The bull market in “animal spirits” has given way to a bull market in uncertainty after worse-than-expected tariff announcements. This new unexpected potential fiscal drag is causing Wall Street economists to raise the probability of a recession, which pressures the forecast earnings growth that fueled the bull market that began in 2023. Here are a few things investors should consider in light of the recent market volatility.

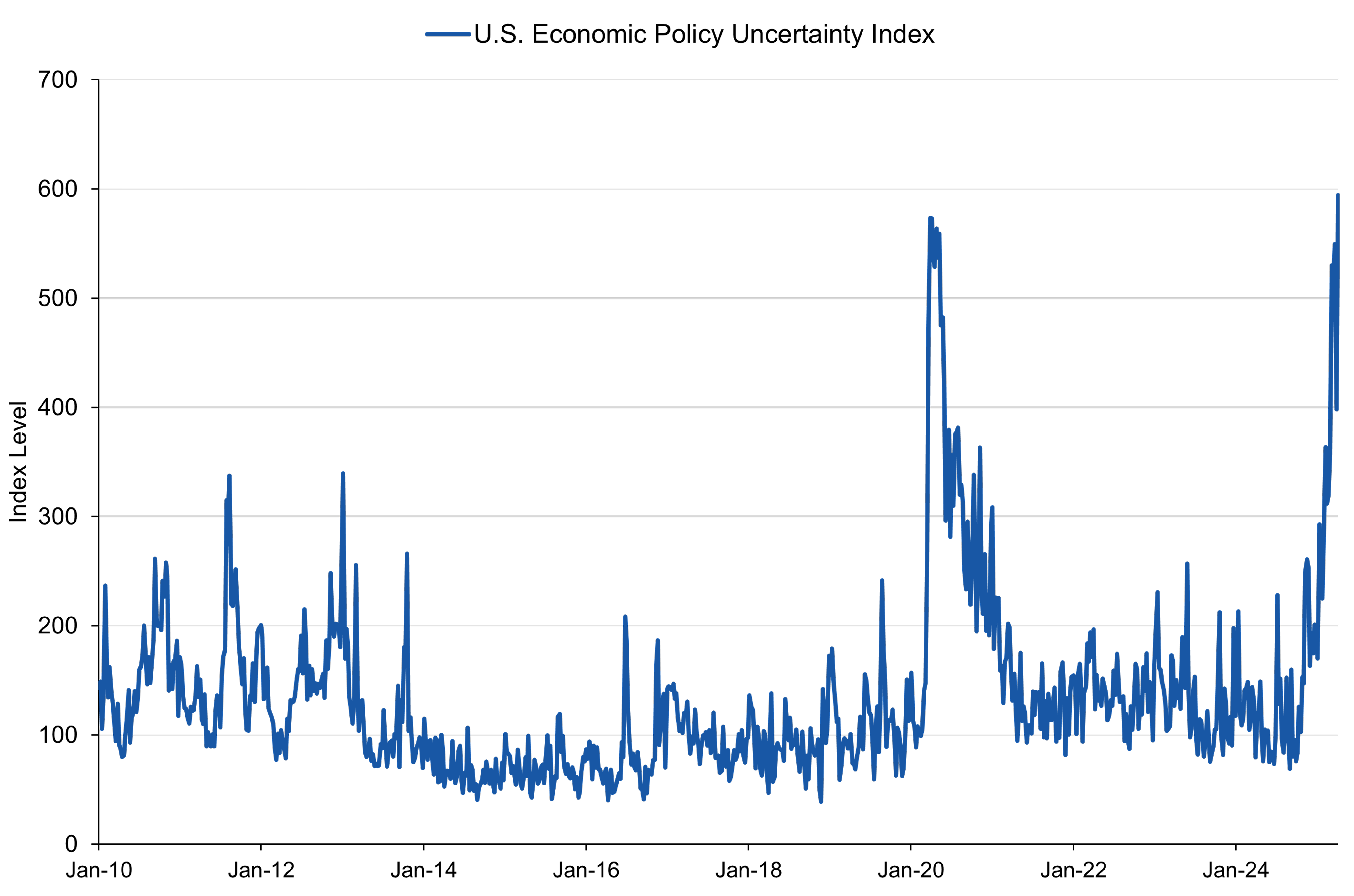

