Inflation and the accompanying interest-rate volatility that shocked financial markets in 2022 continue to drive investor decision-making today. CLOs have emerged as a new “safe haven” asset class amid the uncertainty, and the attraction makes sense. CLOs have very little duration because the coupon payments float with the Secured Overnight Financing Rate (SOFR) and so are largely insulated from interest-rate volatility. The bulk of CLO debt is high quality, with approximately 65% of the asset class rated AAA, and no CLO tranche rated single-A or higher having ever experienced a loss from default.1 Spreads are typically significantly wider than like-rated corporate debt, leading to attractive relative value.

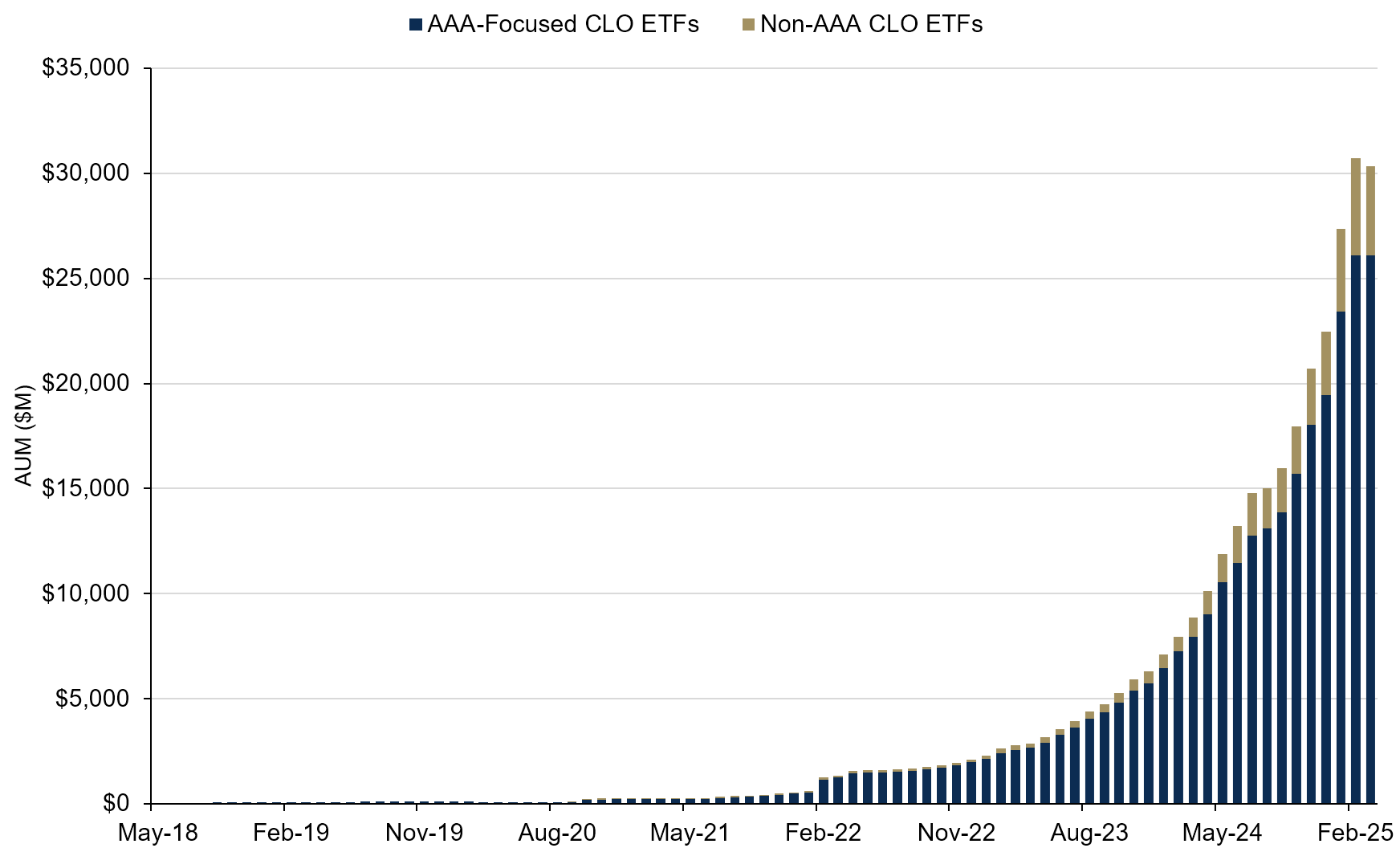

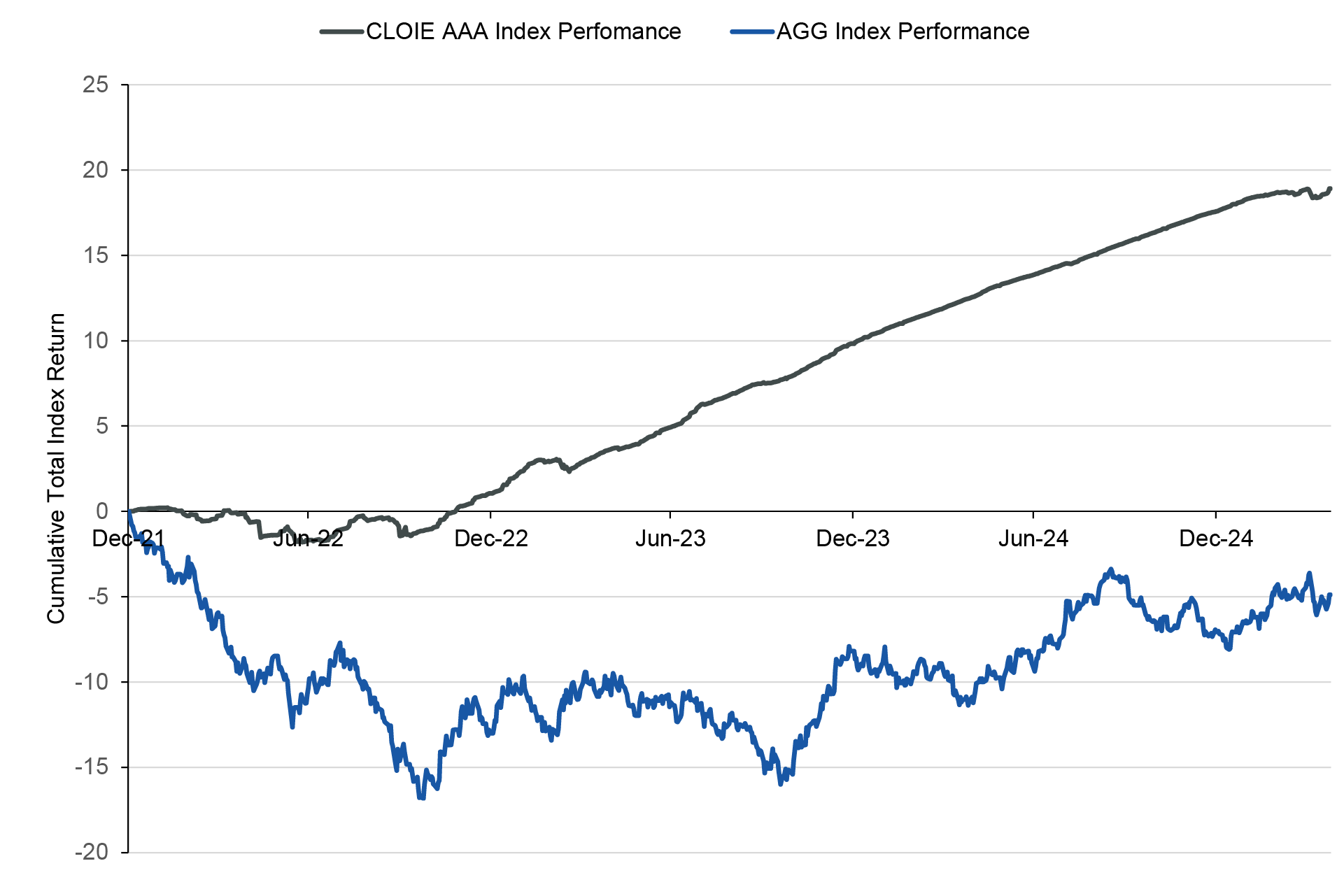

Meanwhile, the emergence of new, convenient exchange-traded fund (ETF) wrappers has made this asset class easy to buy and sell for investors. As a result, flows to AAA CLOs have dramatically increased, while the performance of the AAA CLO index has also been strong, shown in Figure 1.