Key Points

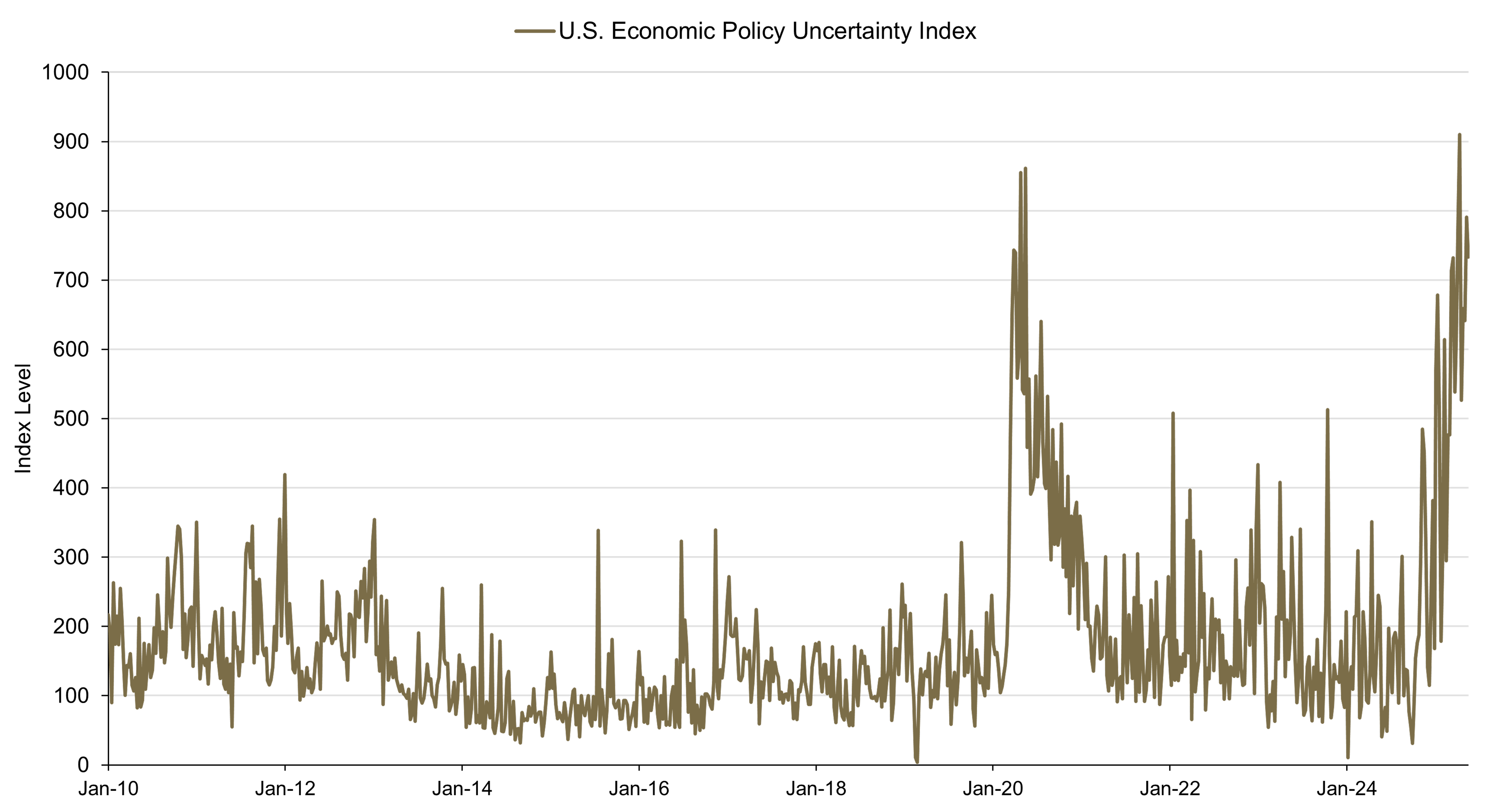

- Markets have mostly recovered since intense volatility was triggered by the tariff announcement on April 2. However, certain indicators show elevated uncertainty persists.

- Mixed signals on the health of the U.S. economy have come from the sharp decline in sentiment and confidence measures (soft data) and relatively healthy job growth and consumer spending (hard data).

