Download the PDF version of this insight

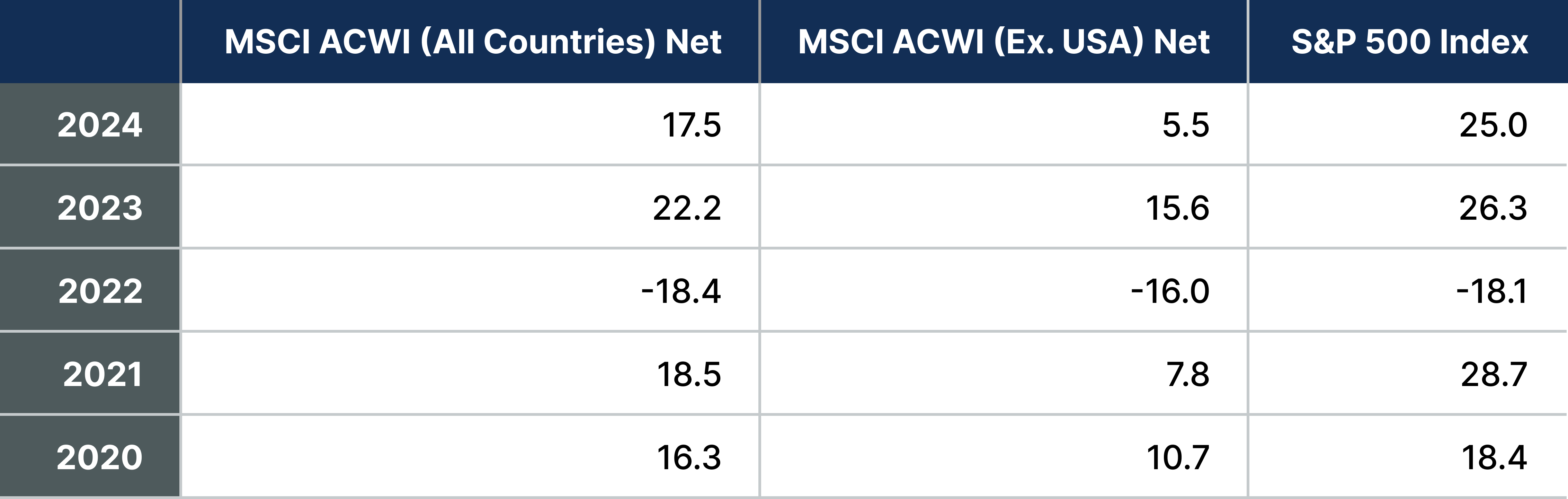

International stocks have had a banner start this year, with the MSCI All Country World Index (ACWI) ex-USA returning 18.1% in the first six months and handily outperforming the S&P 500 by nearly 12%, in USD terms. We believe the changing tide could be just the beginning of a shift in global equity leadership supported by cyclical and secular tailwinds as well as attractive valuations. Past performance is not an indication or guarantee of future results.

