Key Takeaways:

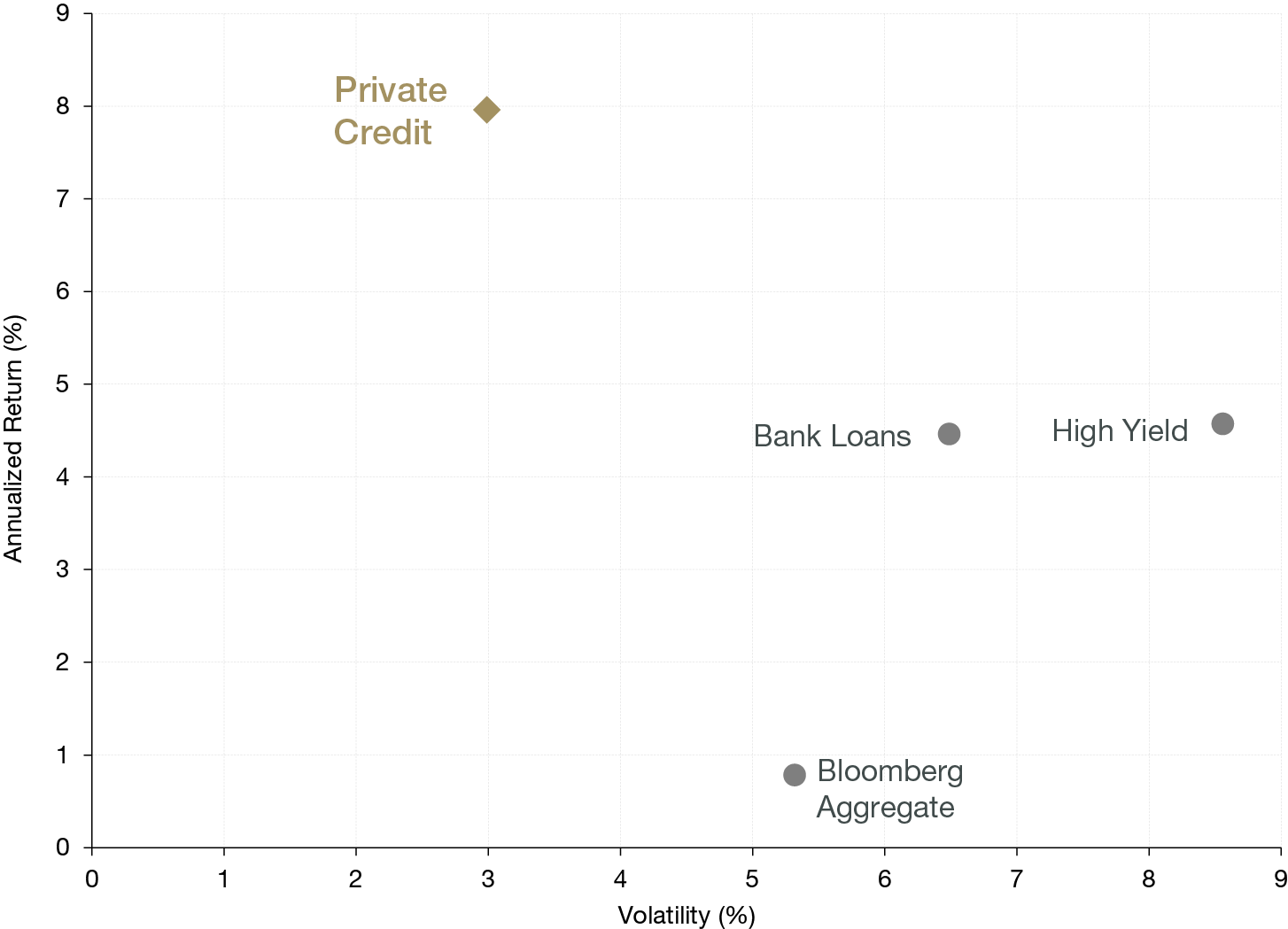

- The growth of direct lending, or private credit, has created what we believe is a beneficial ecosystem for borrowers, asset managers, and investors. It has expanded financing options for corporate borrowers and provided asset managers with opportunities to find value.

- While private credit has characteristics of an alternative asset class, it shares many similarities with traditional credit strategies. Recent convergence among issuers and investors suggests that direct lending may eventually be viewed as a more mainstream credit option rather than an alternative asset class.

At Lord Abbett, we’ve been in the business of capturing credit risk premiums through diligent research and flexible allocations for decades. Today we see the growth of direct lending creating an attractive and healthy ecosystem for borrowers, asset managers, and end investors. For corporate borrowers, private credit has expanded and enhanced financing options. For asset managers, this space has grown to become an opportunity for flexible and well-resourced credit managers to find value across markets. And for end investors, the performance profile of direct lending offers the appeal of attractive income with a risk-reward profile that can potentially be both a great diversifier to traditional assets and a volatility dampener in asset allocations.

