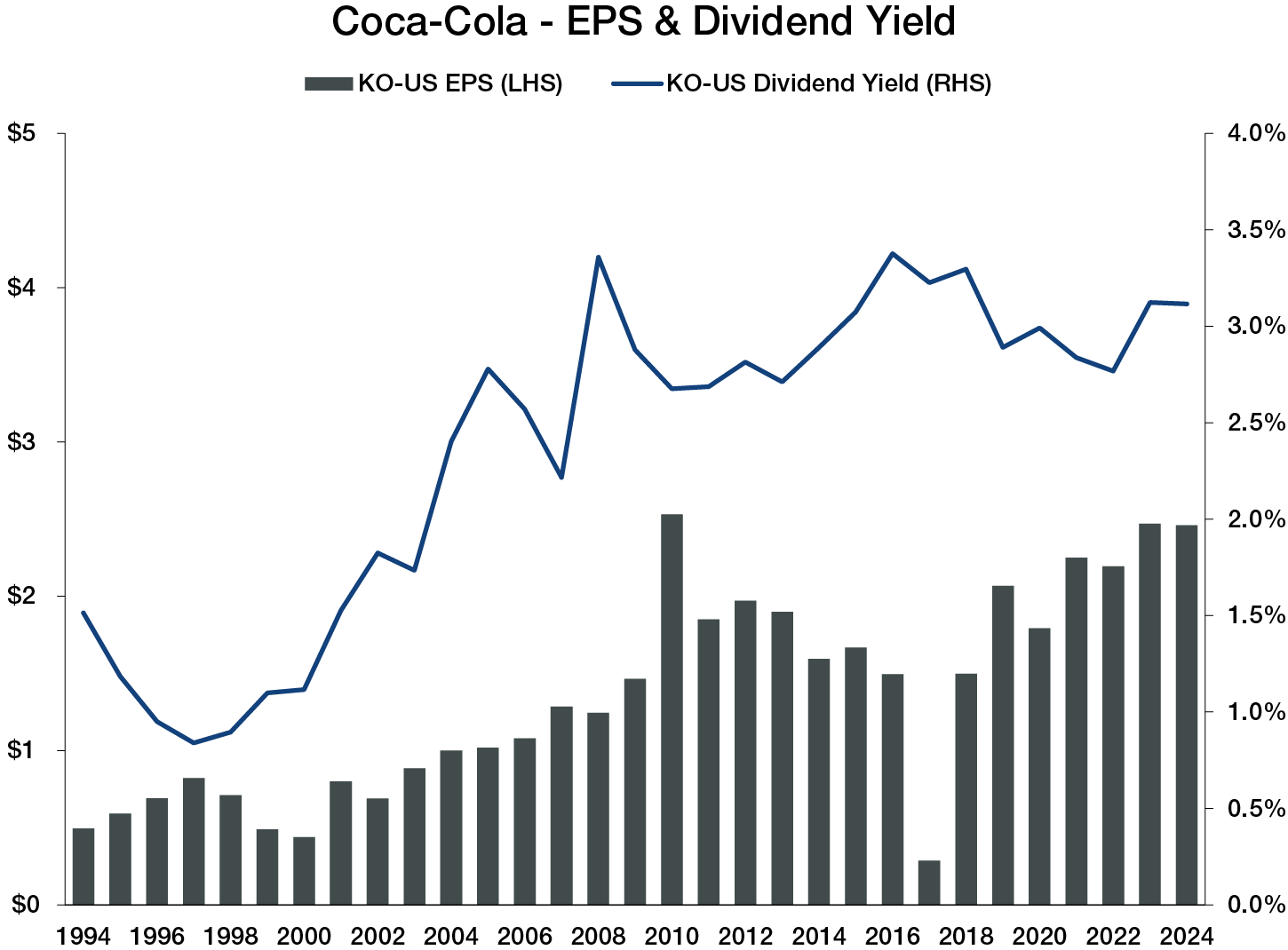

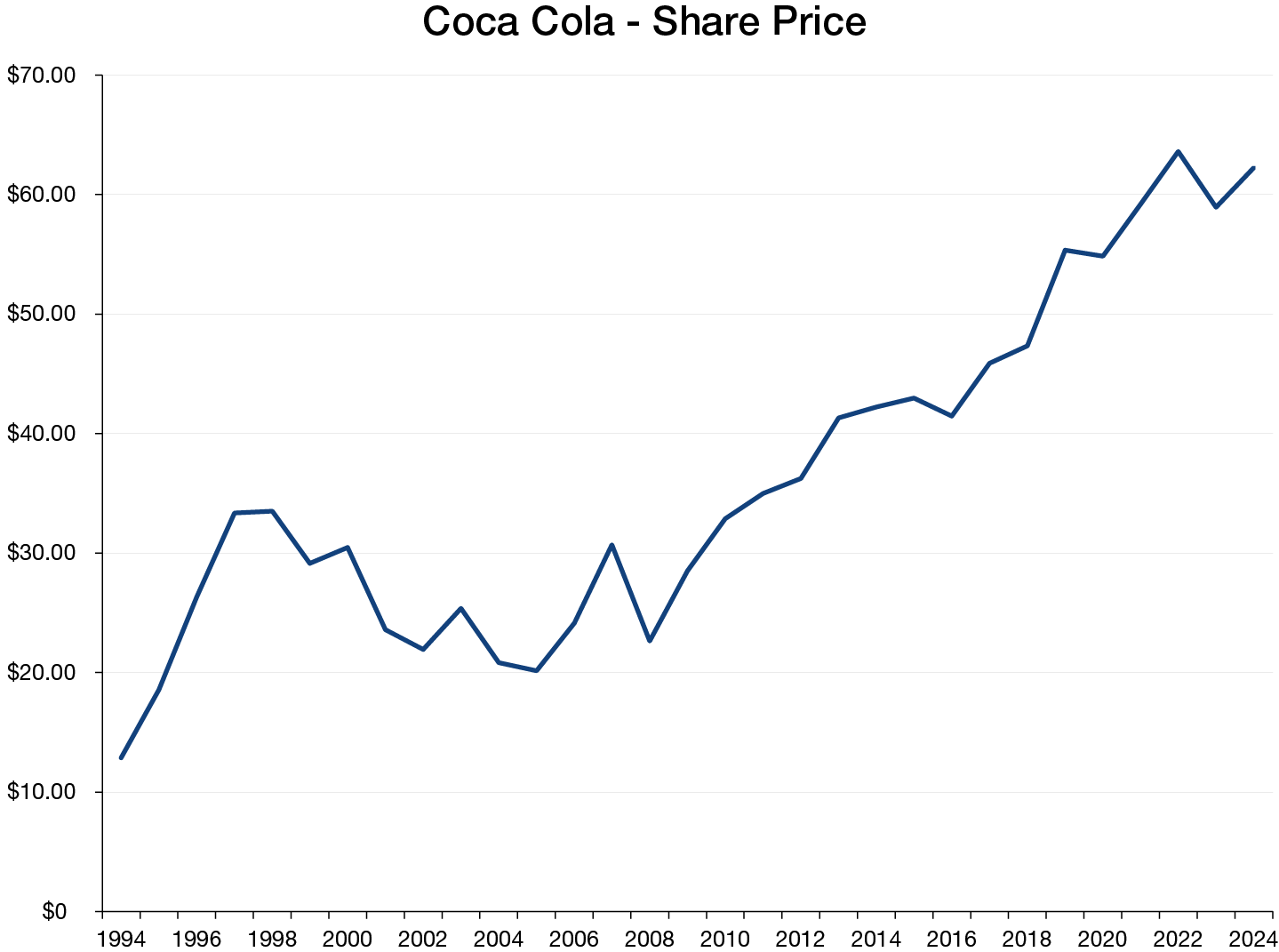

Coca-Cola has increased its dividend by 8% annually over the past 30 calendar years, and this period has been highlighted by Coke’s long-term record of stable earnings growth and its consistent history of returning those profits to its shareholders. Over the past 10 years, Coke’s average dividend yield was 3.1%, as stock price and dividend-per-share amounts increased in tandem. While there are no guarantees, Coke’s long-term history of stable earnings growth and leadership by an effective management team suggest that its record of annual dividend growth will remain intact. And so, while the absolute dividend yield per share is modest, we believe the growth of Coke’s dividend year after year has been a clear signal of quality at the company, along with its ability to adapt to changing tastes and consumer preferences. That consistency has been reflected in the steady climb in its stock price, in our view.