Key Takeaways

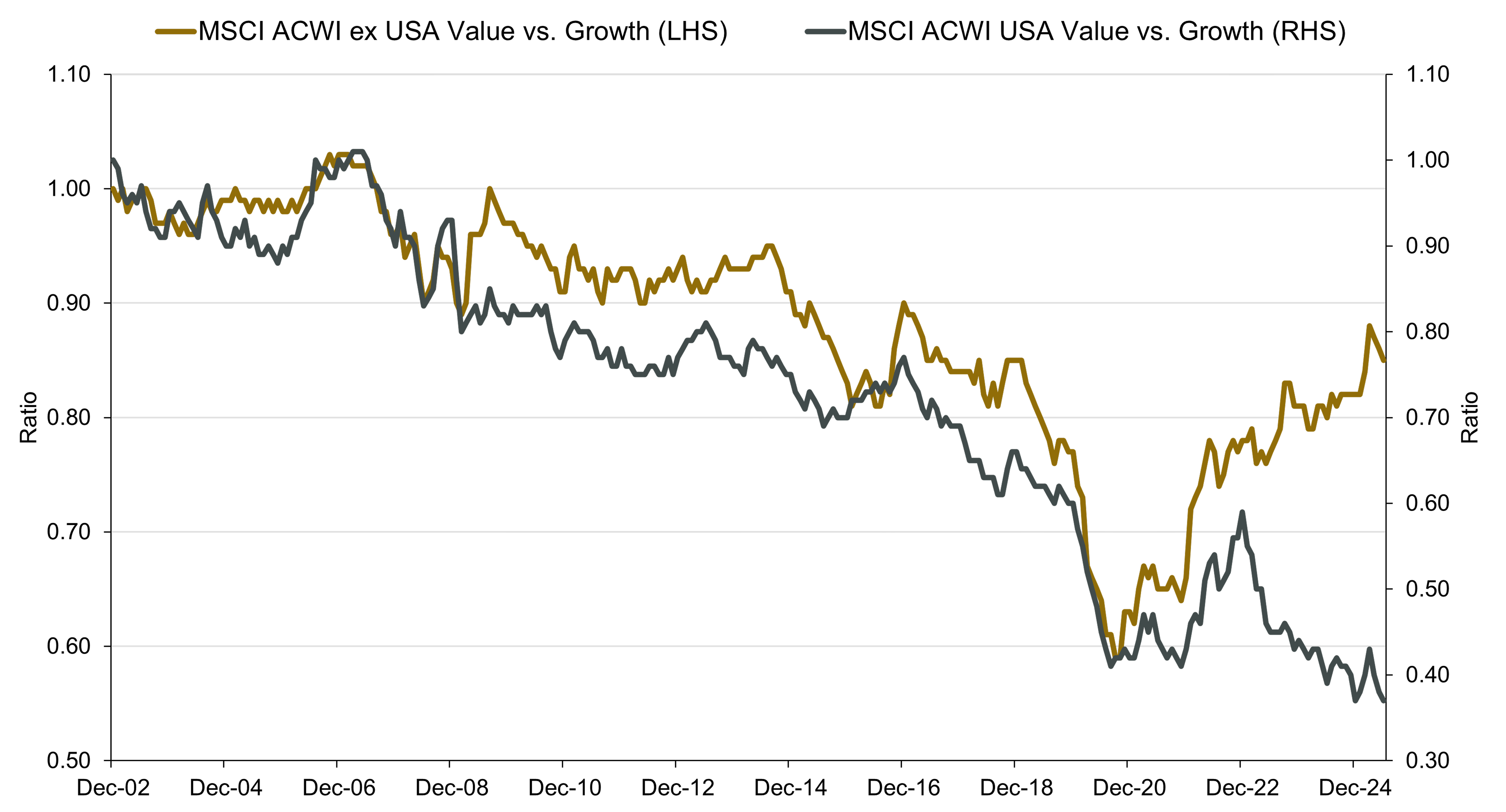

- Higher rates and a more concentrated U.S. stock market create a potential opportunity for better diversification with value-oriented international equities.

