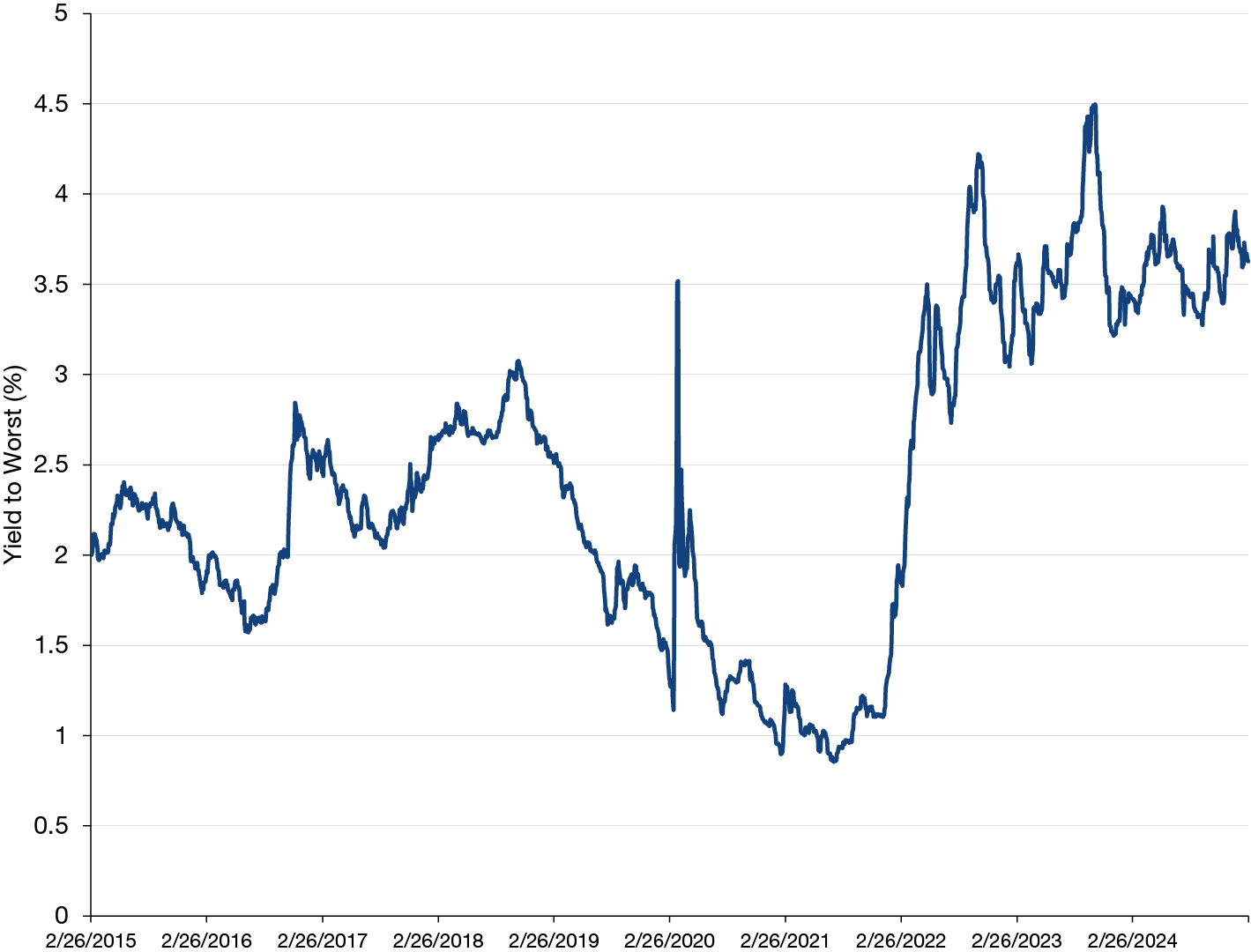

As investors weigh how to allocate their assets following a strong year for equities—and an extended period of high but now falling money market rates—one investment that may prove appealing is municipal bonds, especially with yields near their highest levels in a decade (see Figure 1). We think now may be a good time to consider how investments in municipal bonds can help people attain objectives beyond the traditional benefits of realizing attractive tax-equivalent yields via an asset class with strong overall credit quality.

