Despite concerns about inflation and slowing growth, strong corporate earnings continued to provide support.

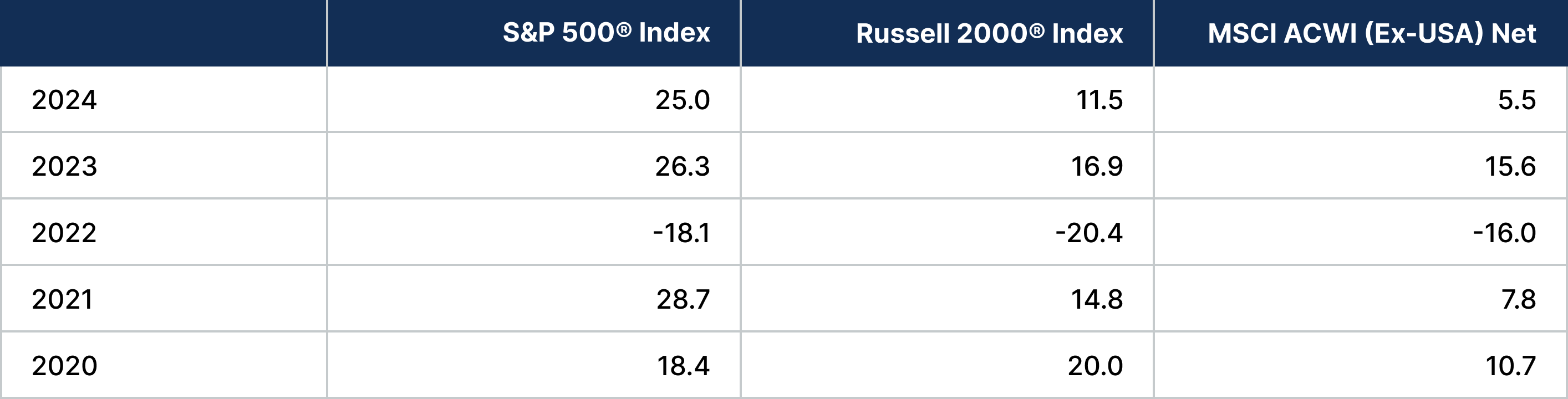

Despite the ever-growing “wall of worry”—namely, concerns about inflation, slowing economic growth, and tariff uncertainties—U.S. equity markets continued their march higher in the third quarter of 2025. In fact, the S&P 500® Index’s return of 8% was well above the long-term average of around 1.5%, setting the stage for the seasonally strongest part of the year.

Among S&P 500 component sectors, Information Technology, Consumer Discretionary, and Communication Services led in the quarter. But participation in the market’s advance was again widespread, with all sectors outside of Consumer Staples delivering a positive return.

The real standout in the third quarter was small caps. The Russell 2000® Index returned more than 12%, outpacing its large cap counterparts by roughly 500 basis points (bps). This is a noteworthy change from the large cap leadership that has persisted in recent years, and a trend we will closely monitor in the future.

It’s worth pointing out that despite the concerns referenced above, corporate earnings have remained resilient. As we noted in an earlier comment, first- and second-quarter earnings for the S&P 500® Index beat expectations by a wide margin. Third-quarter earnings were expected to follow suit; indeed, based on FactSet data, warnings growth for the rest of the year, and for 2026, is expected to be in double digits.

Potential Impacts of a Fed Easing Regime

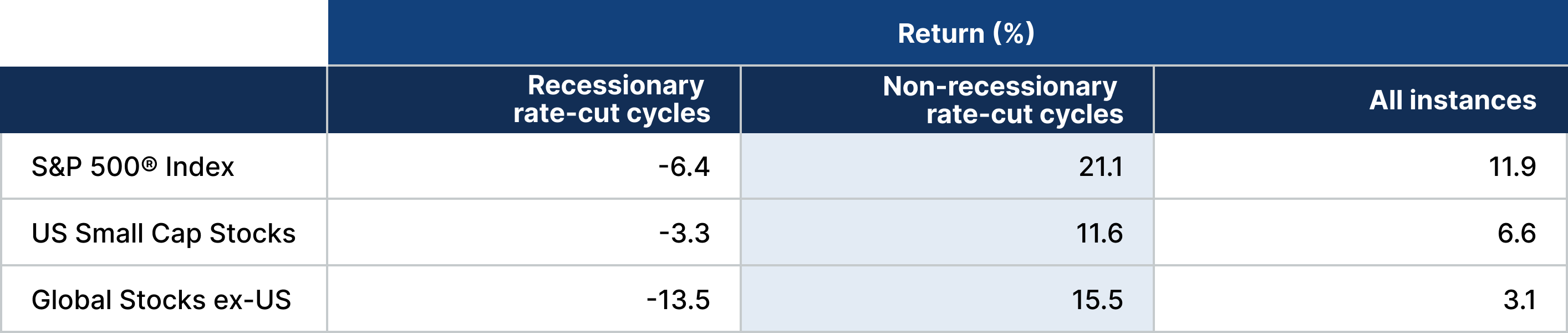

Equities received another boost in September, when, after long anticipation, the U.S. Federal Reserve (Fed) cut rates by 25 bps—the first rate cut since December 2024. Policymakers signaled that two more cuts are likely this year. As Figure 1 illustrates, markets have generally responded well to the implementation of a Fed rate-cut cycle, when the economy is not in a recession.