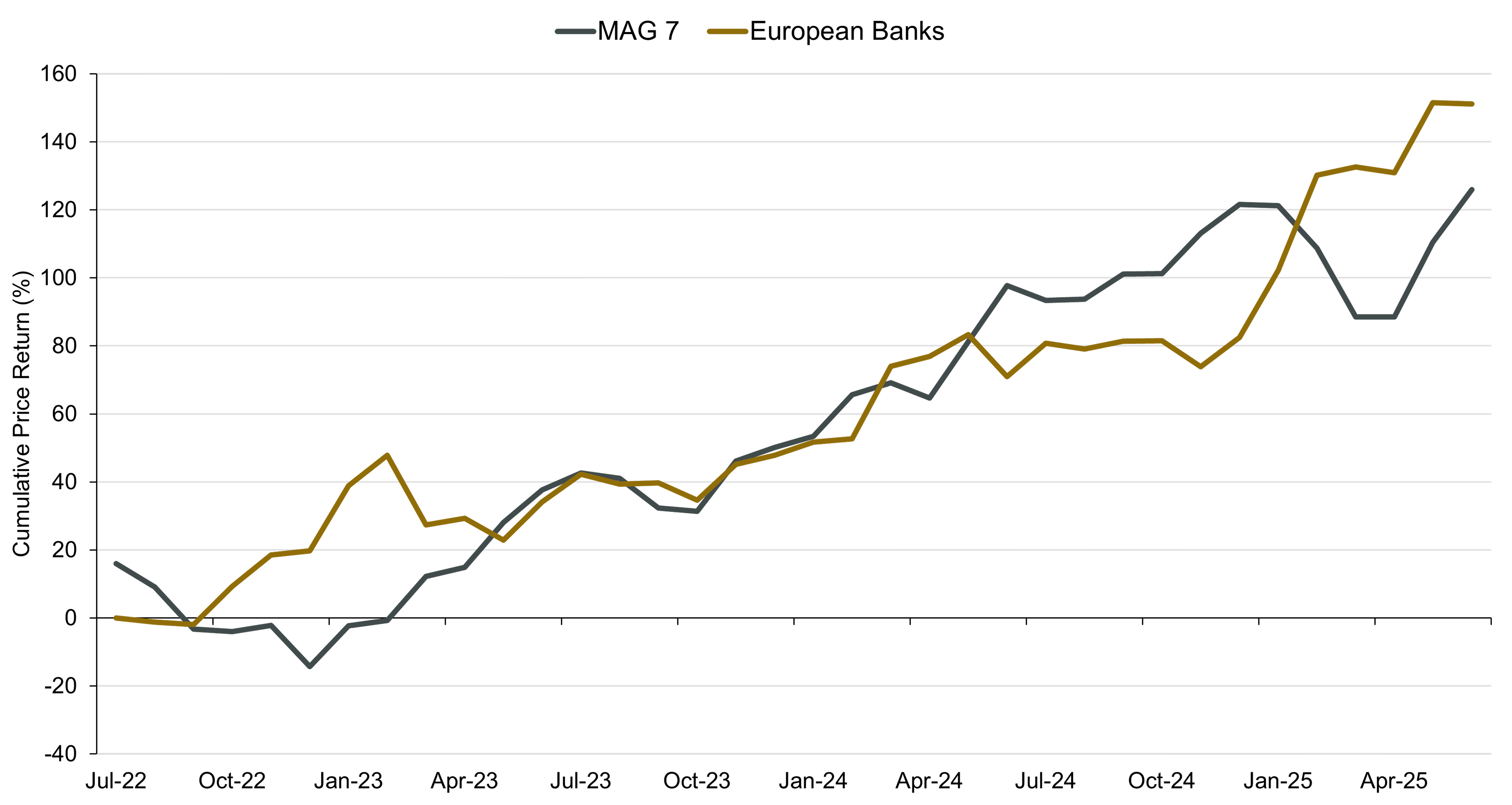

- We believe valuations remain generally attractive, while a fiscal shift also marks a turning point for the European region, with expanded infrastructure and defense spending acting as a catalyst for unlocking value and creating what we see as an attractive growth trajectory overseas.

