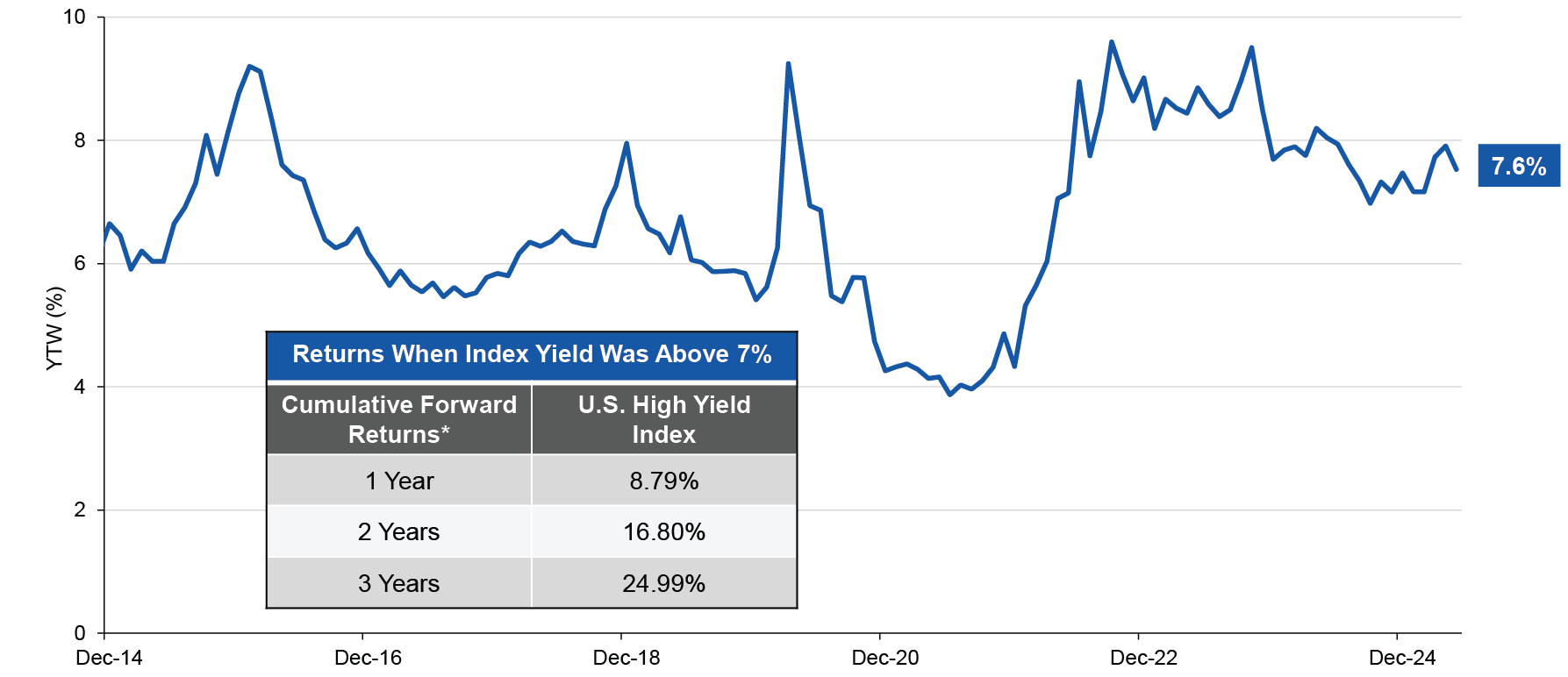

Fixed income markets have re-entered a period of heightened volatility in early 2025, as shifting macroeconomic conditions, evolving fiscal policies, and renewed geopolitical uncertainty have led to heightened recessionary fears in the U.S and meaningful movement in credit spreads. However, the high yield market recovered quickly and retraced most of the spread widening in a short span, highlighting the resiliency of the asset class. Below are several reasons why we continue to be constructive on high yield credit, and why we believe that the sector is poised to endure further macroeconomic uncertainty.

