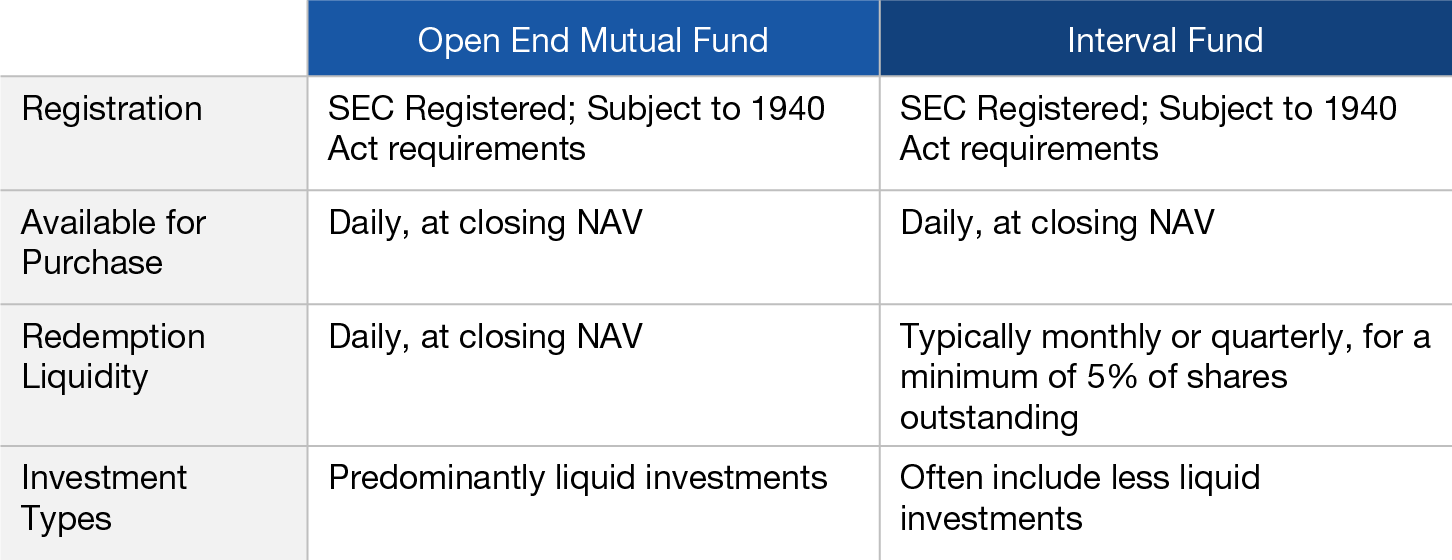

What are the potential benefits to investors of the interval fund structure?

Given the periodic repurchase schedule of an interval fund, as opposed to the daily liquidity of an open-end mutual fund, several investor benefits are introduced. These include:

- The flexibility to invest in ideas with lower liquidity and/or greater complexity, leading to opportunities for higher return potential

- The ability to be an opportunistic buyer in periods of market-wide forced or irrational selling

- The ability for portfolio managers to take a longer-term investment view

What are the risks when it comes to investing in an interval fund?

Given the reduced liquidity of interval funds, investors need to consider their liquidity needs and investment horizon before investing. In fact, it might be prudent to consider an interval fund a semi-illiquid investment. This is because:

- Liquidity risk may be greater in interval funds that invest in securities of companies with smaller market capitalizations, lower rated or stressed credits, private credit, real estate, and/or certain derivatives. As with any financial decision, one should carefully read all information available to understand what makes up the fund’s investment pool.

- Interval funds make periodic offers to repurchase a portion of outstanding shares, therefore investors cannot sell their shares at any given time. An investor can only exit the fund at the designated intervals as described in the fund’s prospectus.

- Even when selling at the prescribed repurchase dates, there is no guarantee that investors will be able to sell interval fund shares in the quantity that they desire. An interval fund is required to offer to repurchase a certain percentage of shares at set periods, or intervals, at a price equal to the fund’s net asset value (NAV).1

An investment in an interval fund is not suitable for investors who need certainty about their ability to access all of the money they invest in the short term. Before investing in an interval fund, investors should be knowledgeable to the risks associated with the investment vehicle, including the liquidity risks discussed herein, and the risk that the fund’s ability to be fully invested and achieve its investment objective may be affected by the need to fund repurchase obligations. In addition, investors should be aware of the risks associated with the types of securities that the fund may invest, and the fees and costs associated with investing in an interval fund which may be significantly greater than those of other fund structures. Investors should fully read all of the fund’s available information, including its prospectus and most recent shareholder report, and consult with their financial advisors about the suitability of an interval fund in their portfolios.

How do interval funds compare to typical closed-end funds?

Interval funds are classified as closed-end funds, but differ in several ways from exchange-listed closed-end funds:

- Traditional closed-end funds are typically issued through a one-time initial public offering and trade on an exchange, while interval funds are continuously offered and are not listed on an exchange.

- Listed closed-end funds may trade at a premium or discount to their NAV, while interval funds are priced at the fund’s daily NAV.

- Shares of listed closed-end funds are continually traded throughout the day, whereas shares of an interval fund may only be redeemed periodically (e.g., quarterly) according to the fund’s repurchase schedule.