Figure 1. Municipal Bond Yields Are Near Their Highest Levels in a Decade

Yield-to-worst on Bloomberg Municipal Bond Index, February 26, 2015–February 25, 2025

Past performance is not a reliable indicator or guarantee of future results. For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

We think the investment appeal of municipal bonds extends beyond those factors. Looking more closely at the range of municipal bonds available today, it is clear they align with some of today’s most compelling investment themes. Here, we’ll take a closer look at those themes, and three strategies that may enable municipal-bond investors to participate in them.

Municipal Bond Market Composition

First, let’s take a brief look at the municipal-bond landscape. People often think that the muni market is entirely composed of general obligation bonds (“GOs”) issued by cities, states, and local governments. In fact, only around 30% of the outstanding bonds in the market are GOs; most municipal bonds are revenue bonds issued in a wide range of sectors covering a broad swath of the economy. Revenue bonds are often used to finance things many of us use every day—structures and services that are vital to the functioning of communities and businesses.

As a reminder, general obligation bonds are supported by the full faith and credit of a government to pay back its borrowings. This means that such issuers will use all available revenues to pay interest and principal on the bonds and will raise tax rates or fees if necessary to keep paying them back. Some of the largest issuers fit into this category, such as the State of California and the City of New York. These types of issuers are the ones in the headlines most frequently.

