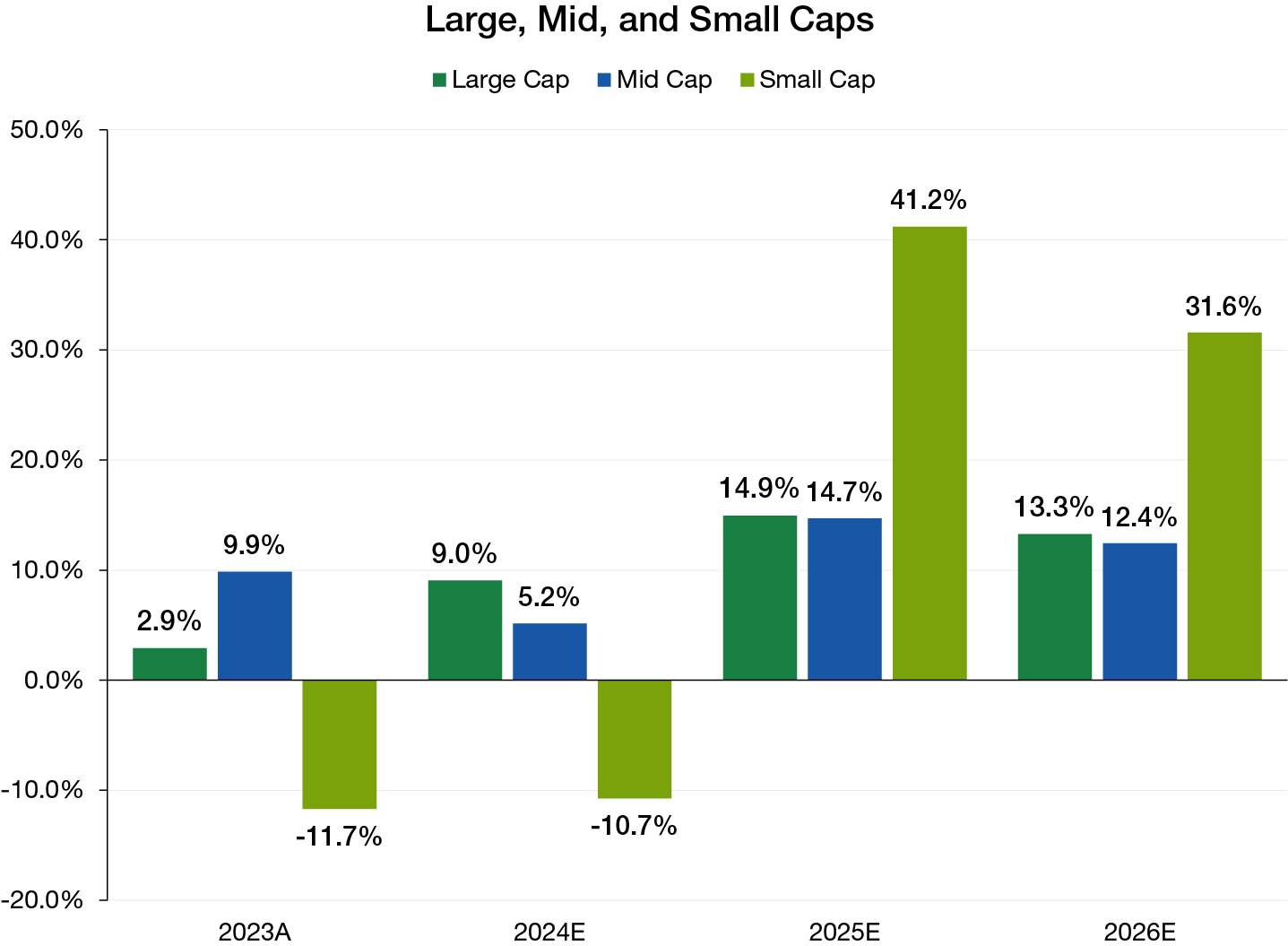

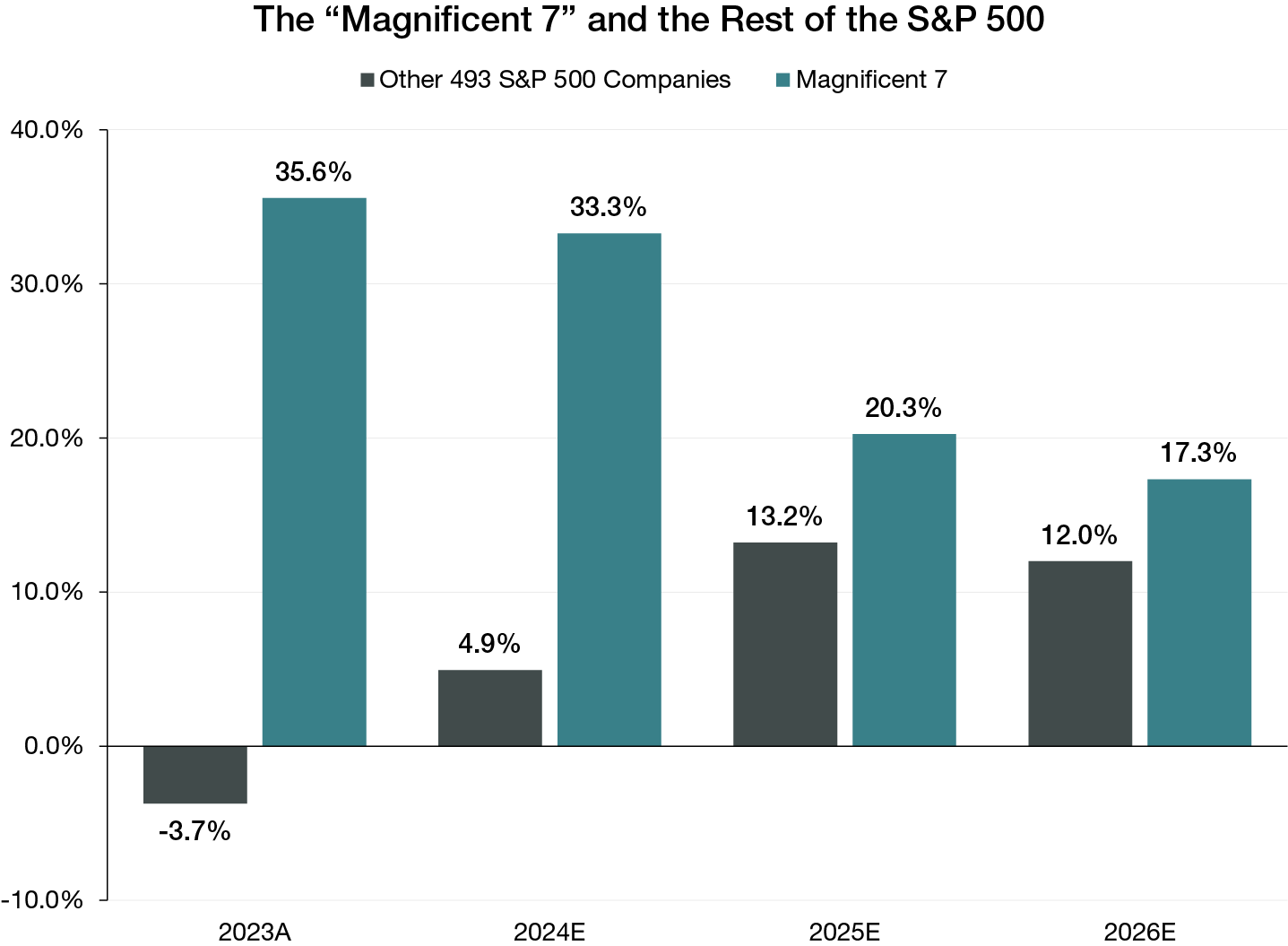

The earnings outlook going into 2025 is quite different. The Magnificent Seven appears set for a continuation of strong growth, but based on analyst forecasts, the rate is going to come down from 33% to around 20%. S&P 493 earnings growth is expected to move up to around 13%. For the Russell 2000, forecasts call for growth to rebound strongly. Note, however, that those forecasts appear to reflect easier year-over-year comparisons for health care companies (a significant component of the Russell 2000), along with an expected drop in the percentage of index members posting negative earnings over the next year.

What are the implications of these shifts? The huge differential in earnings that existed in 2023 has reversed, and the trend appears intact as we head into 2025. We think that if the differential continues to narrow in 2025, small caps, mid caps, and large caps are positioned to do well in comparison to the mega caps.

Select Areas of Opportunity for 2025

Here are some of the themes we will be emphasizing in the New Year:

Generative AI: We believe the potential of generative AI is still largely underestimated by the market and is likely to have an impact similar in scale to the Internet. We have identified three distinct phases tracing the current and future growth of generative AI. The first phase, capital investment in the computing power and infrastructure necessary for widespread AI adoption, is well underway. The second phase, software development, encompasses the applications of AI that enhance revenue and productivity for enterprises across industries. The third and final phase, broad-based deployment, will take shape when the tools and technologies that power generative AI become universally available.

As more companies embrace AI, we expect to see an ushering in of an era of efficiency and productivity gains across industries and market capitalizations. Given the rapid pace of development, we are likely to see additional opportunities in 2025 across the generative AI lifecycle described above.

Quality: We have long emphasized investing in quality companies with durable competitive advantages led by capable management teams. We do this in growth and value stocks, and in U.S. and non-U.S. companies.

Within the universe of dividend-paying stocks, we believe investors can benefit by focusing on high-quality companies with long histories of dividend growth. These companies typically have stable earnings, robust cash flows, and a disciplined approach to returning capital to shareholders.

