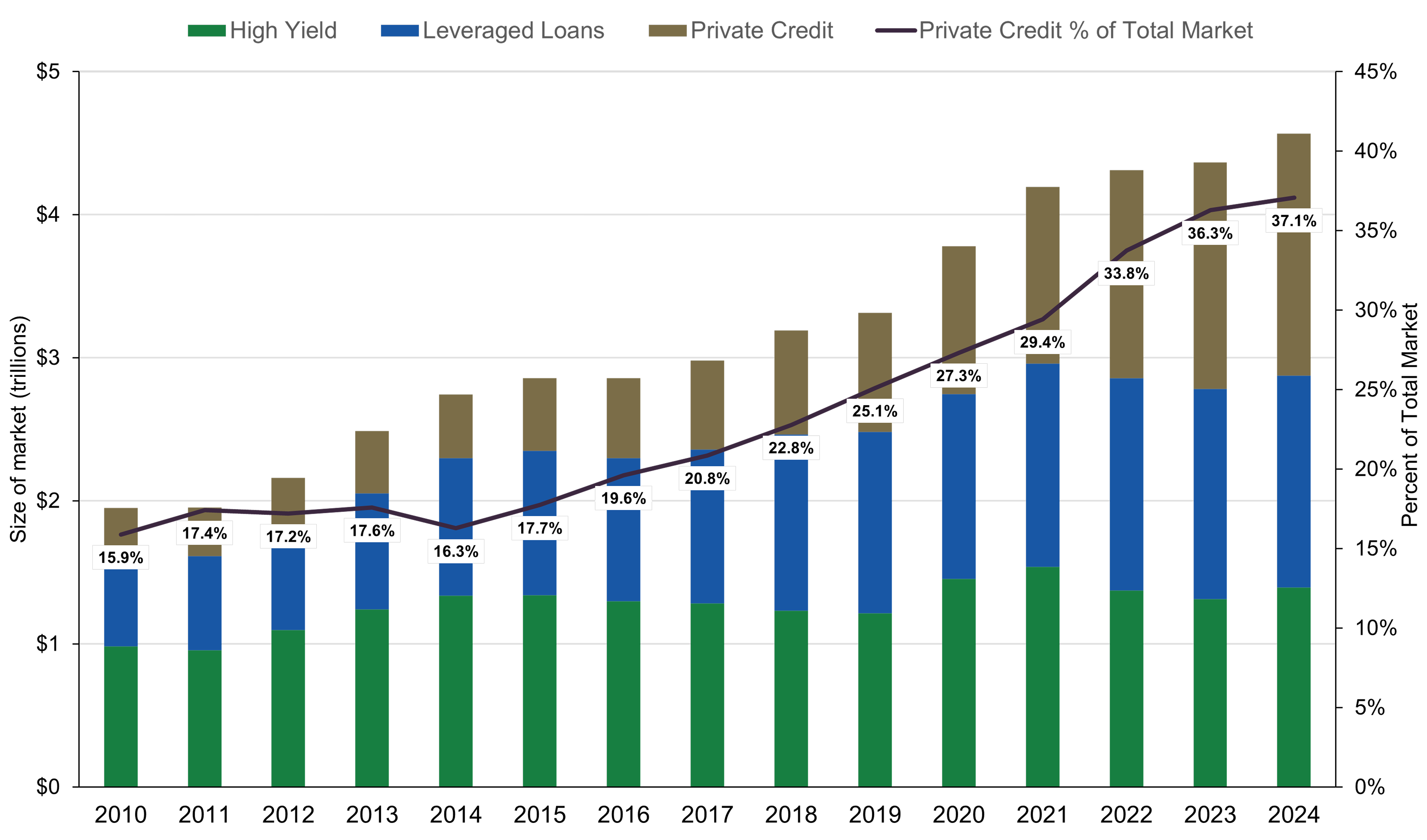

Private credit is one of the fastest-growing parts of the investment world (see Figure 1)—and we think it’s easy to see why. The asset class has become a go-to option for investors looking for higher income, more diversification, and less market “noise”—that is, the prices of privately issued loans are not marked daily, so there is often less day-to-day pricing variation than is commonly seen in other asset classes.

This is a marketing communication.

Figure 1. The Private Credit Market Has Grown in Size and Prominence

Data for various components of the U.S. leveraged finance market for the calendar years 2010–2024

So, what exactly is private credit? Private credit, at its core, involves lending capital directly to businesses outside of traditional public markets—meaning these loans are not bought or sold on an open exchange. Instead of relying on banks as intermediaries or investing in public bonds, investors in private credit act as direct lenders, extending financing to companies in need of capital.

The landscape of private credit has evolved significantly in recent years. While it originally referred mainly to direct lending—typically to mid-sized, privately held companies—the term has broadened to encompass a diverse range of strategies. Today, private credit includes corporate direct lending, asset-based finance (where loans are secured by company assets), infrastructure debt, select segments of structured finance, and private real estate debt.

Despite this diversity, several characteristics unite these strategies. Private credit investments typically offer higher yields compared to their public market counterparts, largely because investors are compensated for taking on lower liquidity—meaning these loans can’t be easily traded or sold. Additionally, their values tend to fluctuate less dramatically from day to day, offering a degree of price stability. Direct lenders also play an active role in the lending process, including the origination of the investment, due diligence, and tailoring of the loan for the specific needs of the borrower.

This recent expansion of the term “private credit” reflects the growing importance and versatility of the asset class. Still, direct lending to middle-market companies remains the foundation of private credit and will be the central focus of our discussion.

