Many investors are attracted to municipal bonds, given their high level of tax-free income, solid credit quality and history of delivering strong returns. Municipals look particularly appealing today, with yields near their highest level over the last decade. As of June 30, the Bloomberg Municipal Bond Index (muni index) yielded about 4%, representing a 6.7% tax-equivalent yield. For investors looking to extend duration, longer maturity municipal bonds are currently yielding 4.9%, or about 8.25% on a tax-equivalent basis.1

But what might be the best approach to investing in the asset class? Here, we offer four reasons why individual investors can benefit from working with a professional municipal bond manager with deep experience in actively managing the unique attributes of the municipal market, and how the active approach can help address some common investor concerns.

1. Institutional Pricing Differentiation

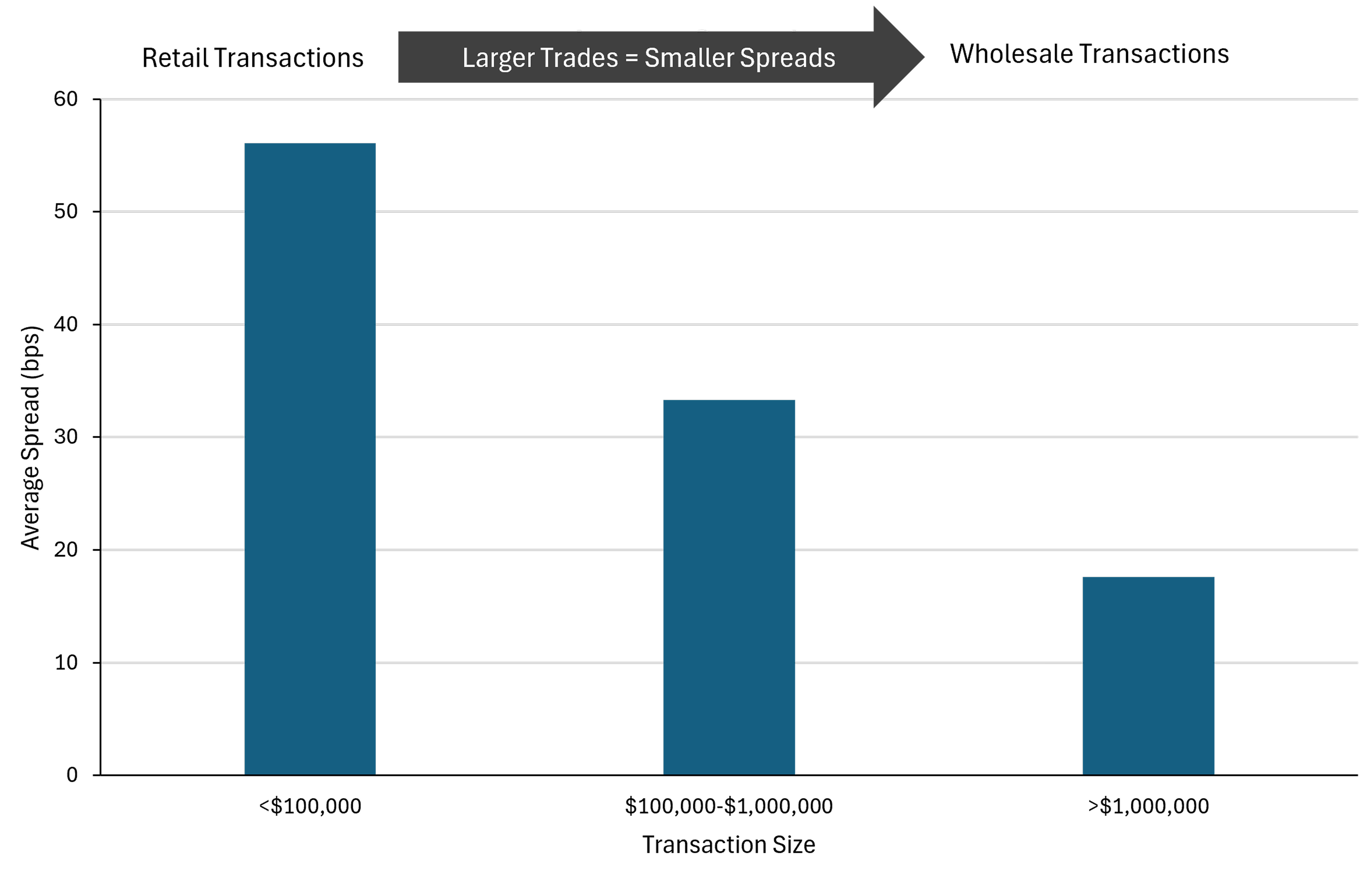

While stocks are traded on exchanges, with prices continuously quoted, municipal bonds are traded “over the counter,” between dealers. Transaction costs, or bid-ask spreads, are typically larger on smaller transactions. Individual investors could benefit from the institutional pricing power of professional money managers, who tend to buy bonds in large blocks, leading to lower transaction costs and higher yields.