Despite an episode of volatility following the April 2 U.S. tariff announcement, global markets are strong as the third quarter begins. Benchmark indexes representing developed markets ex-U.S. and emerging markets1 are both up over 16%, year to date through July 31. Meanwhile, within the U.S., major equity indexes are trading at or near all-time-high levels following a swift recovery as the administration walked back ambitious tariff plans.

Once the policy uncertainty receded, investors were able to refocus on the underlying fundamentals of the market, which are healthy. While global economic growth is decelerating, it remains solid, supported by booming secular forces underpinned by generative AI. These positive factors are translating to impressive corporate earnings growth. This episode shows that in equity investing, to paraphrase a famous maxim often attributed (incorrectly) to management guru Peter Drucker,2 secular forces eat policy for breakfast. That is, the longer-term factors driving growth are more important than short-run monetary and fiscal policy developments.

Where do we stand now? Here is a closer look at what matters most in today’s equity market:

What are the major factors that have driven stock returns?

In our commentary from last quarter, A Bull Market in Uncertainty, we noted how policy uncertainty and investor sentiment were at such extreme levels that forward returns should be favorable. Remarkably, even after a surge from the lows, sentiment measures are still not extreme. Investors are no longer hiding, but they are not overly optimistic either, which is supportive of further market strength.

The stock price momentum of the global equity markets continues to improve from the depths of April. Equity markets worldwide are showing positive trend patterns; as of July 31, the S&P 500 Index is near its all-time high, and small-cap stocks are gaining momentum after a long period of largely being out of favor. The breadth of earnings growth has led to a great number of stocks in uptrends. In April, less than 10% of stocks were trading above their 150-day moving averages, a level so anemic that it foreshadowed above-normal forward returns. Now, nearly 60% of stocks in the Russell 3000 Index are above their 150-day moving averages. Data source for this content is FactSet.

Inflation continues to ease, with the core PCE Index below 3.0% amid uncertainty regarding the effects of tariff policies. We remain unconvinced that tariffs will unleash a major bout of sustained inflation. In any event, the current core PCE near the Fed's 2% target is encouraging and better than anticipated.

Benign inflation suggests that the U.S. Federal Reserve (Fed) may stay on hold or cut rates later this year. As we have noted, equity markets tend to perform best when the Fed is on hold and do well when the Fed is easing. Bond yields, particularly that of the 10-year U.S. Treasury note, have been stable, and credit spreads are near multi-year lows. Taken together, liquidity conditions are favorable.

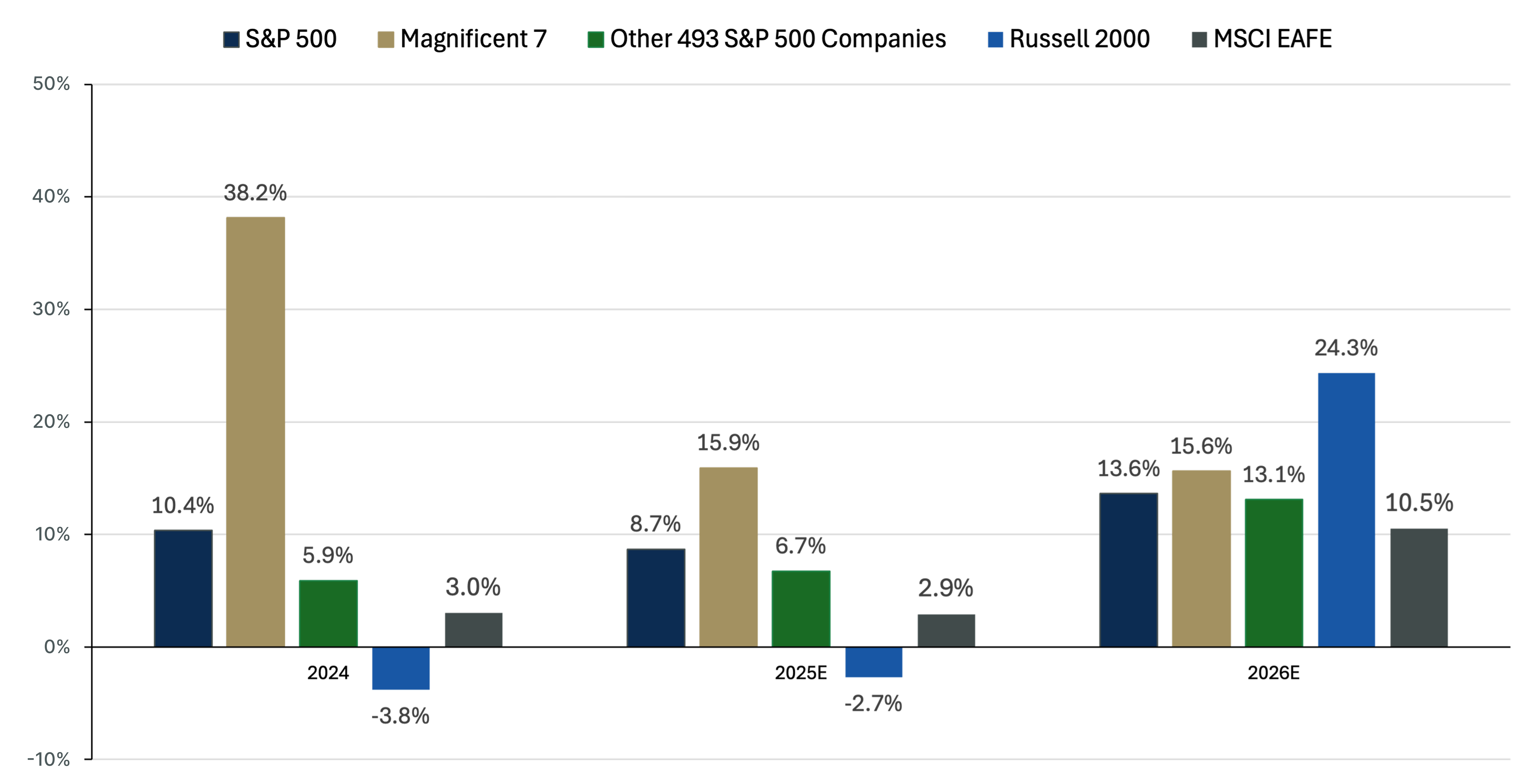

Finally, and most importantly, earnings have proven to be robust. While many attribute the recent rally to changes to U.S. tariff policy, it would be a mistake to overlook the role that earnings resilience played. Mega-cap U.S. technology stocks (namely, the so-called Magnificent 7) continue to shine, but their strength has been accompanied by growth in other large-cap, mid-cap, and small-cap stocks in the United States, and, more broadly, in stocks around the world. A key takeaway for investors is that the difference in earnings growth between the major tech stocks and other sectors continues to narrow.