- Despite the significant policy changes and heightened uncertainty, a strong economic foundation, characterized by full employment and decreasing inflation, should provide stability and continuity going forward.

The overarching theme that has been the focus of financial markets is elevated uncertainty. The economic recovery following COVID-19 demonstrated remarkable strength and resilience. As we now face another round of heightened uncertainty due to significant changes in trade, immigration, fiscal, and regulatory policy all occurring simultaneously, an important question is whether the economy is experiencing a sharp break from the initial years of the current recovery, or if there are elements of continuity going forward. In 2024, U.S. Federal Reserve (Fed) policy was able to reduce inflation, though not all the way down to their 2% target, while maintaining a full employment economy with substantial job creation. This robust economic foundation may help to provide a degree of stability and continuity as we navigate the unknowns ahead, offering a constructive outlook amidst the challenges.

Conflicting Market Signals Add to Uncertainty

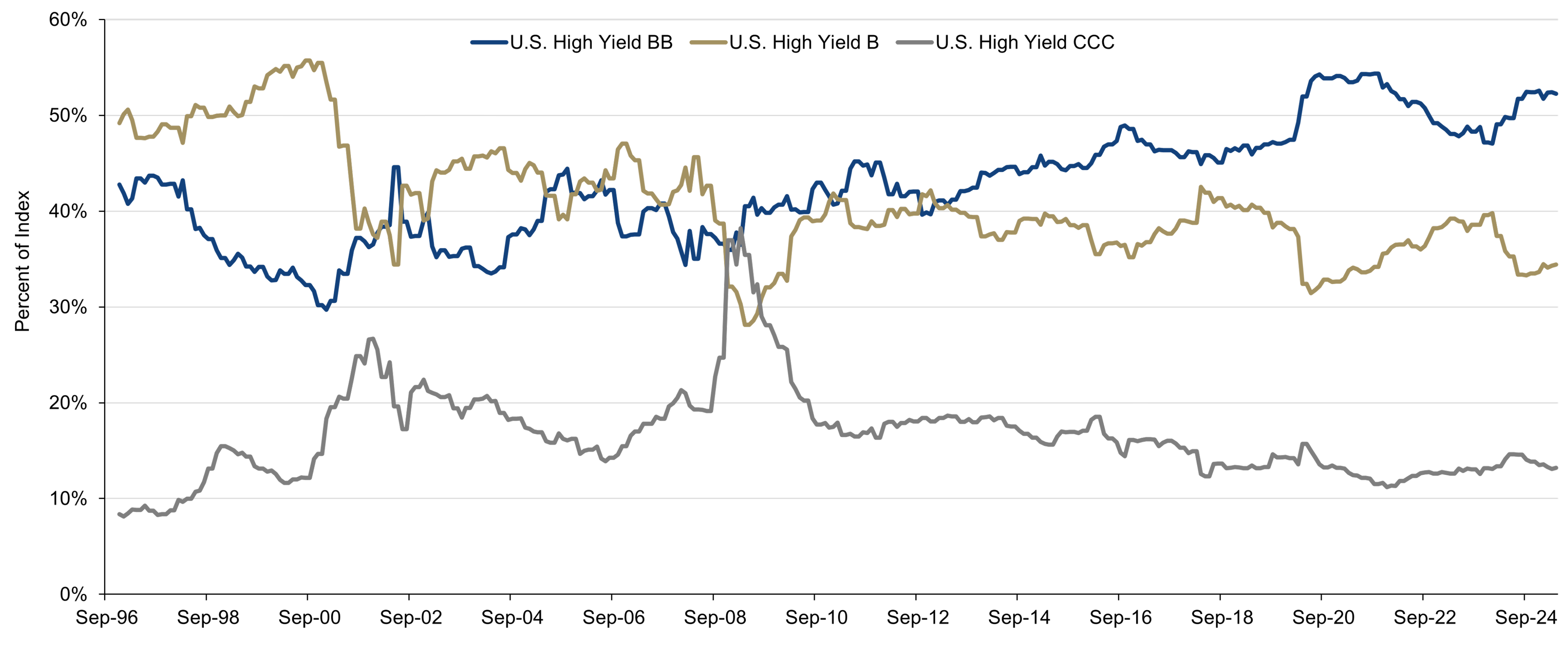

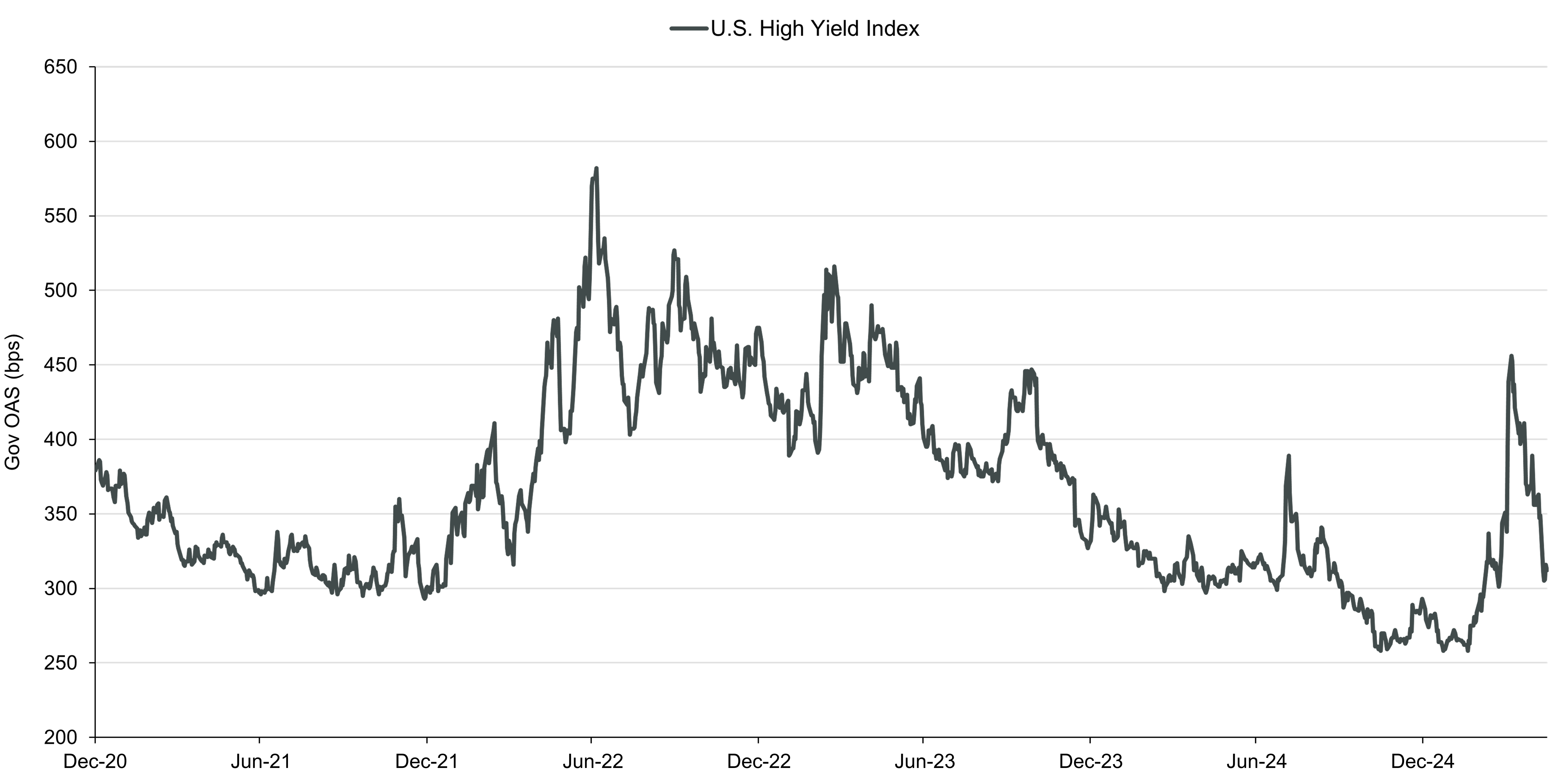

On a positive note, financial markets have been exhibiting optimism. Following the spike in volatility that was triggered by the tariff announcements on April 2, equity markets have moved higher, and high yield spreads have meaningfully tightened. As the implementation of most new tariffs was delayed for 90 days and an initial round of negotiations led to agreements that lowered rates, investors have become less pessimistic about the outlook. Despite the remaining uncertainty, investors have become more confident that a policy “put” exists that ensures policymakers will back away from changes that are deemed too negative for growth and earnings. That has, in turn, led to renewed confidence that technological advancements, such as artificial intelligence (AI), will likely unleash a surge in productivity.

