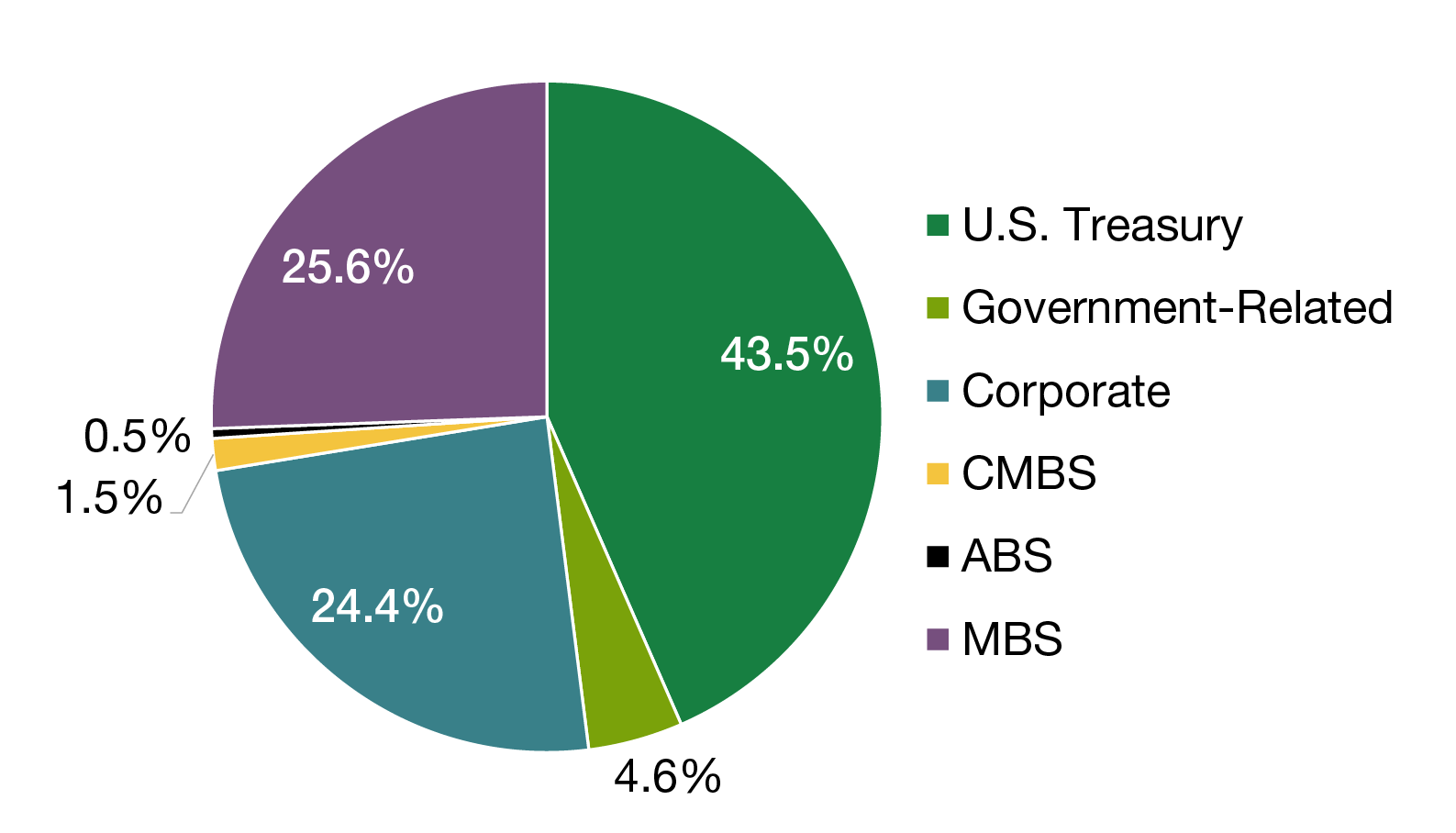

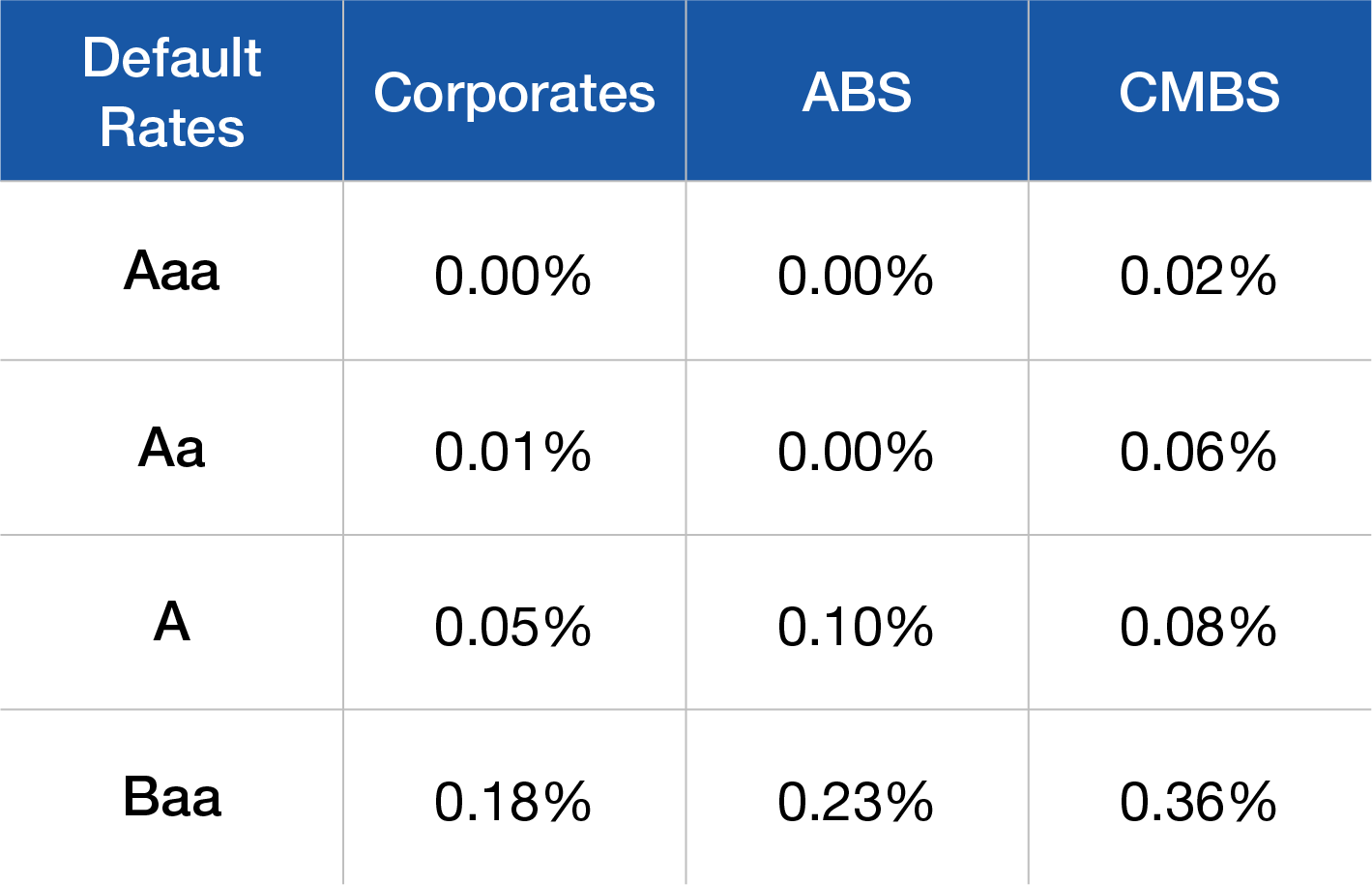

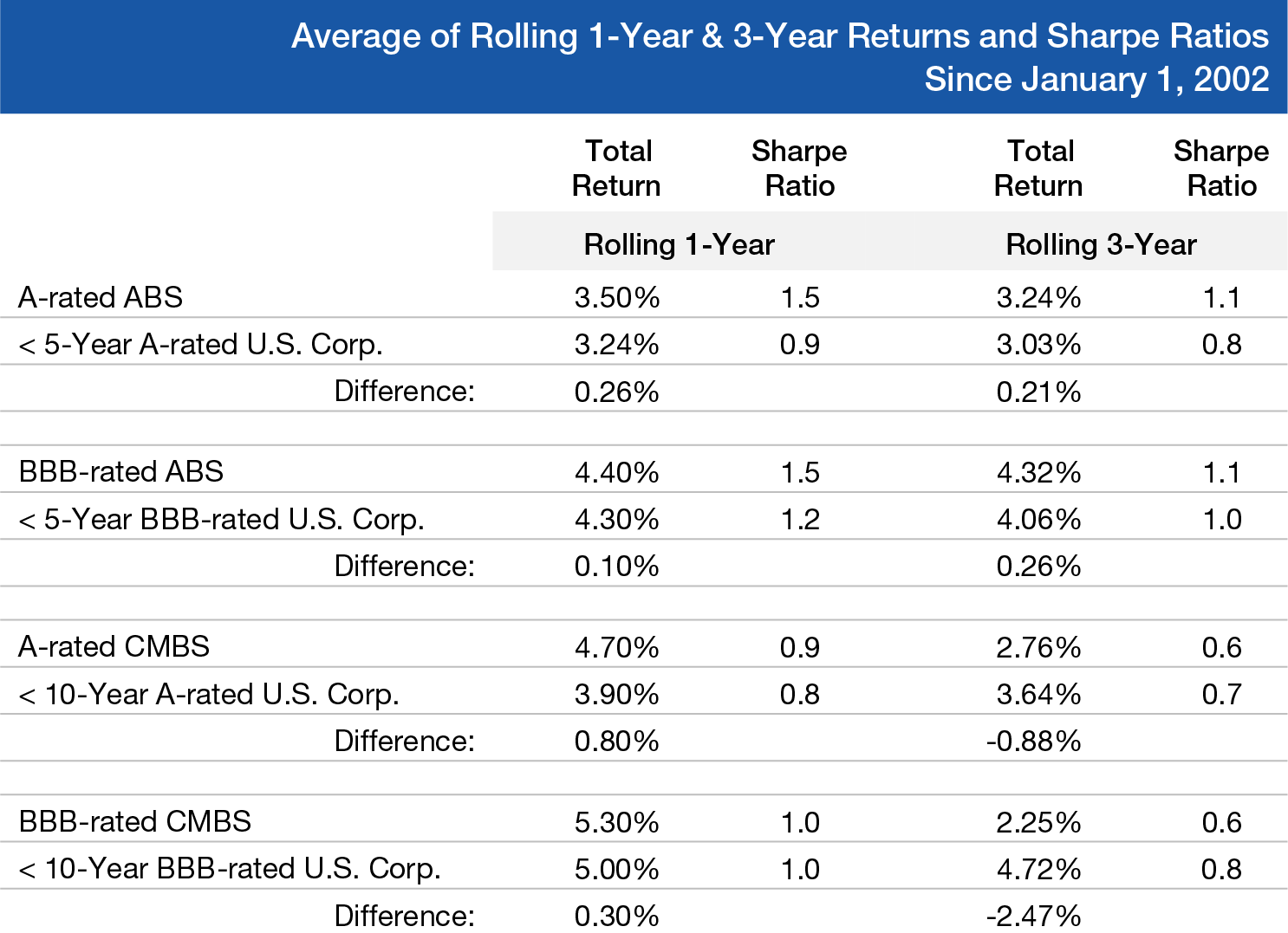

Successful active management to outperform the Bloomberg Aggregate would, of course, include an element of correctly overweighting and underweighting risk in these sectors relative to the benchmark. But we would also suggest