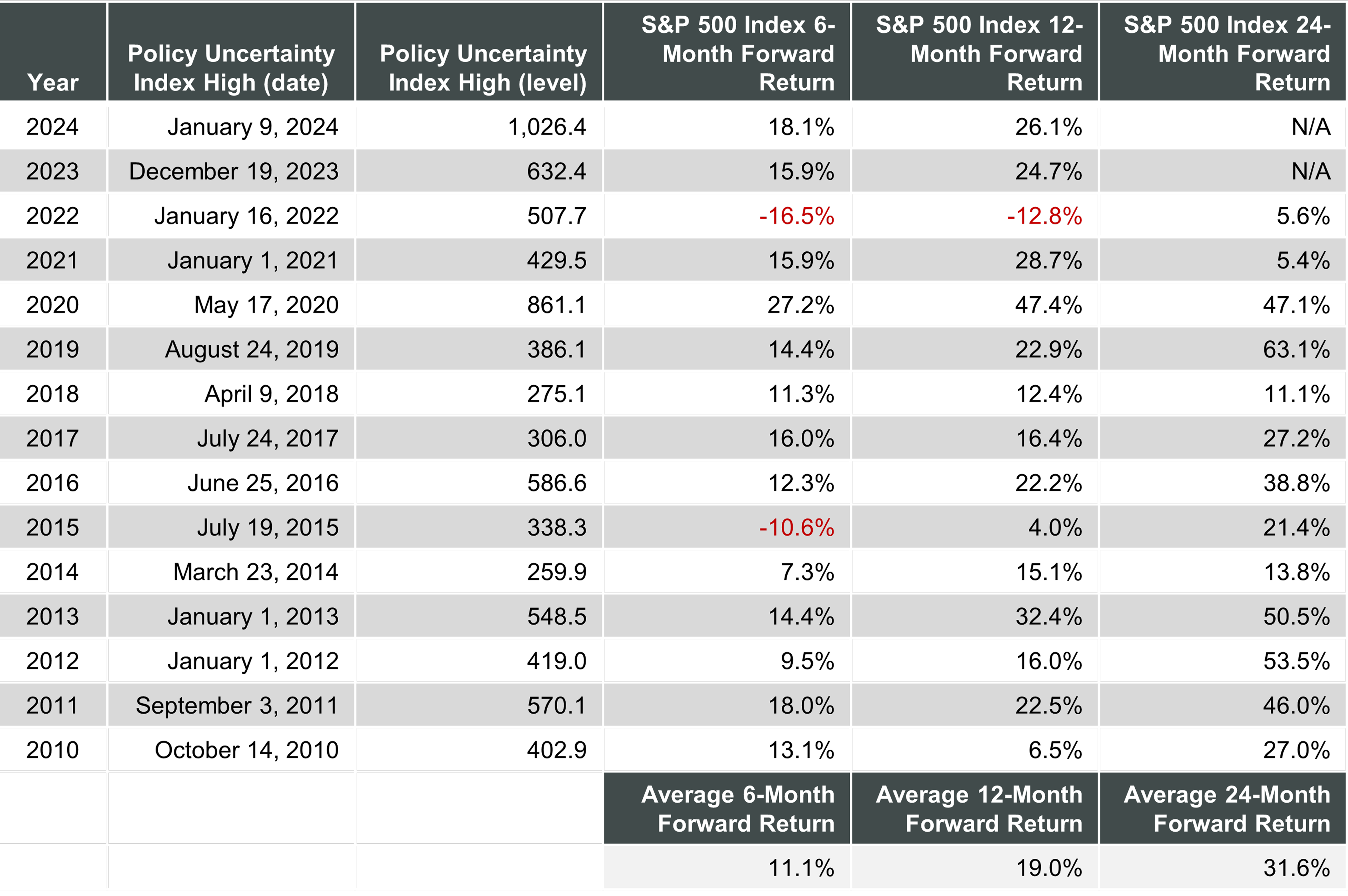

The new administration’s actions have created a surge in policy and economic uncertainty as measured by the Baker, Bloom, and Davis uncertainty index.1 This index has been in production for 40 years and last reached such heights during March 2020. Following periods of elevated levels of policy uncertainty, the U.S. equity market, represented by the S&P 500 Index®, has provided above-average forward returns, shown in Figure 1.