How does private credit compare to high yield corporate bonds, or broadly syndicated loans?

Investors have long relied on traditional public leveraged credit vehicles, such as high yield corporate bonds and broadly syndicated loans, as a way to receive income. But given the historical characteristics of private credit, investors are increasingly looking at the asset class as an alternative, for a few key reasons:

- Higher spreads

Private credit loans often pay more than public loans of comparable credit quality, sometimes yielding 2% to 4% more. That’s largely because they’re less liquid (you can’t buy and sell them every day), and the terms are negotiated deal by deal. - Better protections for investors

Since the loans are private, lenders can build in stronger protections—things like financial covenants, collateral, and reporting requirements—that can help reduce losses in the event of a default. - Potential protection against rising rates

Most direct loans have floating interest rates, which adjust with the market. That means they can help protect portfolios when rates rise, unlike most traditional bonds with fixed coupons. - Lower volatility

Private credit isn’t priced on a screen every day, so it avoids the daily ups and downs you often see in public markets. That helps create more stable principal values. - Effective diversification

Because private credit doesn’t move in lockstep with stocks or traditional bonds, it can potentially offer a smoother ride across market cycles.

What is direct lending, and how does it fit in with private credit investing?

The heart of private credit today is direct lending—where a fund or manager makes a loan directly to a company on a first-lien, senior secured basis. These loans are typically made to privately owned businesses and are often first in line to get paid back in the case of a default.

Borrowers use the money for things like buying another company, refinancing debt, or expanding operations. Many are backed by private equity firms, though not all.

Direct lending offers investors the potential for:

- Higher yields than similar public investments

- Floating interest rates

- Stronger lender protections

- Custom deal structures

What are the main categories of direct lending in private credit?

The direct lending universe is broad. Here are the main categories:

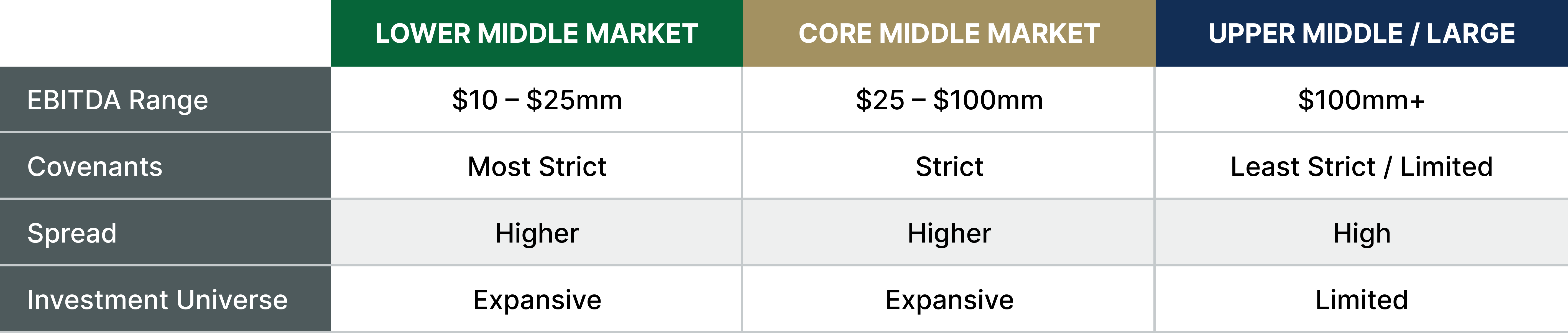

- Large cap/upper middle market

These are loans to large companies (over $100M in EBITDA), often backed by large private equity firms. These are usually very competitive, with tighter pricing and fewer protections for lenders. - Lower middle market

These loans are extended to smaller businesses (typically $10M–$25M in EBITDA). Loans here can offer higher yields but come with more execution risk and less financial stability. - Core middle market

This space—mid-sized companies with $25M–$100M in EBITDA—tends to offer a strong balance of return, risk, and deal quality. It’s often overlooked by the biggest funds and is less risky than the smallest companies, which we believe makes it a compelling place to invest.

Why is private credit growing in popularity?

Institutional investors have been increasing their private credit allocations for over a decade. That’s because the asset class offers the potential for:

- Income: Attractive yields compared to public markets

- Stability: Less volatility and mark-to-market pressure

- Top of the capital structure: Loans are often senior secured, meaning better recovery in a default

- Low interest-rate sensitivity: Floating rates help in rising-rate environments

- Diversification: Returns for private credit investments don’t always move with the broader market

What are some of the potential risks to consider when investing in private credit?

As we have discussed, private credit offers several potential advantages, but there are some potential risks that should be considered. These include illiquidity, since loans are typically held for years without a secondary market to trade them in, and limited comparability for certain loans and loan types due to bespoke (i.e., customized) deal structures. Additionally, outcomes can vary widely depending on manager skill, making due diligence and underwriting discipline critical in the private credit space.

What are the key takeaways for investors considering private credit?

Private credit, and direct lending in particular, is becoming a core part of many investor portfolios. It offers the potential for high, consistent income, especially in times of market uncertainty. But it’s not just about the headline yield, the diversification benefits alongside high yield, broadly syndicated loans, and even equities make it a great complementary strategy.

To us, the core middle market stands out as a compelling opportunity. It’s big enough to offer scale and reliability, but not so large that deals become commoditized. For investors looking to add floating-rate income, portfolio stability, and real credit diversification, this is a space worth watching.