that a consistent overexposure to risk in investment-grade sectors as well as a more significant use of the sectors, which comprise only 2% of the total of the Bloomberg Aggregate Bond Index, i.e., ABS and CMBS, are key to consistent risk-adjusted outperformance.

Through the Lens of Credit Quality: Agency MBS, ABS, and CMBS

U.S. agency MBS was once considered to be backed with the implicit guarantee of the U.S. government prior to the Great Financial Crisis (GFC). But upon being placed into government conservatorship in 2008, the cashflows of agency MBS are understood to have an even stronger “explicit” guarantee; hence, an investor in agency MBS does not assume default risk. Instead, the investor assumes negative convexity—the value of a bond with negative convexity can decline with a decline in interest rates—and prepayment risk, and given the dynamism of interest rates, this risk is costly and erodes spread compensation, income, and return, both total and excess.

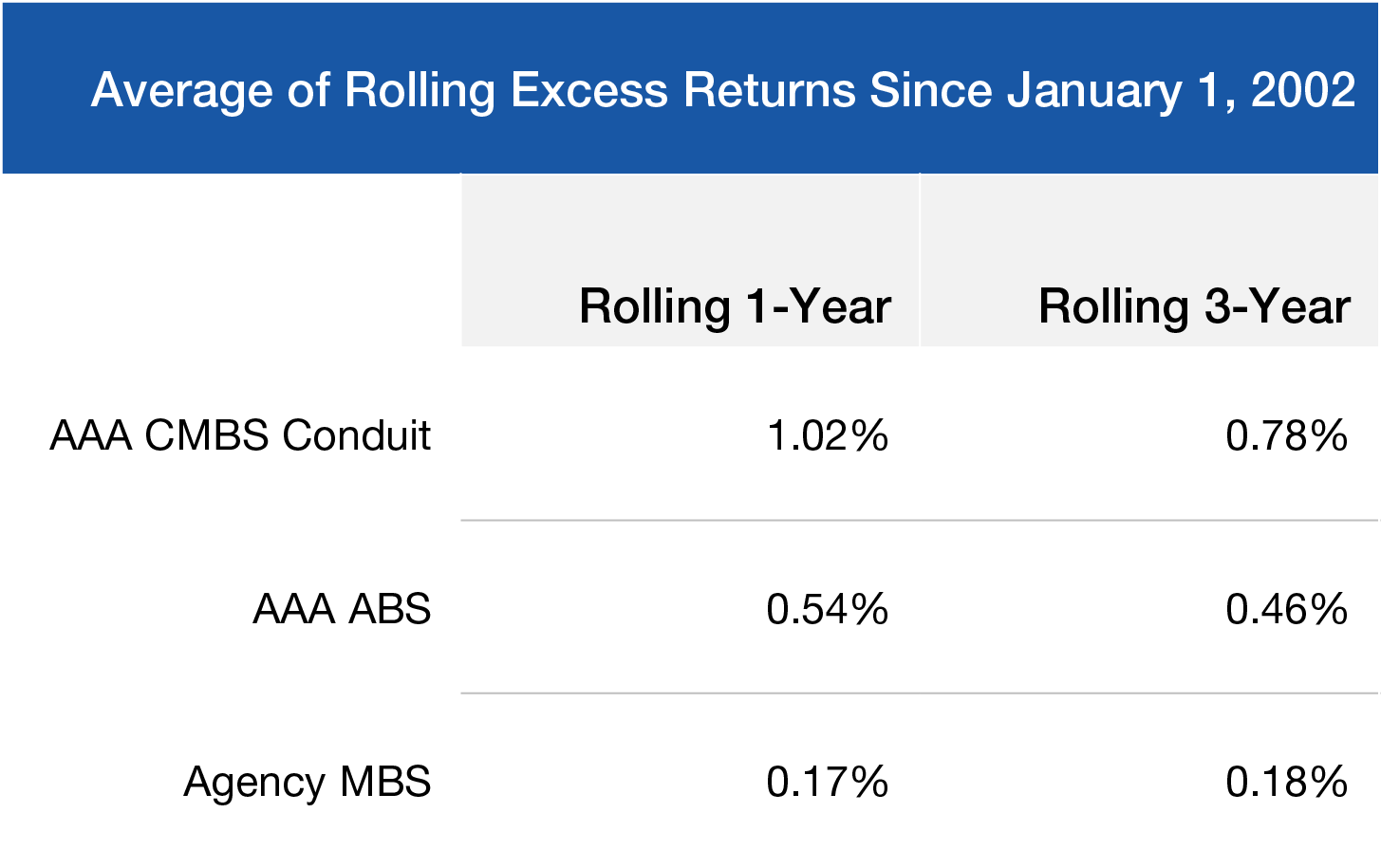

