Key Takeaways:

- AI’s initial build-out phase may be disruptive as companies expend substantial capital to gain a strong competitive position.

- Software that can effectively harness AI’s potential to improve productivity could provide future investment possibilities in the second phase of AI’s development.

- We remain focused on generative AI as a long-term investment theme across equity strategies and are vigilant of the potential risks as innovations emerge.

It has been just under two years since the artificial intelligence company, OpenAI, rocked the technology world with its initial demonstration and launch of ChatGPT. Here, we reflect upon the progress made in the generative AI domain, imagine what might be to come, and discuss the potential investment opportunities within what we believe are the three phases of AI’s transformative impact.

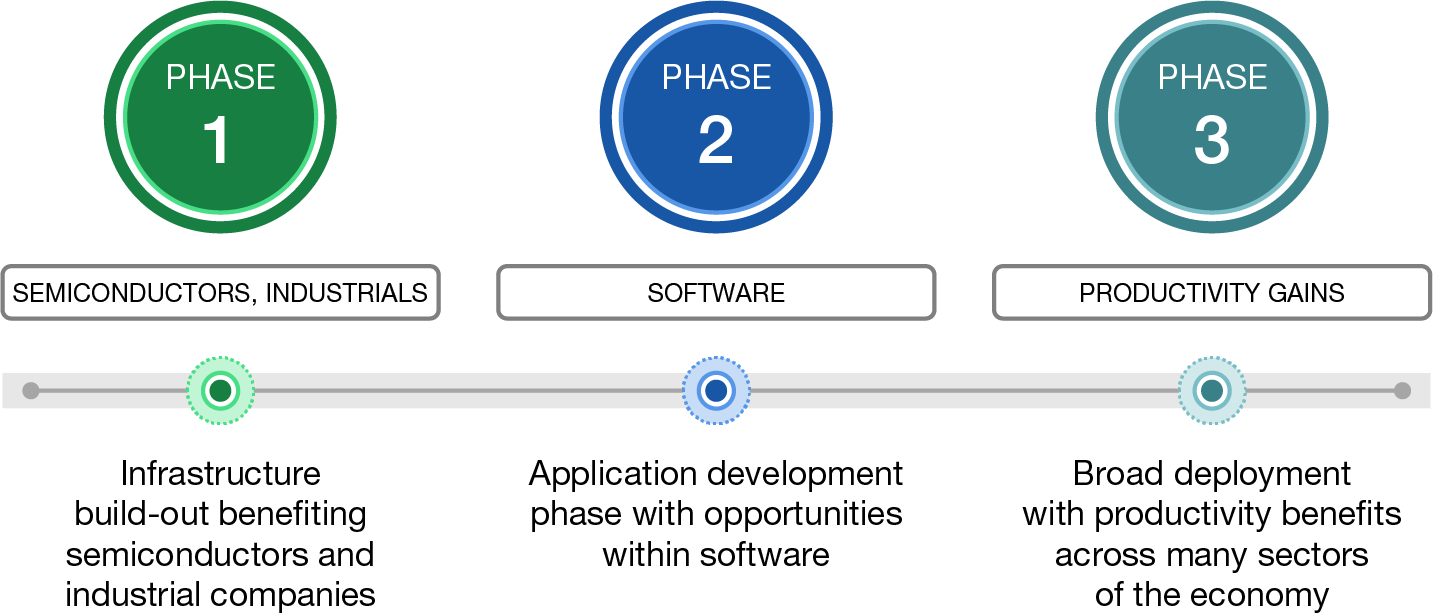

The Three Phases of Generative AI

Phase 1. Capital Investment

Since the release of ChatGPT, technology has undergone numerous iterations, and new competitors have emerged. We firmly believe we are still in the first phase of generative AI industry build-out (see Figure 1), which is characterized by the development of necessary infrastructure to support the substantial computational power required for advanced AI applications. This infrastructure development is primarily occurring within data centers, which, from a market perspective, has been a tailwind for semiconductor and industrial stocks that are levered to the electrification, cooling, and engineering services necessary for scaling this new technology.

At this stage, the capital expenditures into accelerated computing have yielded material incremental improvements in computational power, which leads us to believe further investments are likely. This creates an incentive for the established hyperscalers—large technology companies that can provide scalable cloud and storage resources— to invest to out-compete each other and to stave off competition from well-funded upstarts. A technology shift like this will likely be very disruptive, and the stakes for success or failure are extremely high.

Phase 2. Software Development

We believe the next phase of generative AI will be the development of applications that enhance revenue and productivity. Already, we are seeing green shoots of these applications in areas such as coding efficiency, vertical software solutions, customer service automation, digital advertising, and in information technology (IT) support, to name a few. Companies that develop these applications will be fertile ground for new potential investment opportunities.

Phase 3. Broad-Based Deployment

The third phase will be when these tools are universally available, and investment opportunities will be influenced by the management teams and companies that can deploy these tools to change the revenues, earnings, free cash flows, and return on invested capital of their respective companies. As noted above, we believe we are still in the first phase of this market developing, and we are excited to see what will occur in the future. This may take years or decades to play out.