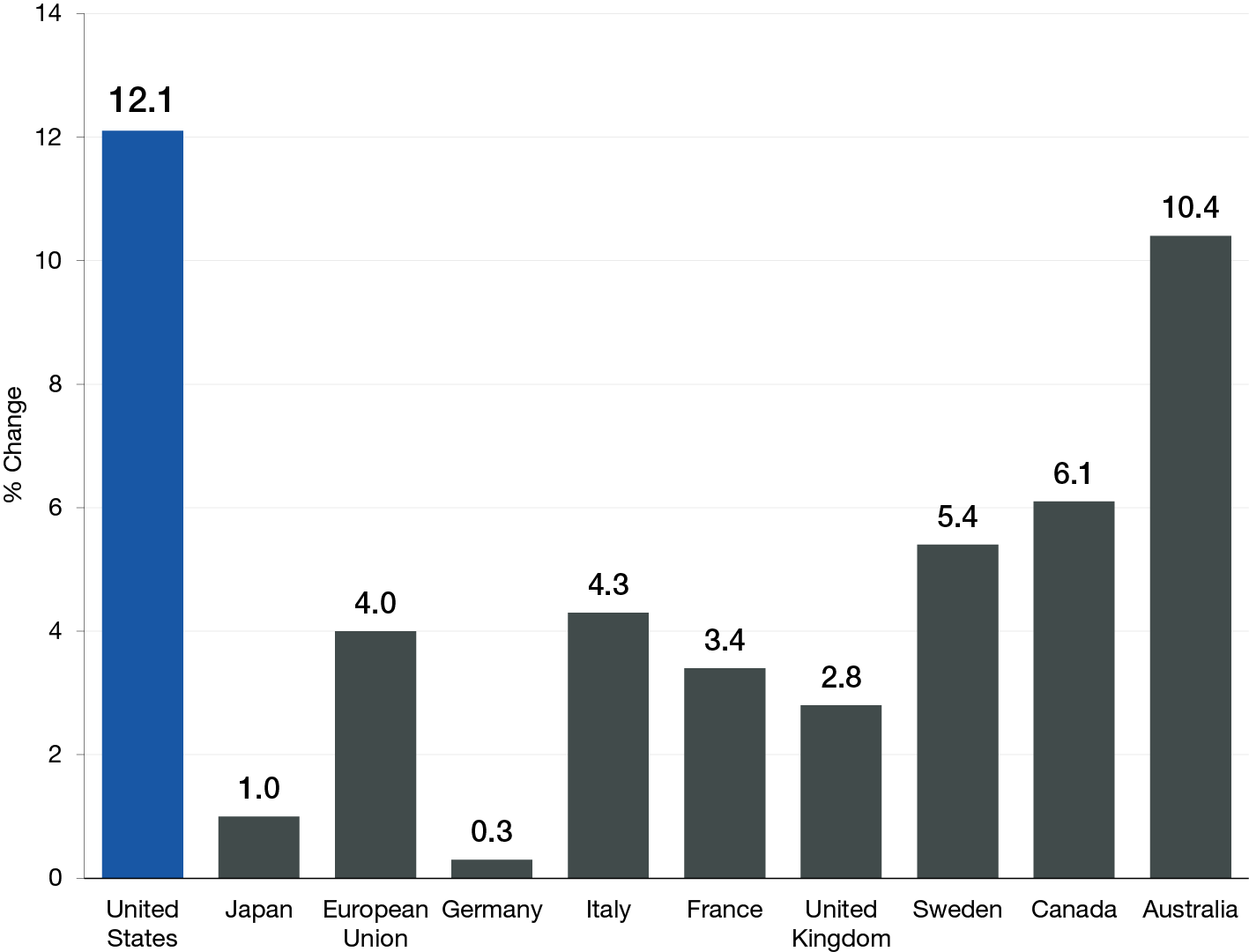

International Exposure: We are also positive on prospects for international stocks in 2025. As mentioned above, the global disinflation narrative is intact, which has allowed central banks globally to begin easing monetary policy. Based on forecasts from the International Monetary Fund, a “soft landing” is in view, as economic growth is expected to moderate next year but stay positive in most developed markets, while maintaining a stronger profile in emerging markets. Historically, this kind of environment tends to be positive for the type of strong, global businesses we favor in international equities.

The appeal of a broader geographic exposure becomes evident when one considers the many secular drivers that are positioned to benefit companies outside the United States. For example, the increasing adoption of AI cited earlier could benefit AI-adjacent companies in Japan and Taiwan, many of which are smaller concerns that play in other parts of the supply chain outside of chip manufacturing. The next wave of drugs to treat obesity, including once-daily oral treatment, GLP-1 combination therapies and amylin analogues, are expected to deliver further weight loss benefits to a much wider population but also to address the less desirable side effects of the current class of drugs; most notably, nausea, vomiting, and muscle loss.

In addition, there are several other significant secular growth opportunities which may provide support to companies we invest in, including the need for extensive investment in the power grid, data centers, public infrastructure, European defense, and regional supply chains. We also anticipate further investments arising from the continuing efforts to deliver Japanese corporate reform and the rapid economic growth of India.

While we believe the U.S. equity rally may still have room to run, we think it is worthwhile to look at non-U.S. equity markets as well for their diversification benefits amid cyclical and secular tailwinds.