With the downgrades of the United States by S&P and Fitch in 2011 and 2023, respectively, one could argue that AAA-rated securities would be a higher-quality investment compared to agency MBS. In the spirit of this comment, we wanted to explore the historical returns and volatility experience of AAA-rated ABS and CMBS relative to agency MBS. In other words, since agency MBS is a major component of the Bloomberg Aggregate Index, in a hypothetical and extreme sense, is there a “replacement” benefit of allocating to high-quality, AAA-rated ABS and/or CMBS?

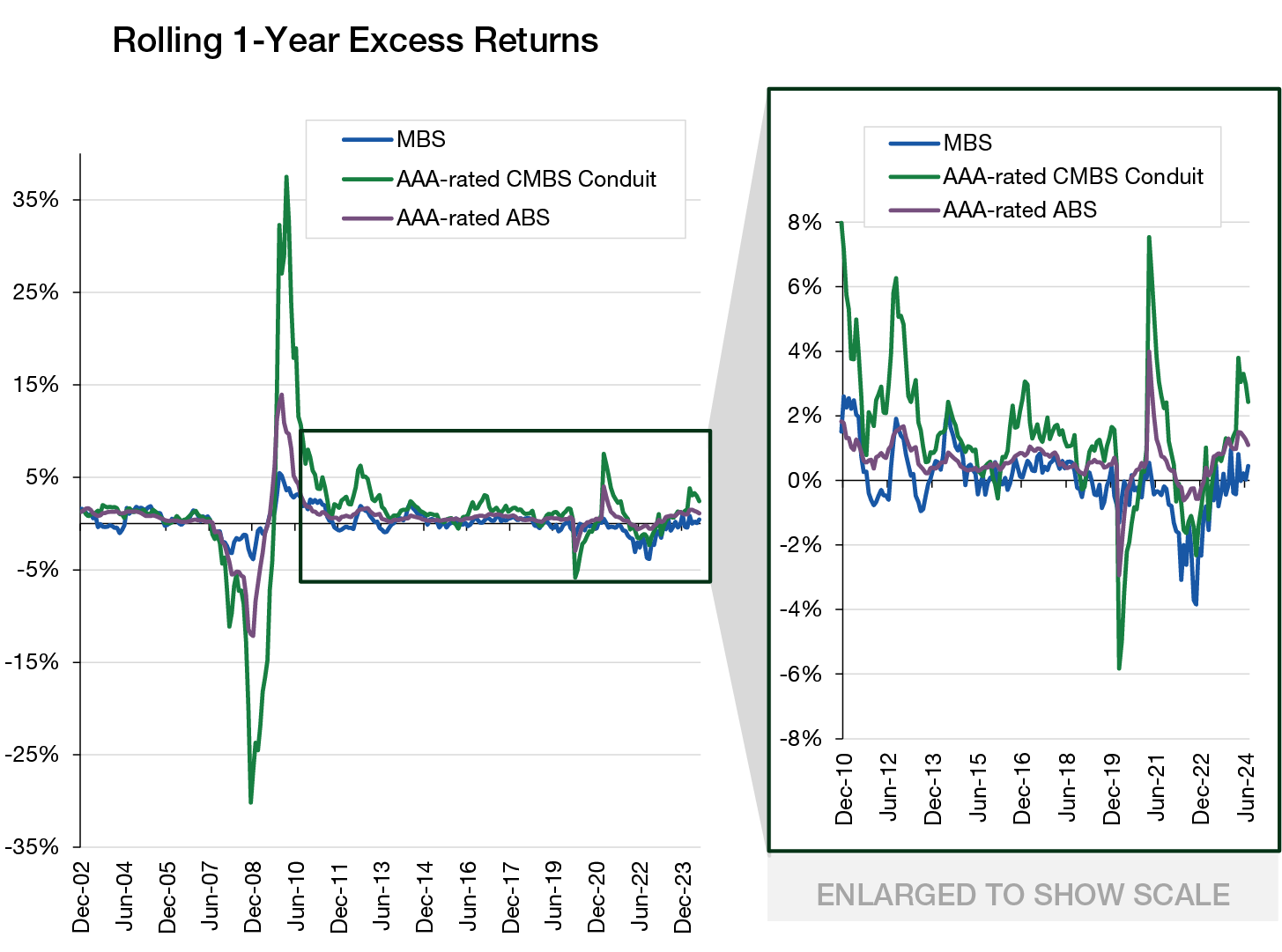

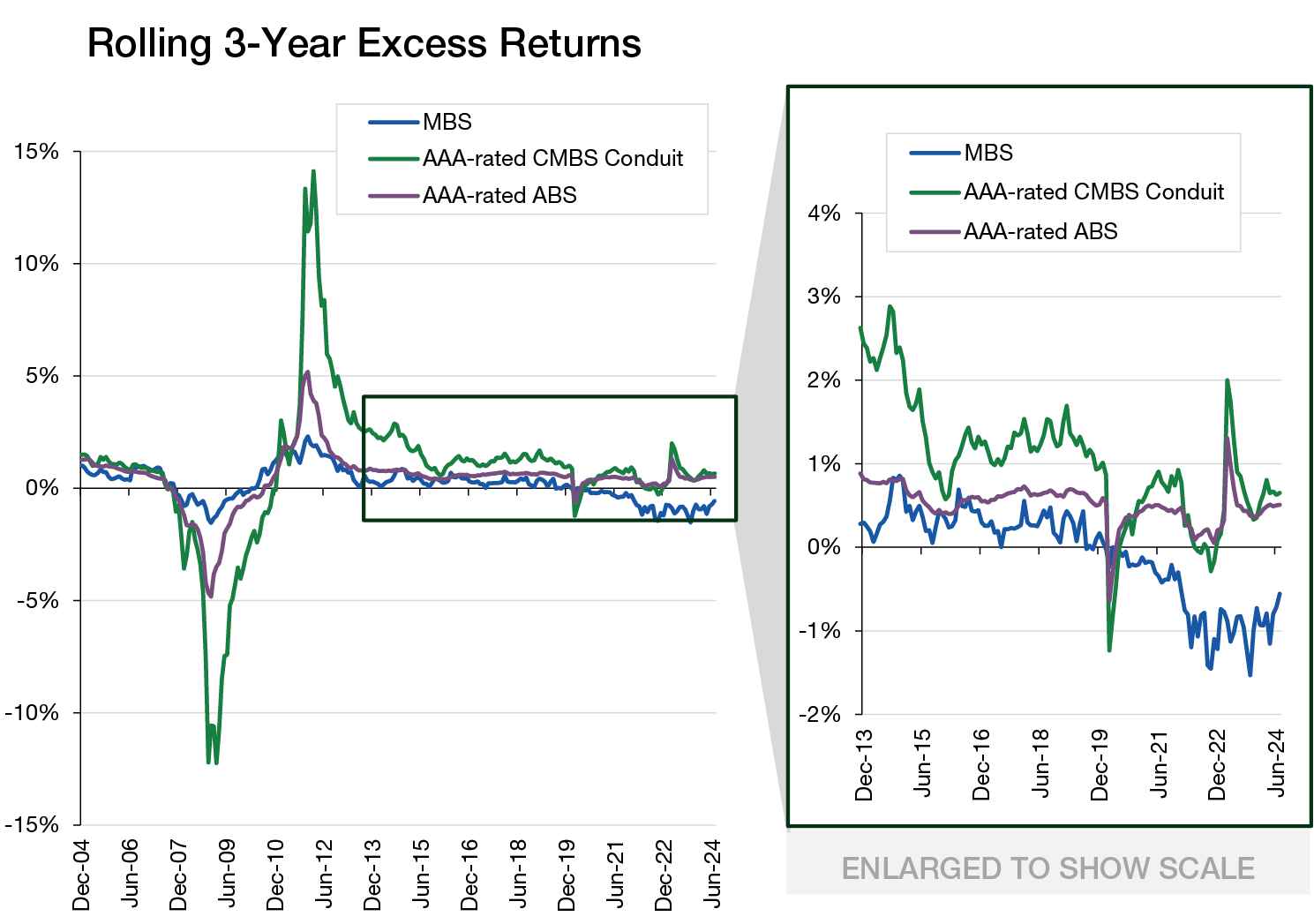

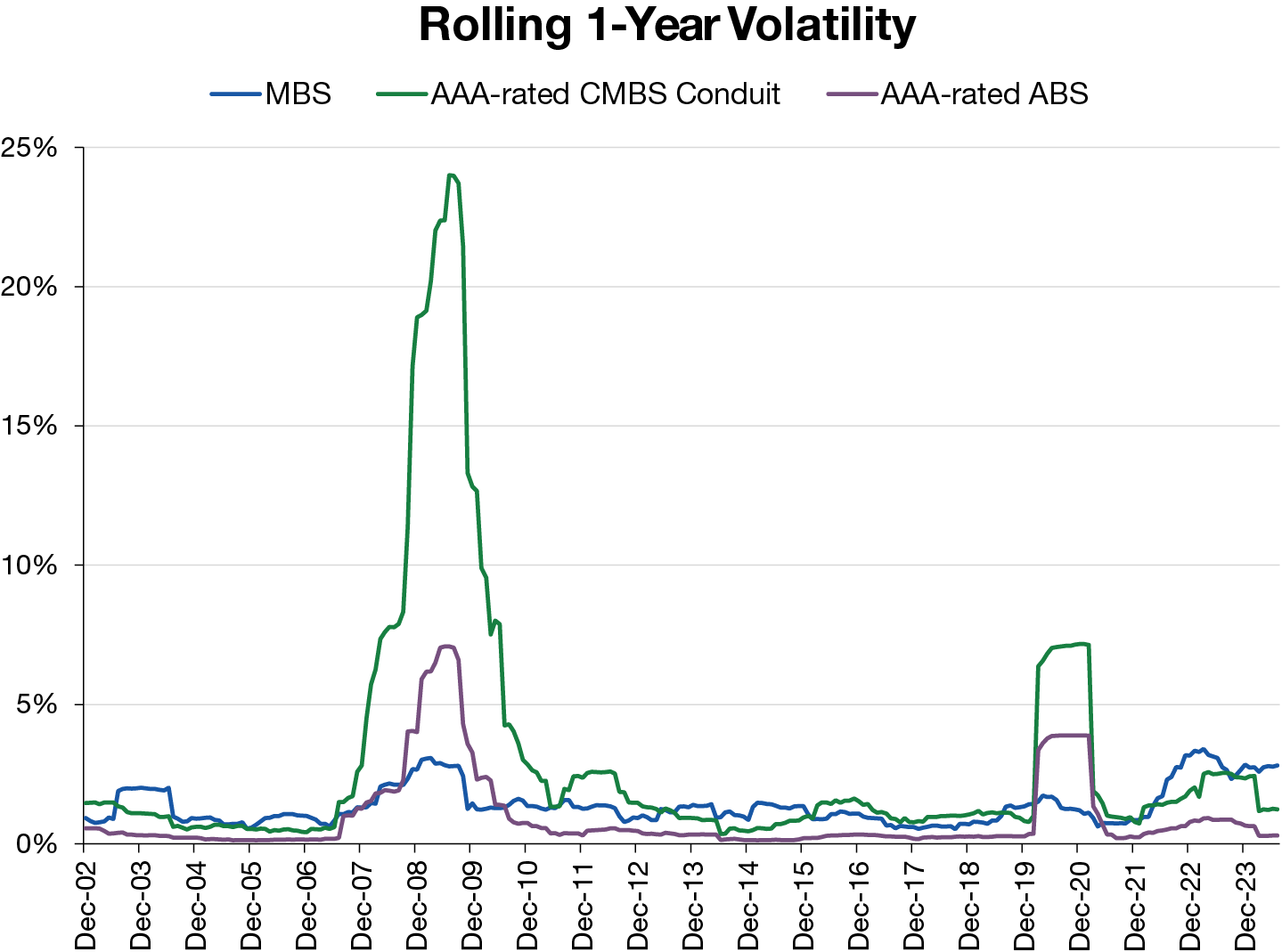