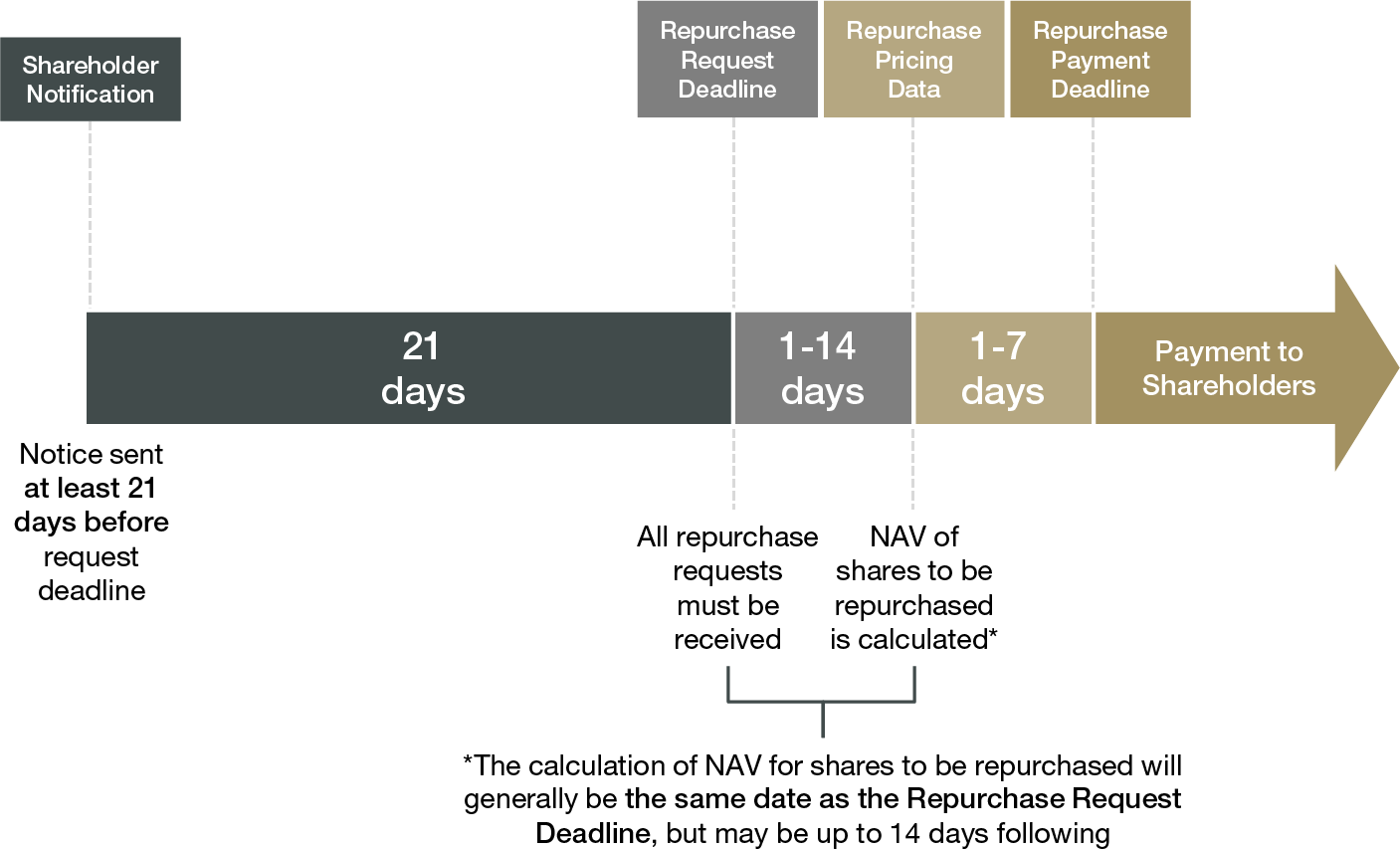

How do investors redeem shares of an interval fund?

- The fund will mail a repurchase notice to shareholders that outlines the details of the repurchase process, including the date by which requests must be made, and the actual repurchase date.

- In order to redeem shares, shareholders must submit repurchase requests in advance of the “repurchase date.”

- An interval fund is obligated to repurchase at least 5% of its shares on a periodic basis while other vehicles offering periodic liquidity may not be legally required to do so.

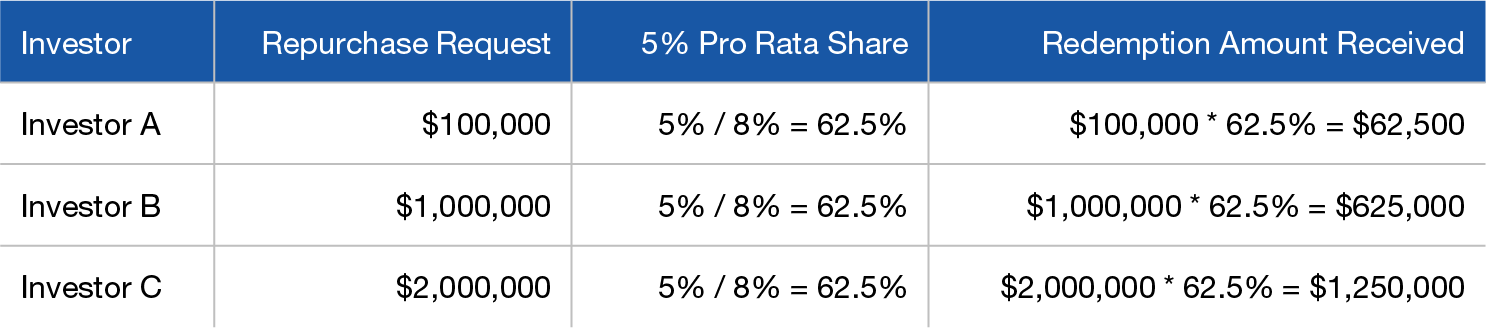

- If repurchase requests exceed 5% of the fund’s outstanding shares, the fund may redeem shares on a pro rata basis.

- The table below demonstrates the outcome for three separate investors who redeem different dollar amounts in a scenario where total redemptions requests aggregate to 8% of shares outstanding.