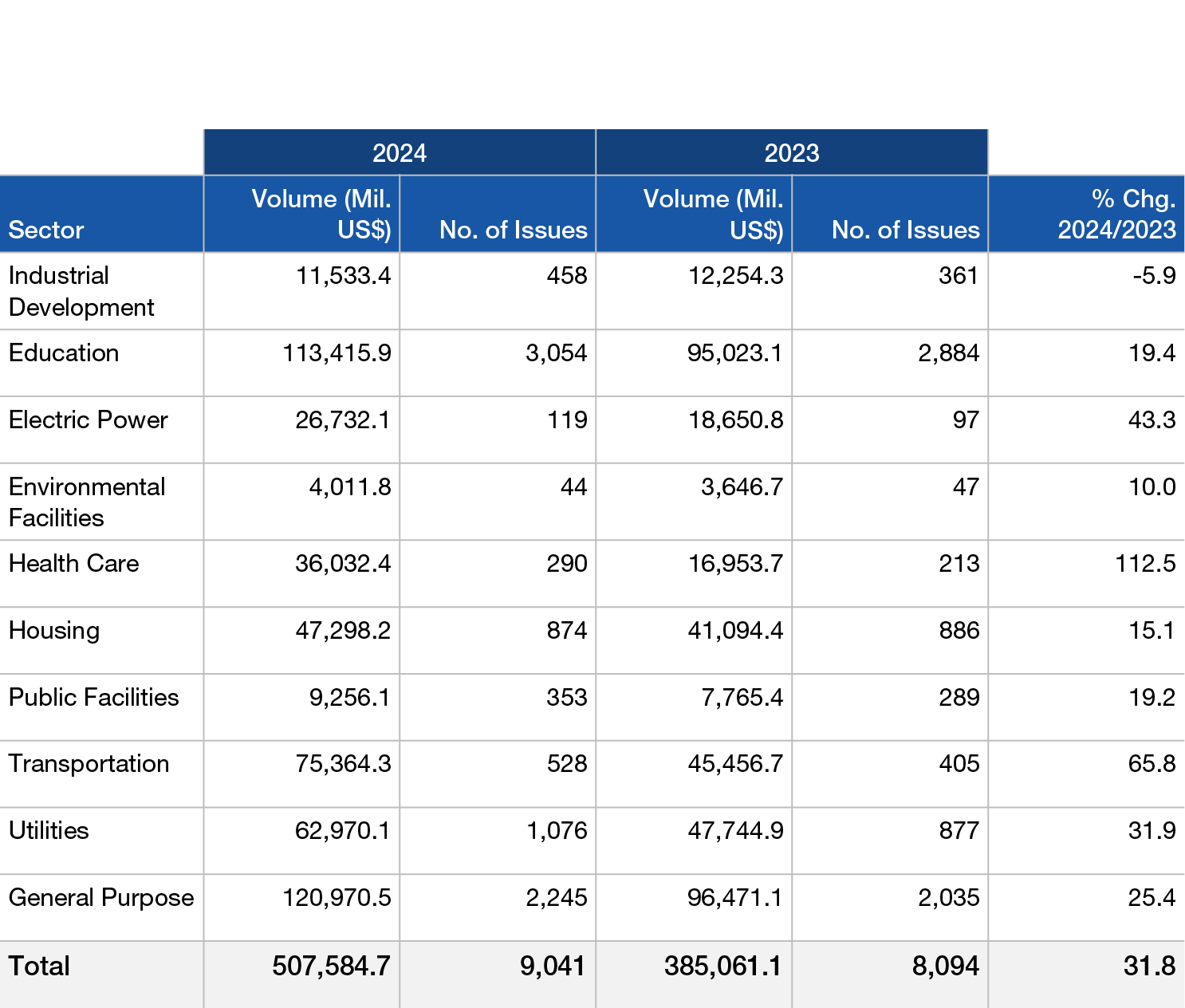

On the other side, revenue bonds are backed by specific revenues of an issuer. Some of the best-known issues of this kind are those backed by public utilities and water and sewer systems. Some of the less well-known issues might be issued for universities, not-for-profit hospitals, airports, toll roads, charter schools, housing, corporations in the industrial development space, and senior living facilities (see Figure 2).

Figure 2. Municipal Bond Issuance Climbed Across a Broad Array of Sectors in 2024

Long-term municipal bond sales volume and issuance counts by year

These bonds are an attractive opportunity set for active managers, often providing more yield than general obligation bonds because they require more research to understand, come from smaller issuers, and are less actively traded.