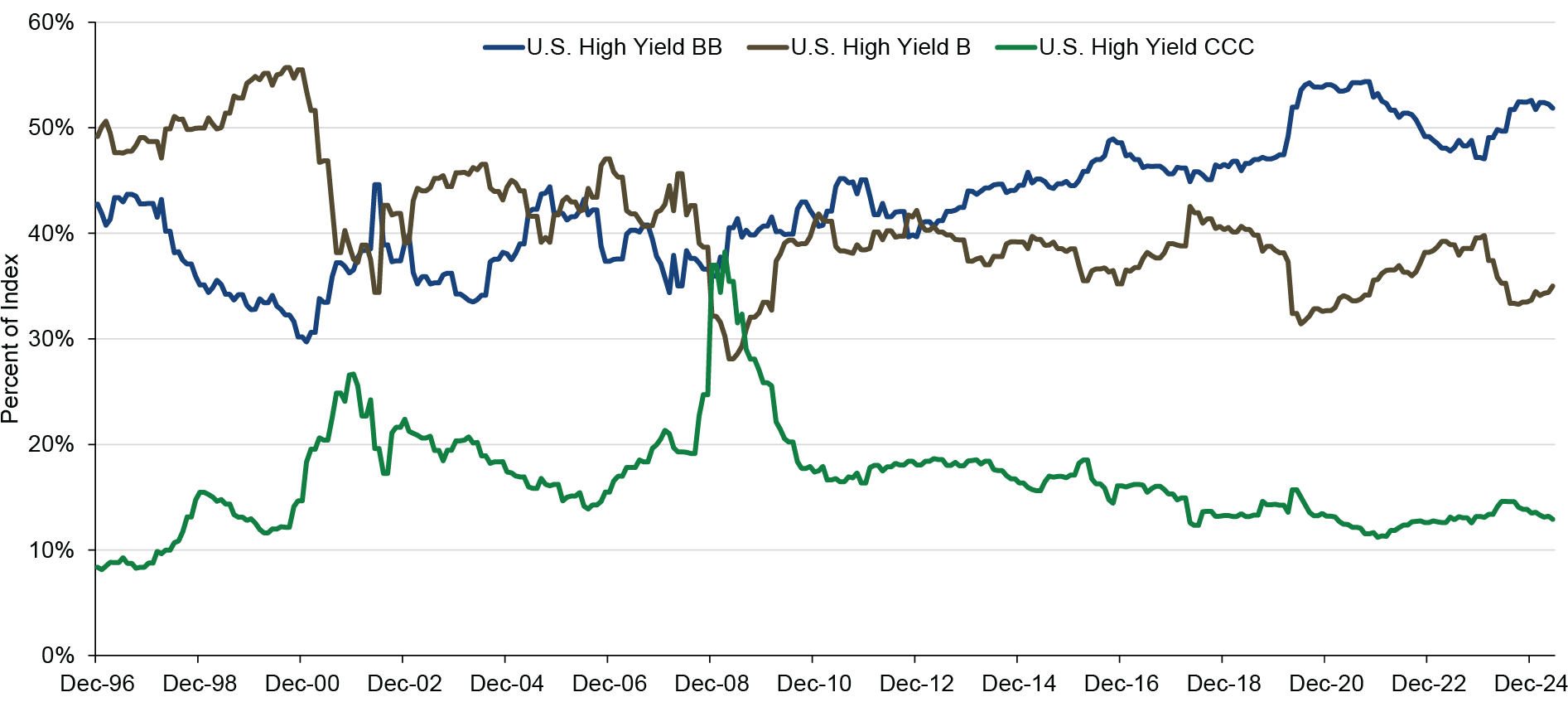

Credit Quality of the High Yield Market Has Improved

The credit quality of the high yield index has greatly improved over the past two decades, with a majority of the index shifting to higher-rated securities. Today over 50% of the high yield index is rated BB, while the proportion of the index in B- and CCC-rated securities has declined, as noted in Figure 1. This is important when thinking about potential industry default rates in a slowing economy, since defaults typically come from issues in the CCC bucket. With the index allocation to CCC near the lowest levels in 20 years, one may expect that default rates will not reach levels as seen in previous crises.