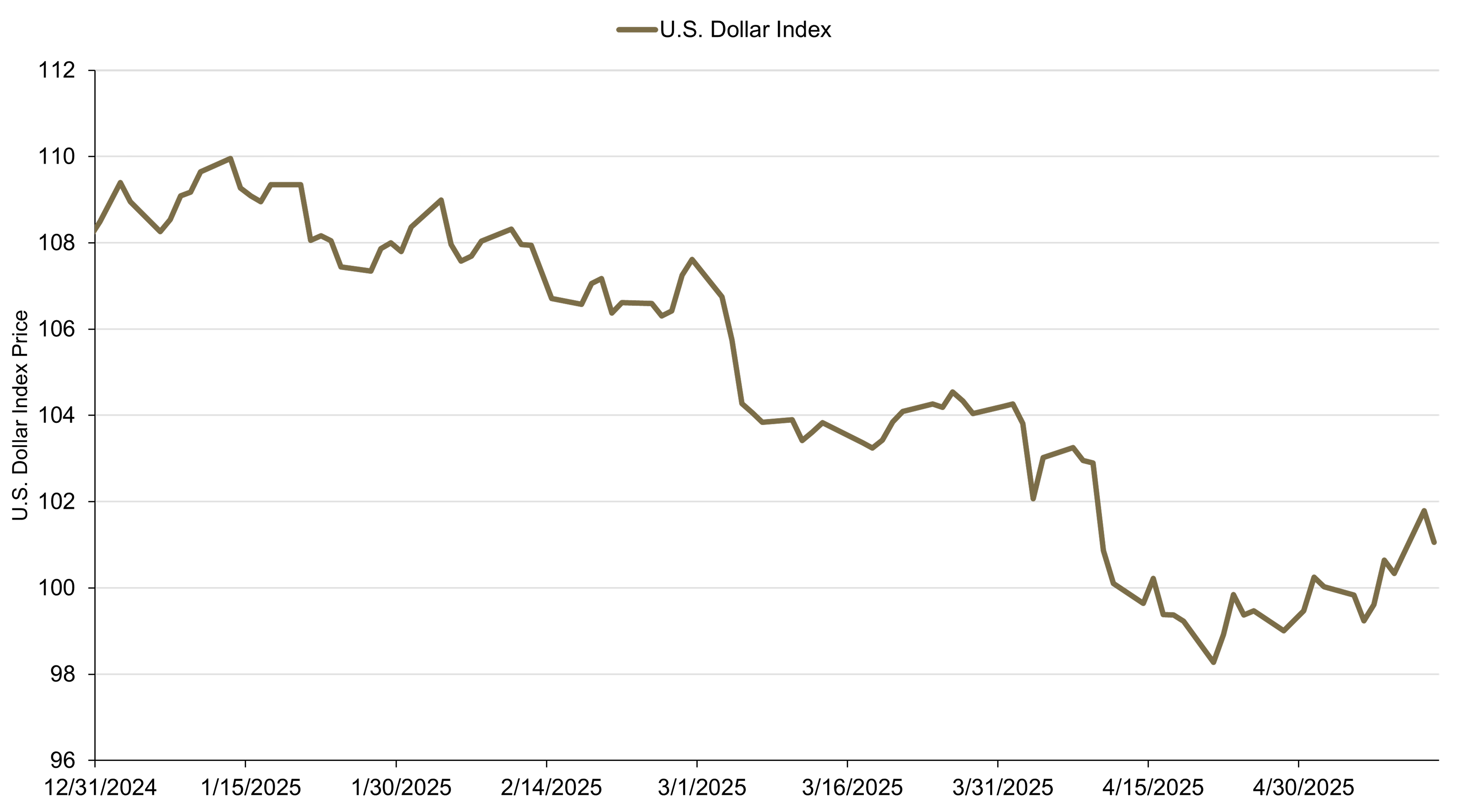

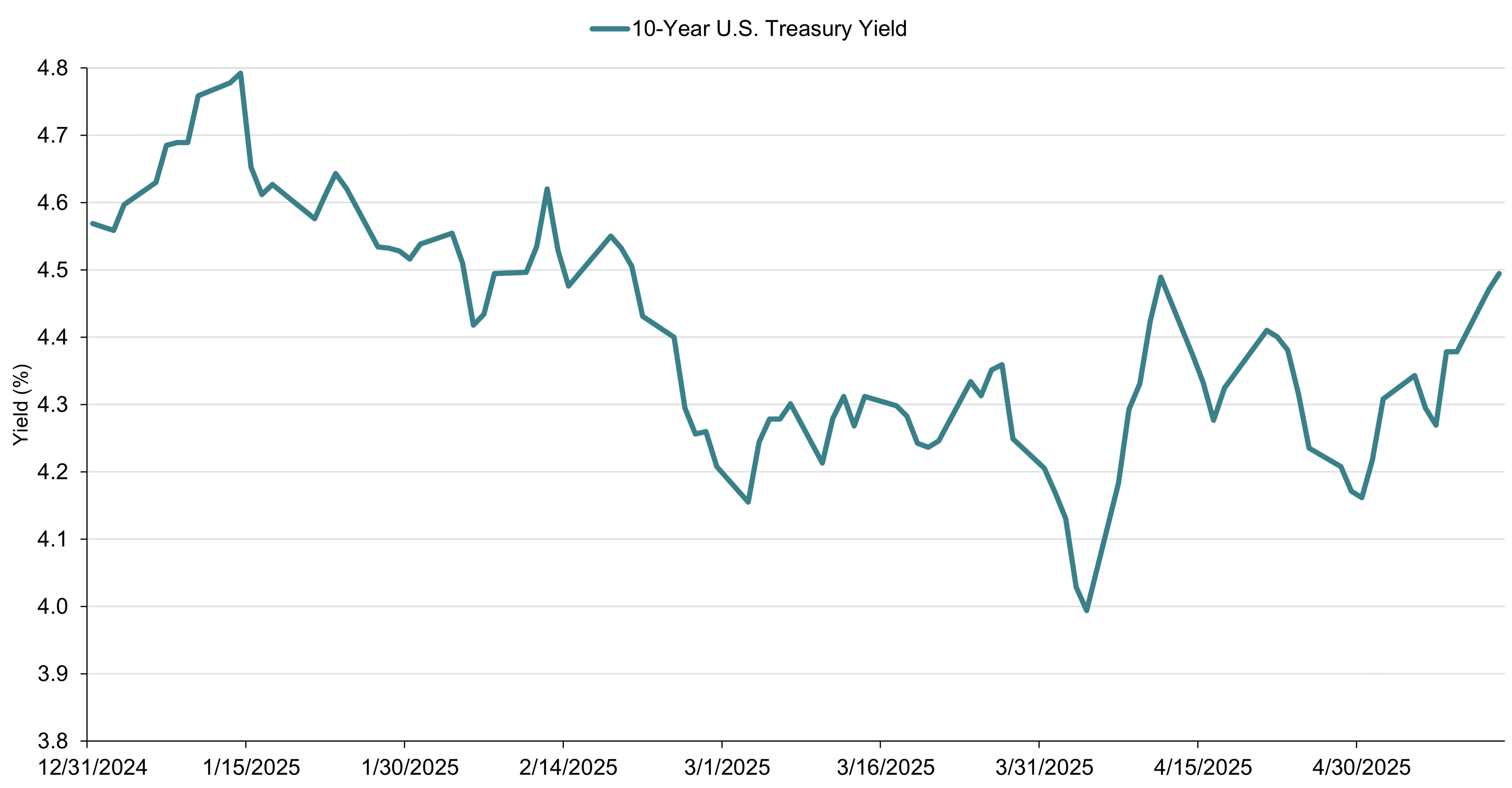

However, there are also concerning signs. During the market sell-off from mid-February to early April 2025, safe haven assets did not play their usual role. Normally, in a global market sell-off, the U.S. dollar would strengthen, and U.S. Treasury bonds would appreciate as these have typically been considered global safe assets. Instead, we saw the Treasury market sell off and the dollar weaken (see Figure 1).