Going into 2025, we think the factors that have driven the equity bull market of the last two years remain favorable. Here is a quick review of each:

- Technology advances: The tech revolution continues to be a tailwind for equities, opening new markets and enhancing economic productivity. Breakthroughs in generative artificial intelligence (AI) over the past couple of years have strengthened this positive force.

- Market momentum: The momentum of the market remains positive based on technical signals. The S&P 500® Index, the Nasdaq Composite Index, and the Russell 2000® Index are in healthy uptrends. Market breadth—as measured by the percentage of companies in the Russell 3000® Index trading above their 150-day moving average—has improved meaningfully since reaching a low in October 2023.

- Moderating inflation: Inflation in developed markets has come down significantly and is now at a level that should be supportive for forward market returns. In the United States, the core U.S. Personal Consumption Expenditure price index, or PCE (i.e., excluding food and energy) has moderated since hitting a peak of 5.6% in September 2022 and is near the U.S. Federal Reserve’s (Fed) stated target of 2%.

- Easier monetary policy: Central bank policy moves are supportive. The Fed cut the target fed funds rate by 50 basis points (bps) in September 2024, 25 bps in November, and 25 bps in December. While market observers may differ over the number of Fed moves in the months to come, we think the most important takeaway from the changing monetary policy regime is this: the aggressive Fed tightening cycle that whipsawed markets in the past few years is in the rear-view mirror.

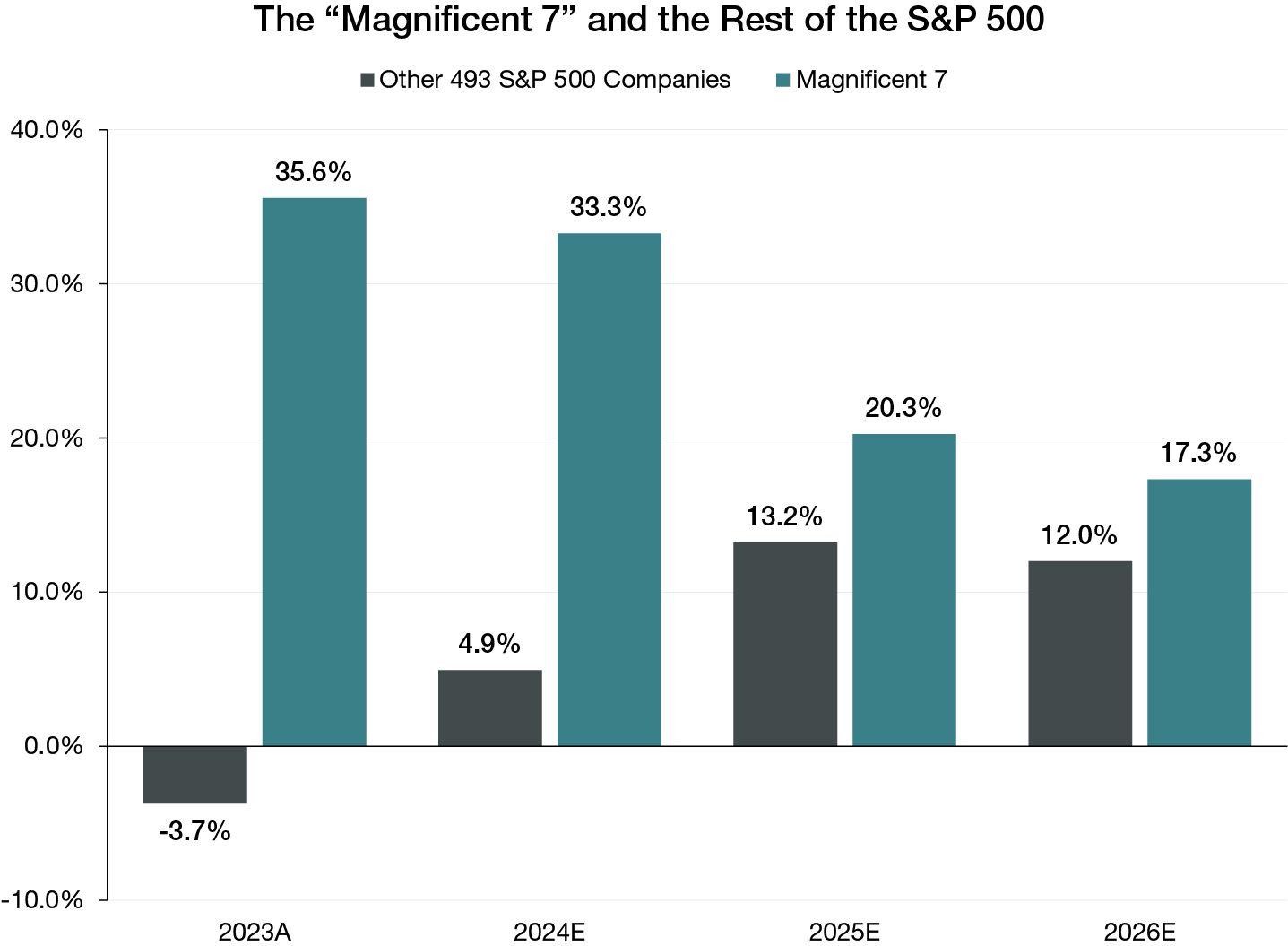

- Favorable earnings trends: The earnings backdrop remains favorable. Earnings for the S&P 500 for the fourth quarter of 2024 are expected to grow around 12%, and similar growth is expected for 2025. This estimate seems reasonable to us. Additionally, as we have written previously, we believe that the growth potential of the S&P 493 and the Russell 2000 is likely to narrow the gap with the Magnificent Seven (see Figure 1). We think this bodes well for the returns of large cap stocks, mid cap stocks and small cap stocks, in comparison to mega cap stocks (i.e., the “Mag 7”). We continue to like the Mag 7, as they are driving generative AI and are therefore essential to the health of the overall market; however, we think their wealth will spread and allow bigger gains for the remaining 493 stocks in the S&P 500.