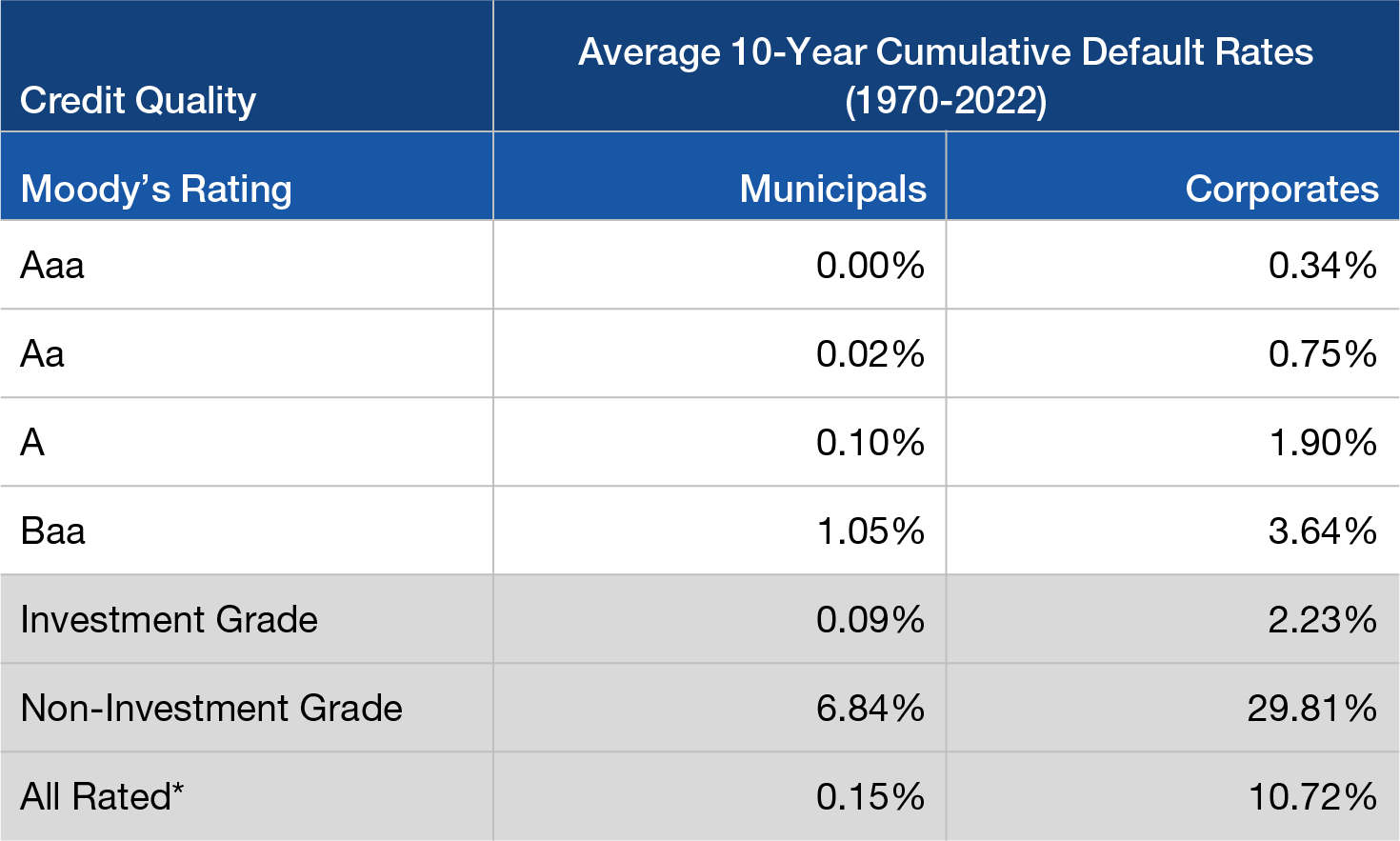

Municipal bonds are highly regarded by many investors for their resilient credit quality. Most municipal bonds carry investment-grade ratings, and the market historically has had low default rates (see Figure 3). However, there is a sizable amount in the below-investment-grade category as well; these bonds can provide even more yield and total return potential, along with lower historical default rates than comparably rated corporate bonds.

Figure 3. Municipal Bonds’ Historical Default Rates Are Much Lower than Those of Similarly Rated Corporates

Source: Moody’s, “Moody’s U.S. Municipal Bond Defaults and Recoveries, 1970–2022,” July 2023 (latest available historical data). Data show the average 10-year cumulative default rates of Moody’s rated corporate and municipal bonds for a study covering the period 1970-2022.

For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Past performance is not a reliable indicator or guarantee of future results.

A Diversified Investment Opportunity

The sheer number of muni-bond sectors, and the fact that many of them provide essential services, offer investors the opportunity for effective diversification, in our opinion. For example, when the U.S. economy went through uncertainty following the onset of COVID-19 in early 2020, people still had to pay their water, sewer, and energy bills. They also still paid college tuition while students attended classes remotely. With shoppers pivoting to online stores, revenue from trucks on toll roads increased substantially. Hospital admissions increased during the pandemic, so although elective surgeries were reduced, patient volumes were very high. Even though airports saw reduced traffic, they still earned fees from airlines who didn’t want to lose their gates; fortunately, airports had stockpiled a lot of cash on their balance sheets to help them ride out disruptions such as a global pandemic.

In addition to the attractive qualities listed above, municipal bonds can also be used to meet many investment strategies that are top-of-mind today, including those tied to strengthening infrastructure, shifting demographics, and responses to the imposition of tariffs by the United States and its trading partners.

