The private credit market—particularly corporate direct lending—has expanded significantly in recent years, prompting some investors to question whether such growth is sustainable. In our view, two concepts can hold true at the same time: 1) the market for private credit has the capacity to support continued expansion of the asset class, and 2) investors should remain attentive to emerging risks when selecting a private credit manager. Below, we’ve highlighted several considerations regarding the growth of private credit.

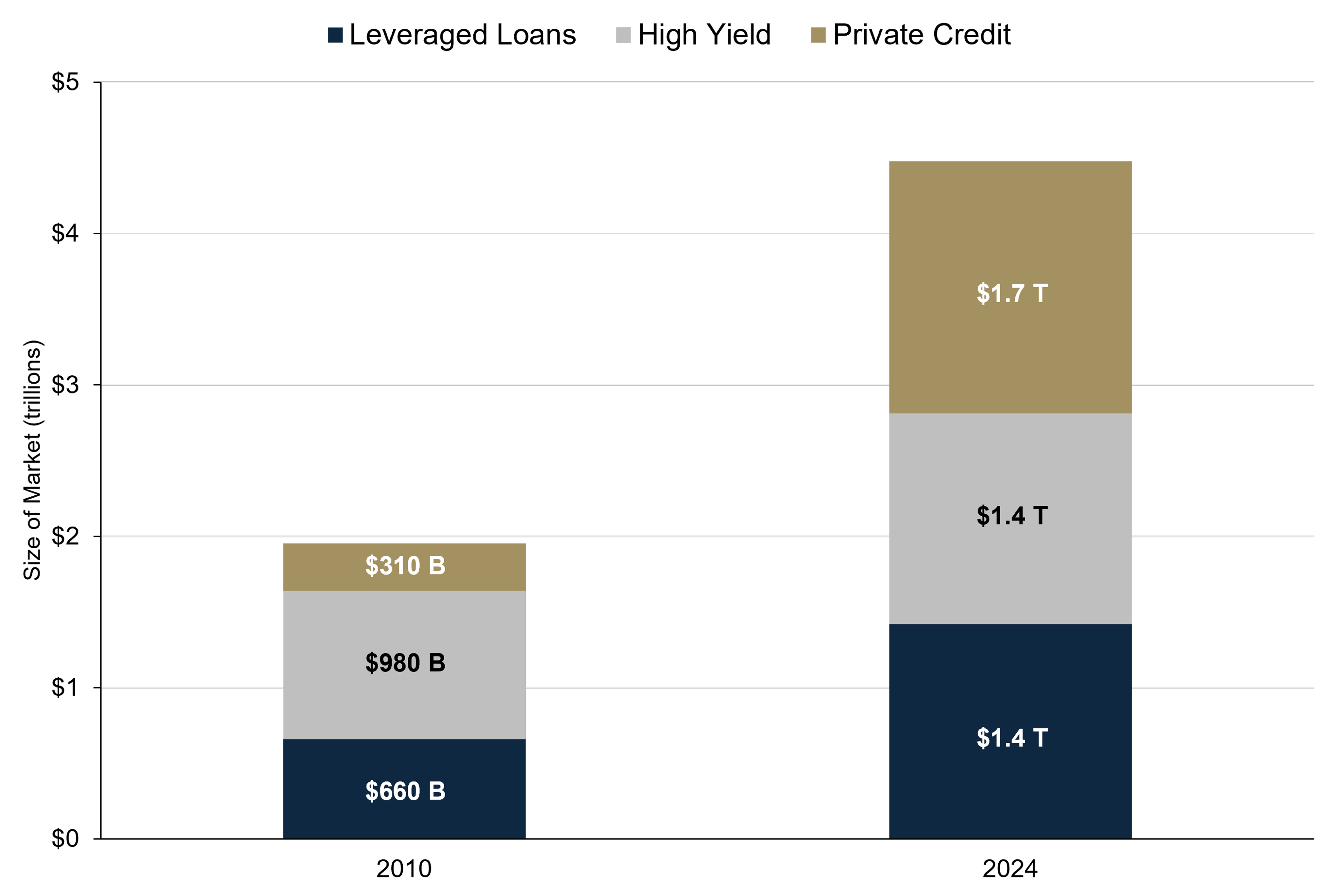

Each Subcomponent of Leveraged Credit Has Experienced Growth Over Time

In 2010, the value of private corporate loans totaled $310 billion. Today, that number has reached $1.7 trillion, now roughly one third of the overall leveraged credit market. For context, the high yield bond market began to develop as a stand-alone asset class in the 1970s. Initially, high yield bonds were born from downgraded investment-grade bonds, or “fallen angels.” Over time, we began to see bonds that were newly issued as below investment grade. That market, which started from virtually nothing, has grown to nearly $1.5 trillion, shown in Figure 1.