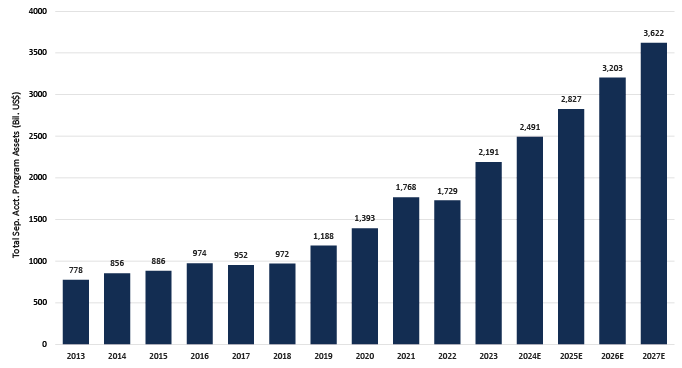

Separately managed accounts (SMAs) have seen tremendous growth in recent years—and have gained greater attention from investors as a potentially effective way to build investment portfolios. According to research firm Cerulli Associates, assets in separately managed accounts (SMAs) are expected to reach $3.6 trillion in 2026, up from $778 billion in 2013 and $2.2 trillion in 2023.

Figure 1. Tracking the Rapid Growth of SMA Assets Over the Years

SMAs, which have been around since the 1970s, were originally developed to bring institutional-quality investment management to the individual investor. Previously, retail investors could gain access to broad diversification and professional money management via mutual funds, but separately managed portfolios of individual securities were only available to investors that could meet institutional minimums.

Thanks to the evolution of technology, account minimums have decreased for much of the industry. Today’s SMAs allow individual investors to potentially benefit from institutional-style professional management across a wide range of equity and fixed-income strategies with much lower minimums than institutional separate accounts.

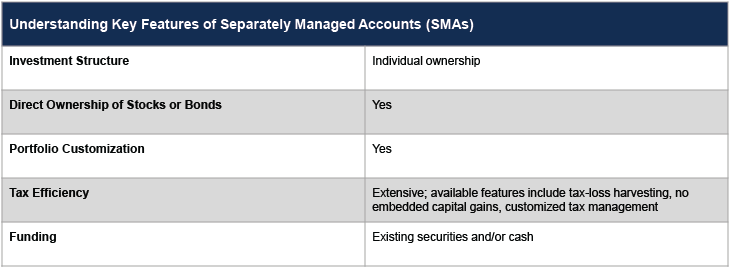

Here’s a closer look at some important characteristics of SMAs:

Source: Lord Abbett. See Glossary Definitions, below, for more information on the terms used in this illustration.

Separately managed accounts may not be appropriate for all investors. This information should not be relied upon as investment advice or a recommendation for any particular investment product or strategy and is provided for informational purposes only.

Some of the potential benefits of an SMA that come from individual security ownership include:

- Transparency: The structure of SMAs allows for a real-time view into portfolio holdings.

- Personalization: Flexibility to customize portfolios, allowing for tailored investment strategies that can align with individual client goals and risk profiles.

- Selectivity: Ability to implement security and industry restrictions.

- Tax Efficiency-Embedded Capital Gains: Since the underlying securities are purchased directly, SMA investors will only pay taxes on gains related to their account.

- Tax Efficiency-Tax-Loss Harvesting: SMA investors can potentially benefit from tax-loss harvesting, strategically taking losses on individual positions to offset gains in other parts of their portfolio, reducing their overall tax obligation.

Investors considering SMAs should also weigh potential risks and tradeoffs:

- Investment minimums for SMAs tend to be at higher levels than those of mutual funds or ETFs.

- The performance of an SMA can deviate from its target benchmark as the result of security or sector restrictions.

- The underlying securities in an SMA account are subject to the various risks inherent to fixed income or equity investing, as well as the specific investment strategies employed.

In the end, investors should weigh their options and determine the investment vehicle that is best suited to their needs.

How SMAs Can Potentially Help Investors Meet Their Objectives

Separately Managed Accounts may be ideally positioned to address investors’ preferences for personalization, customization, and tax optimization. As mentioned earlier, SMAs can help enable tax-loss harvesting and other tax management strategies to help optimize after-tax returns. Investors can also choose to exclude certain companies or sectors from their portfolio based on personal preferences and risk-tolerance profiles. This is all possible because SMAs directly own the underlying securities, providing investors with greater transparency and control.

These features can be quite useful in addressing some common situations experienced by today’s investors. Consider the following scenarios:

- An investor who has a concentrated stock position may want to exclude that holding from their portfolio.

- Some investors may wish to limit exposure to a specific industry due to concentration in another part of their portfolio.

- An account holder may wish to have more control over realizing tax losses to enhance after-tax returns.

- A municipal bond investor may desire to put limits on states, credit ratings, or maturity ranges in their portfolio.

In each case, a separately managed account may provide an appealing option.

A Final Word

At Lord Abbett, we are active managers focused on delivering long-term performance for our clients through disciplined, repeatable investment processes. That approach is an important part of our management of SMAs. Given many of the characteristics described here, it seems likely that SMAs will become an increasingly important part of client conversations in today’s market environment.

Three key questions for investors considering opening an SMA:

- How does the manager approach active management?

Lord Abbett has been an active manager since 1929 and has offered SMAs for over three decades. We have deep experience in guiding investment portfolios through a variety of market and economic environments. - What levels of customization are available?

SMAs can be customized to meet specific investor objectives and preferences. For example, municipal SMAs may accommodate state-specific and quality parameters; equity SMAs may be tailored to exclude certain stocks or optimized for tax efficiency.

- What degree of customer service does the manager provide?

We believe this is an essential part of the client experience. In seeking to provide a superior client experience, we offer accessible Lead Portfolio Managers; dedicated Personal Account Managers; a dedicated client service team; and easy account setup.