Strategy 1: Infrastructure Investment

Municipal bonds offer a way to invest in infrastructure, a sector where there are many funds being created for taxable or equity investments. The infrastructure category includes many more types of issues. For example, municipal bonds are issued to help:

- Create low-income or workforce housing

- Build toll roads

- Provide support to public corporations in building factories (via Industrial Development Bonds)

- Produce and distribute various sources of energy

- Support state disaster insurance efforts

In our view, municipal bonds may represent the largest opportunity set among the major asset classes to invest in building, maintaining, and repairing infrastructure in the United States.

Strategy 2: Demographic Shifts

For those focused on changing demographics, including how to make investments in the services that baby boomers (for our purposes, people from ages 60 to 80) will need as they grow older, there are many municipal bond options available. An obvious one is not-for-profit hospitals, where a large portion of the revenue comes from patients insured by Medicare. In the high yield municipal bond market, there is a whole sector for Continuing Care Retirement Communities (CCRCs) where occupancy is over 80% on average, and many parts of the country are facing shortages of available senior housing options. There are real estate communities that cater to older people (such as the Villages in Florida), which frequently issue bonds to support their growth.

A bigger-picture approach might be to invest in general obligation or revenue bonds in areas of the country that are attracting increasing numbers of retirees such as Arizona and Florida. More people are turning 65 this year than any year in history, so the revenues coming from this segment of the population should continue growing.

Strategy 3: The Potential Impact of Tariffs

Another hot topic lately is tariffs. Without suggesting an opinion about how they might affect the economy, one thing that is certain is that our government is not going to put tariffs on companies doing their production within the United States. As mentioned above, there are ways in the municipal bond market to invest in domestic production of goods and services through the industrial development bond sector. It may seem surprising that corporate issuers are able to bring municipal bonds to the market, but they can do so through private activity bond issuance. Each state has an allocation of municipal bond issuance to make available to public corporations to spur economic growth. Industrial development bonds can include issues covering a wide range of sectors such as steel, chemicals, airlines, investor-owned utilities, waste management, paper, and metals. Regardless of how the planned levies on non-U.S. producers are implemented in coming months, production within the United States will not face tariffs, so domestic industries could benefit.

Implementing These Strategies

Many of the strategic themes mentioned above may already be part of a municipal bond portfolio. Figure 2 pointed to the rising volume of issuance in key sectors; that growth is reflected in their weightings in the Bloomberg municipal bond indexes. In the investment-grade index, healthcare accounts for 9% of issuance, transportation 15%, housing 4%, and utilities 13%. In the high yield index, healthcare (combination of hospitals and CCRCs) represents 18%, industrial development bonds 20%, housing 10%, and special tax (which includes a lot of real estate-backed bonds) 19%. (Figures based on Bloomberg data as of February 14, 2025.) So, each of these strategies has a material size weighting in representative indexes.

Beyond the indexes, active managers of municipal-bond portfolios can harness their credit research and security-selection capabilities to make strategic allocations to capitalize on these trends. Also, those who hold separately managed accounts focused on municipal bonds may be able to customize weightings in these sectors or to certain parts of the country based on their individual preferences.

Summing Up

The municipal bond universe goes well beyond issues backed by general obligations of cities, states, and local governments; it encompasses a broad, differentiated set of revenue sectors as well. They provide not only diversification and attractive yields, but also the possibility of investing along many of the themes that strategists are currently highlighting for other markets. Additionally, revenue bonds have historically outperformed general obligations over the long term.

The current yield environment puts these considerations into sharper focus. Tax-equivalent yields have historically been attractive versus other fixed-income sectors, and bond yields are now on the higher end of where they have been over the past decade. The credit quality of the overall muni market is strong, in our view, and studies of historical default rates show they are lower for municipals than other markets.

Municipal bonds give people the opportunity to invest in things that are important to them and regularly affect their daily lives. With all the uncertainty globally, we believe muni bonds are a good way to invest in domestic assets that might benefit from some of the investment themes we’ve detailed here, while potentially realizing attractive returns.