What is perhaps equally as interesting to those looking at this relatively newer investment option is that while private credit overall has some of the hallmarks of an alternative asset class—liquidity profile, product structures, private sourcing—it could be argued that there is more that ties it to traditional credit strategies than not. At its core, it’s about lenders and borrowers, and we can imagine at some point, direct lending may not even be considered an alternative asset class. In the following pages, we discuss the growth of the direct lending market, its effect on, and convergence with, publicly traded credit, and our expectations for the credit environment going forward.

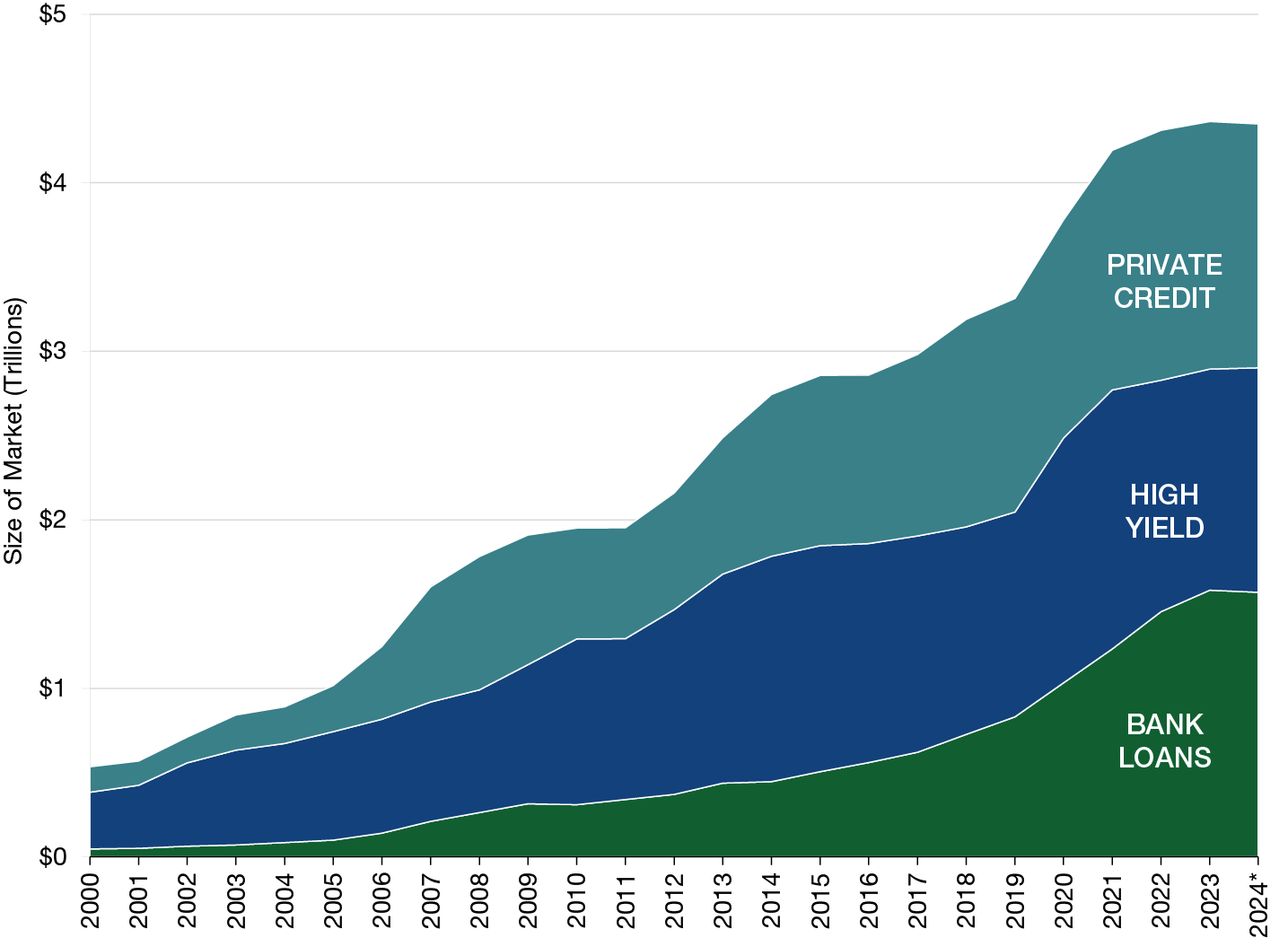

The Growth of Private Credit

Although direct corporate lending has been a longstanding practice, a window of opportunity opened over the last 15 years as the financial constraints imposed on banks after the great financial crisis (GFC) led to a significant shortage of capital for middle-market companies. This regulatory shift led to a massive expansion in the role of direct lending to these businesses. Large private investment houses responded to the increased demand by raising this needed capital through vehicles such as public and private business development companies (BDCs) to allow investors to integrate direct lending into broader diversified portfolios. At the same time, the industry built out human capital to increase the sourcing, assessment, and management of direct lending portfolios to allow for greater loan diversity and transparency, while further increasing investor comfort with the asset class.