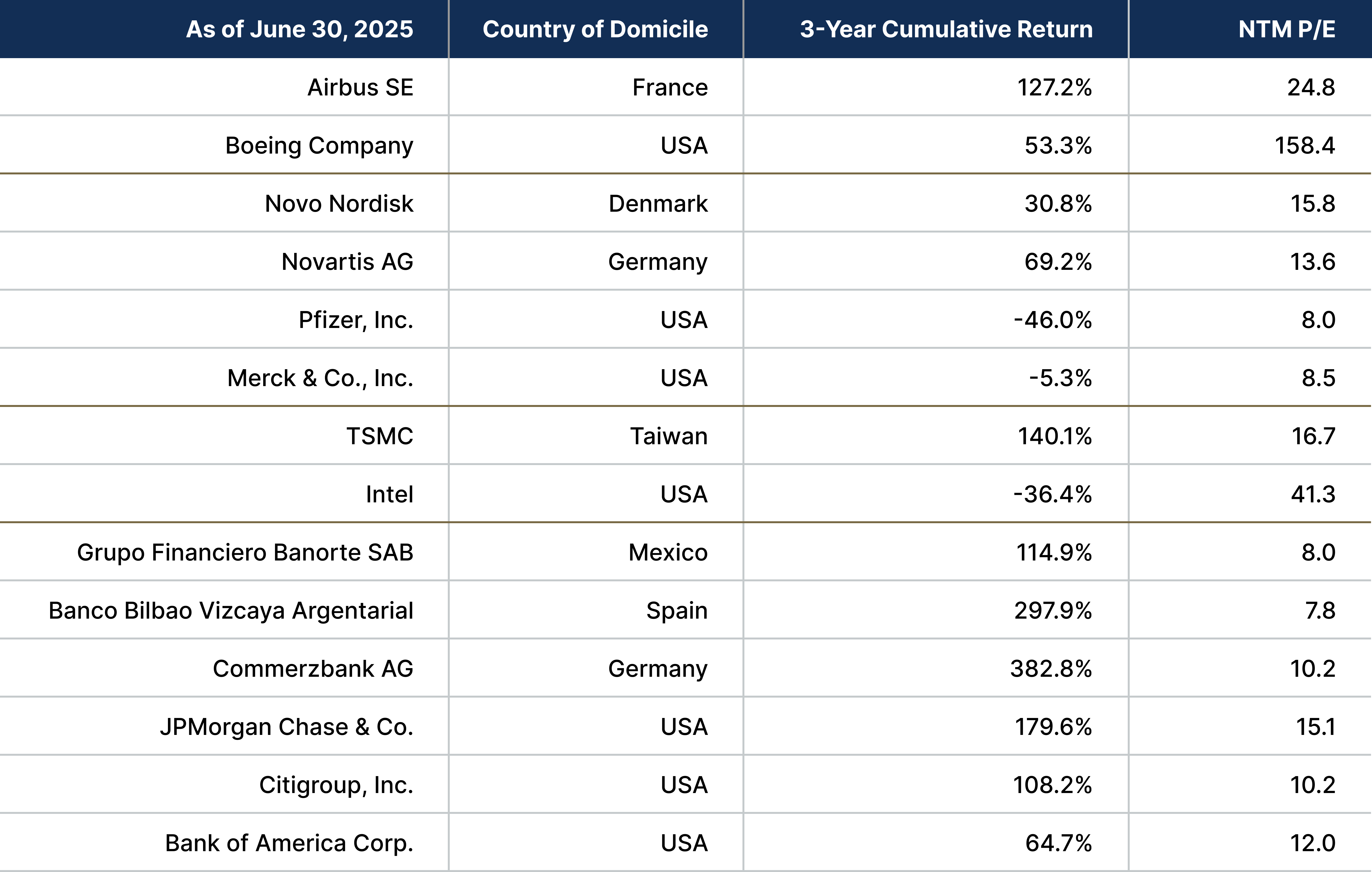

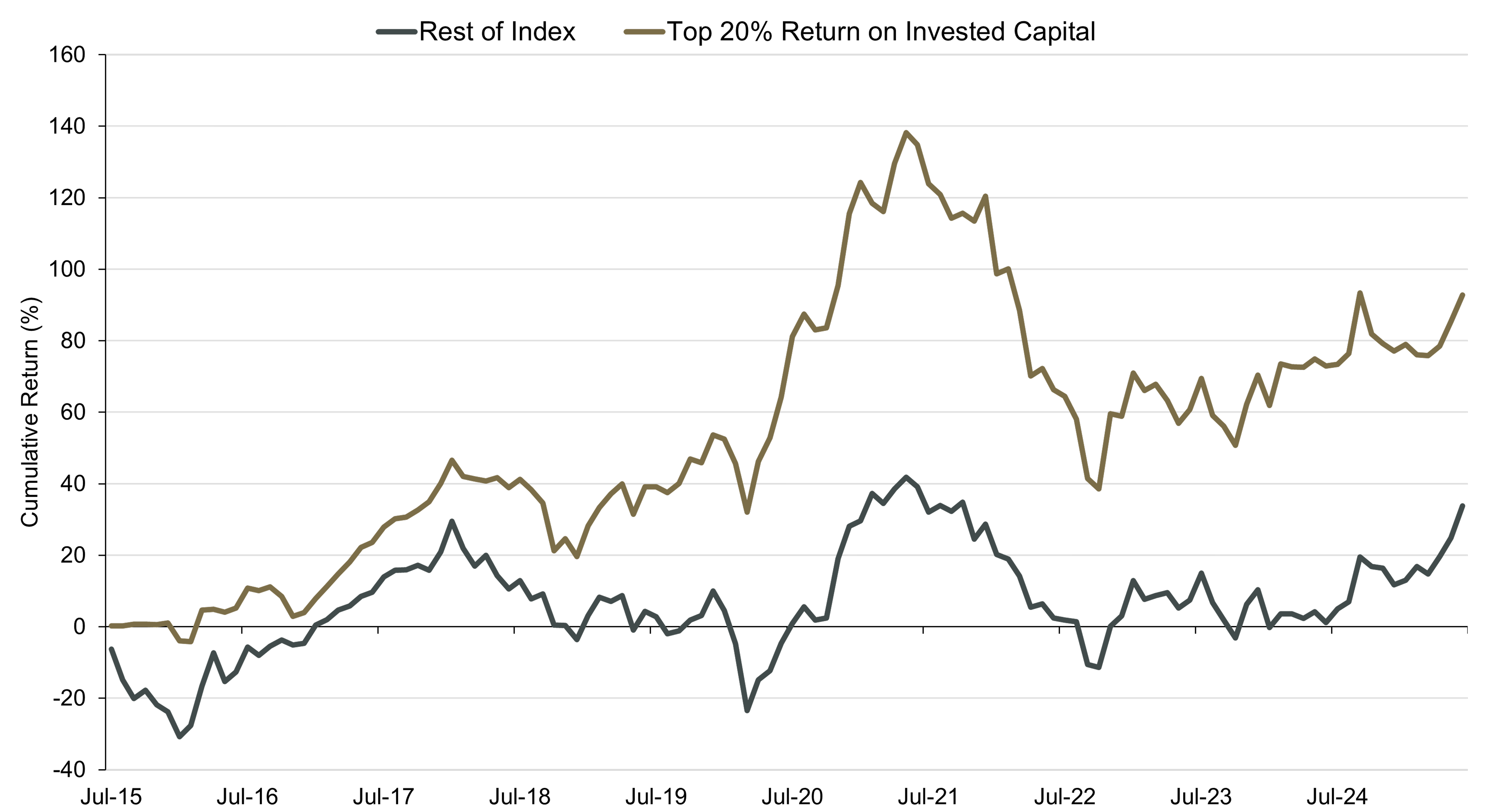

- Many of the world’s top-performing, globally recognized companies are based outside the U.S. and are represented exclusively in international equity benchmark indexes. This underscores the value of an active, selective investment approach—one that seeks to identify quality metrics that have been historically linked to outperformance across the broad and diverse global equity landscape.

International equities underperformed U.S. equities over the better part of the last 15 years post- Global Financial Crisis (GFC)—a reminder that cycles of outperformance and valuation discount extremes can last a long time. While the global economy took a massive hit during the GFC, the U.S. bounced back faster than the rest of the world for several reasons, including a larger and quicker fiscal stimulus response, a stalled recovery in Europe due to its sovereign debt crisis, and high inflation coupled with a collapse in exports out of China. Add monetary stimulus into the mix with near-zero interest rates in the U.S., and there was a huge perceived opportunity to buy stronger U.S. risk assets, leading to a massive influx of both domestic and foreign investment.