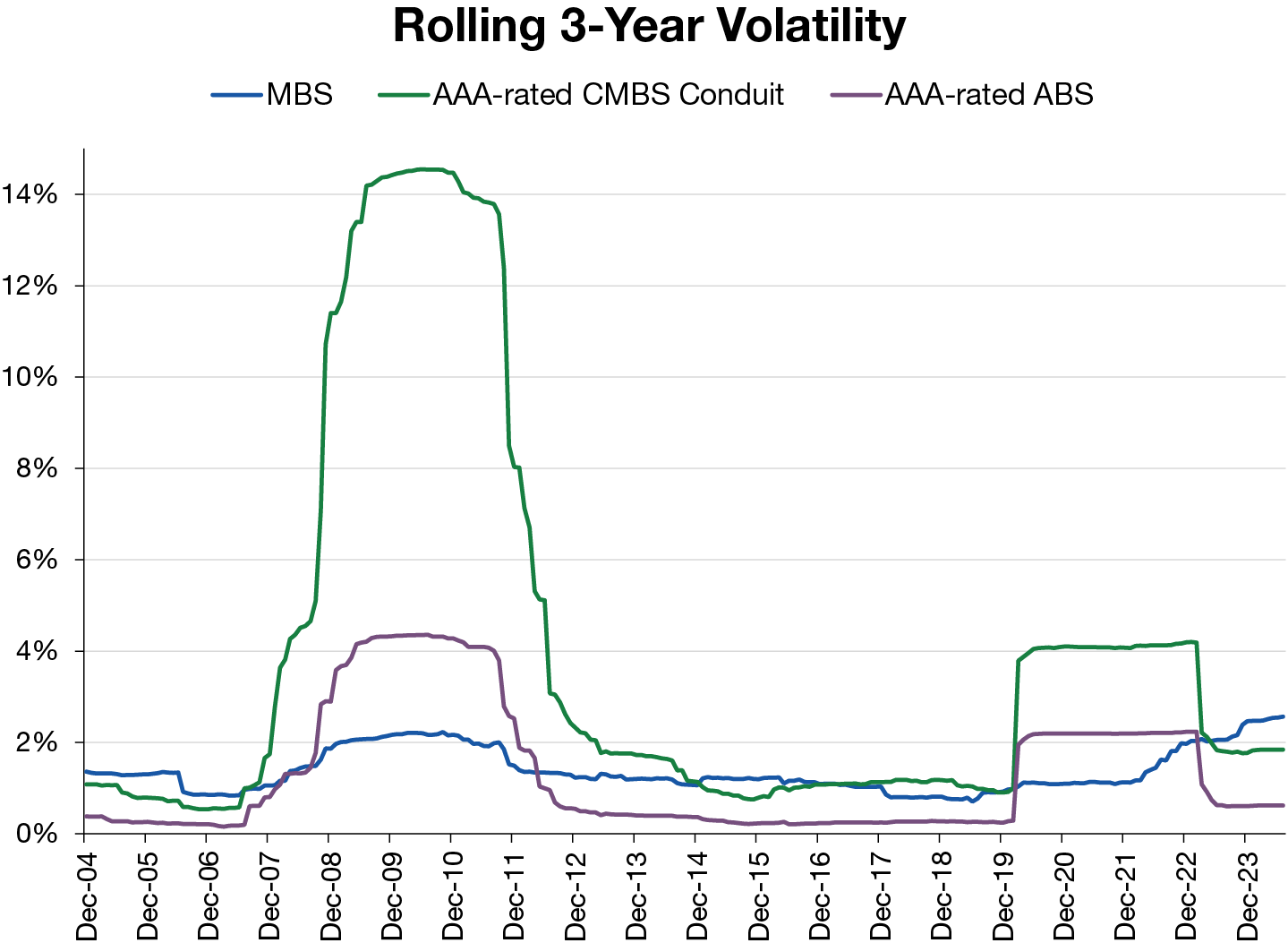

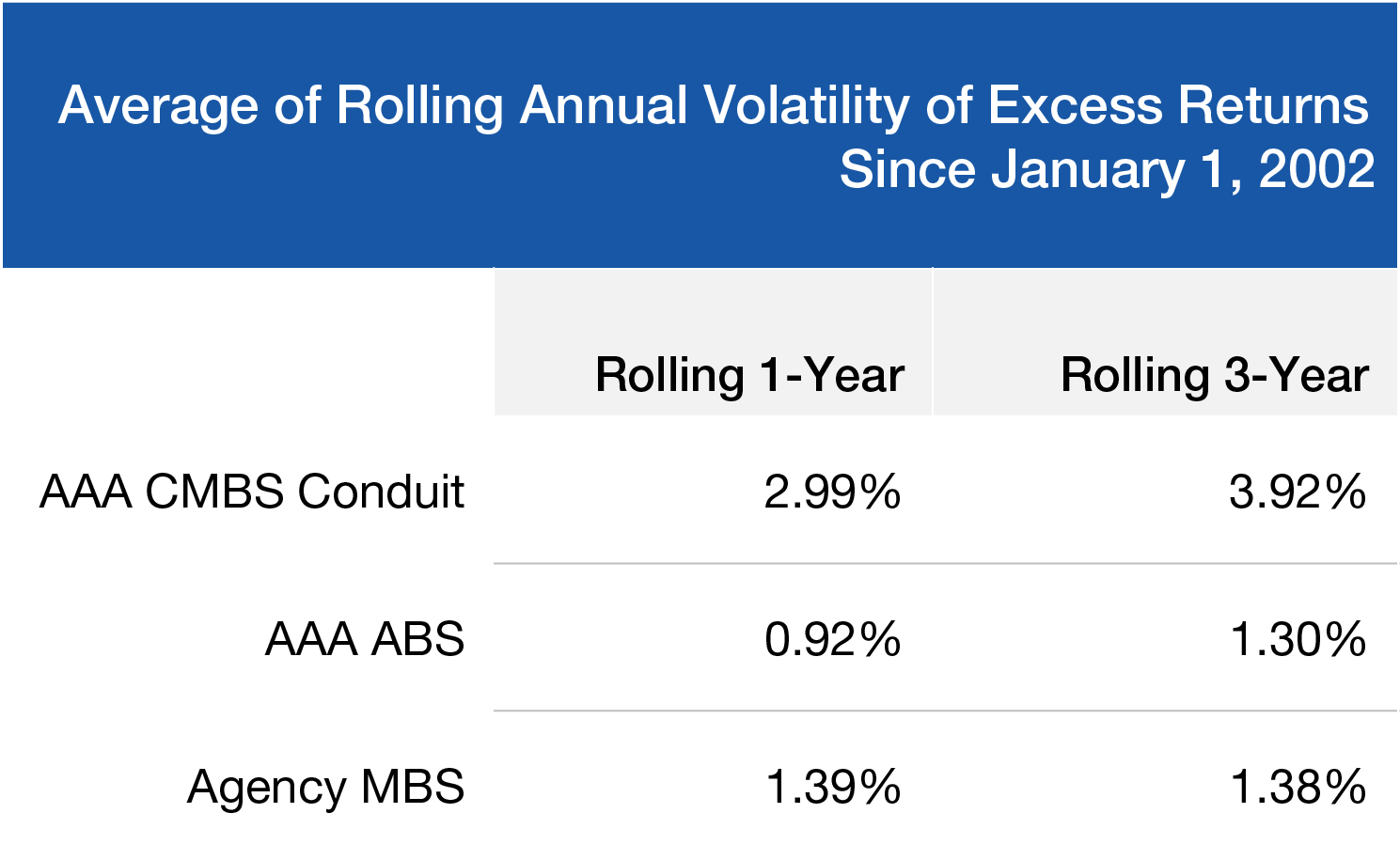

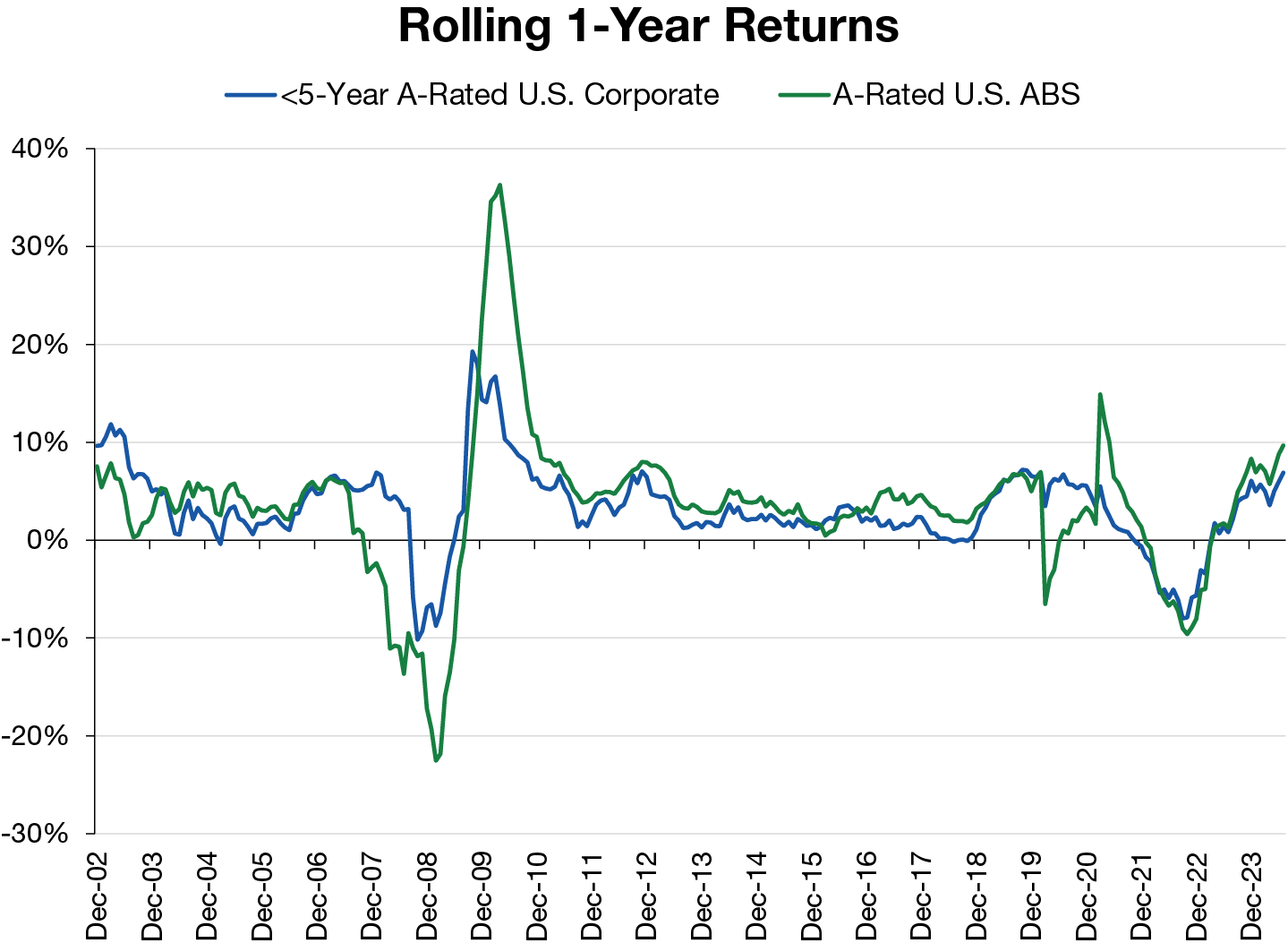

For the analysis, we use a more complete and robust data set provided by ICE BofA indexes, i.e., a longer historical availability as well as a more complete representation of the opportunity set within ABS, CMBS, and MBS. In Figure 2, we represent the rolling one- and three-year excess returns of agency MBS, AAA-rated ABS, and AAA-rated conduit CMBS. And as the table at the end of Figure 2 shows, the averages of the rolling excess return for AAA-rated conduit CMBS and AAA-rated ABS have both historically exceeded the excess returns of agency MBS over the last approximately 20 years.