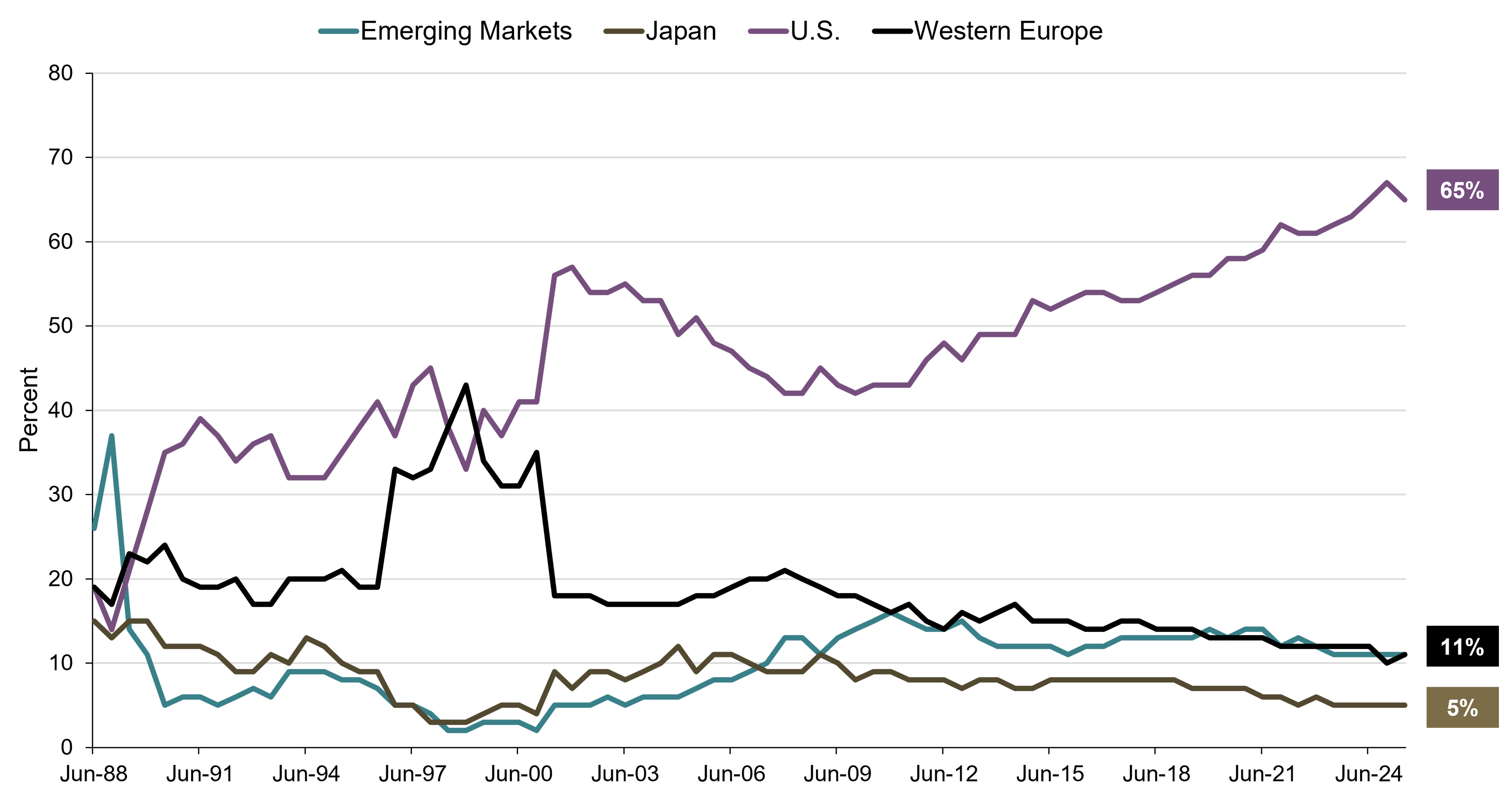

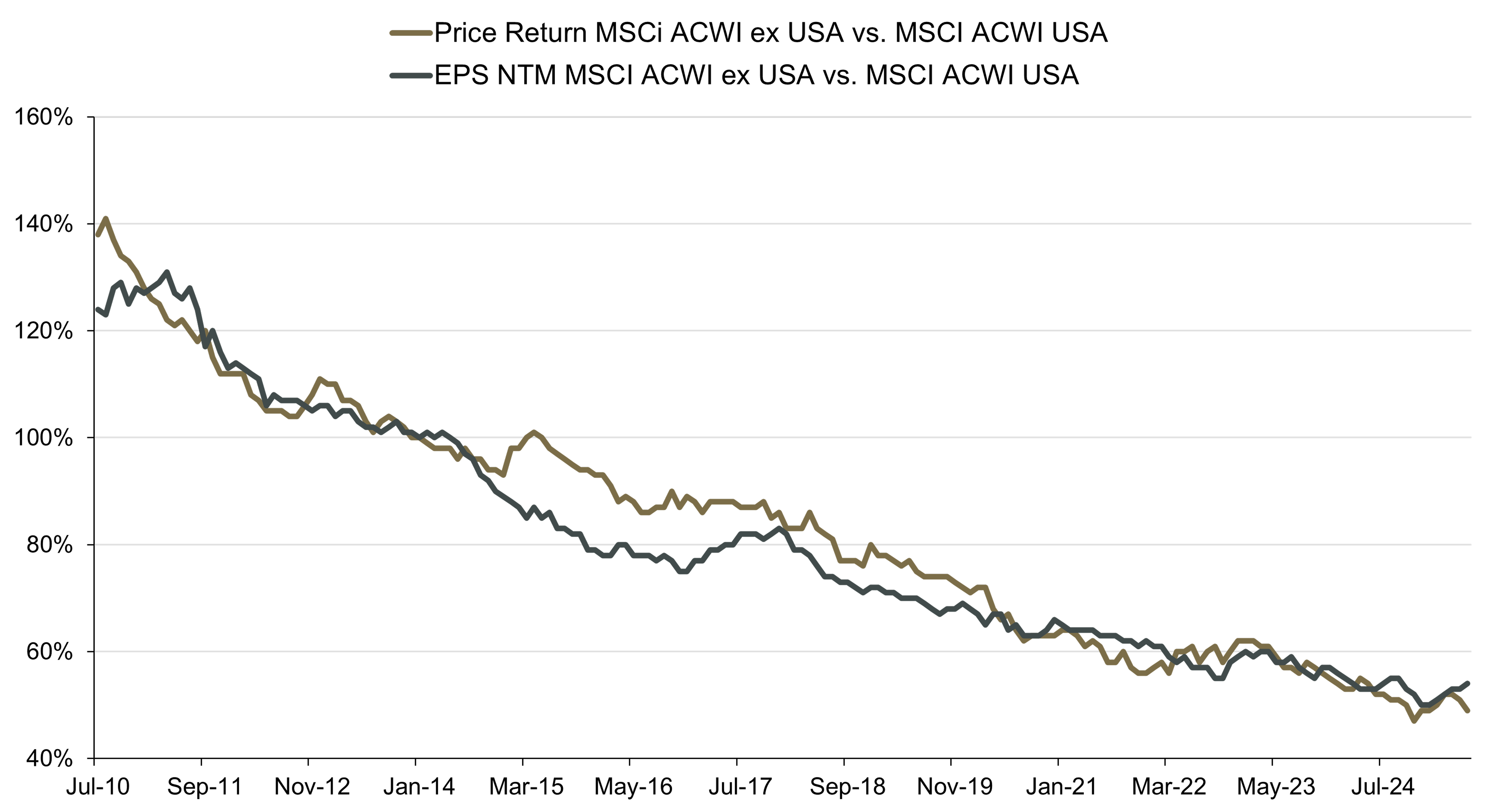

And yet, the extraordinary growth of U.S. equities from approximately 40% of the global equity market capitalization (cap) to 65% today (top panel Figure 1) proved not to be a bubble, but rather a reflection of superior fundamental profit growth (bottom panel Figure 1), driven largely by the technology sector.